Next-gen family members expect to check portfolio results on a phone and trust what they see. They want to filter by entity, know partner capital balances, and see how much cash is available today without waiting for a monthly packet. They need clear views of upcoming capital calls and planned distributions, with look-through across partnerships that lines up with what auditors will review. Static PDFs freeze last month’s numbers and miss mid-month movements that change decisions. The work falls on accounting teams who spend hours reconciling exports, answering one-off requests, and explaining why a dashboard and the general ledger don’t match. What they want is straightforward. Real time, mobile, and reliable.

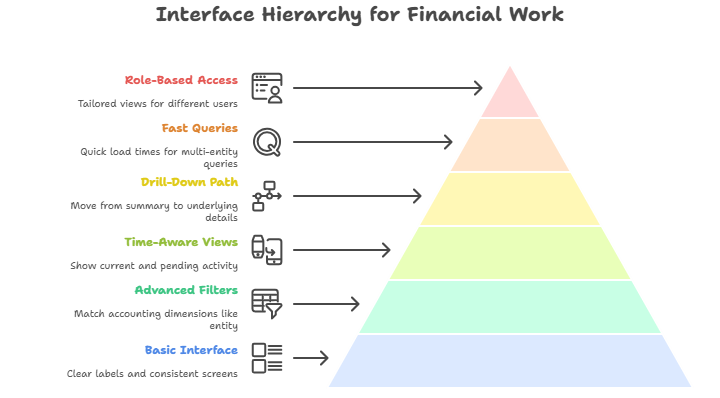

Next-gen interface expectations

An effective interface should mirror daily finance work, not just display numbers. Users need a single view that is consistent on phone and desktop, with filters for entity, partner, asset, currency, and date. Each figure should carry a clear timestamp and allow a direct path to the supporting entries and documents. Mid-month activity must appear alongside prior close so cash, capital, and commitments reflect what has changed since the packet. Permissions should follow the data model so family members, staff, and auditors see the same calculations at the right level of detail. Saved views and fast load times matter because questions repeat and time is limited. When these basics are in place, reports function as a control panel for decisions rather than a file to archive.

Design for workflows rather than screens. A partner asks why their balance moved last week; the interface should open on their capital account with the right entity applied and a clear path into the entries that changed it, with documents pinned to each line. A treasurer checks morning cash; the view should show bank balances, pending wires, settlement holds, and cut-off times on one page with the timestamp visible. An analyst prepares for an audit; the system should preserve calculation logic, record who changed what and when, and let reviewers retrace figures without separate workbooks. Keyboard-friendly navigation, predictable chart behavior, and annotations that travel with the numbers reduce back-and-forth. If the tool supports these jobs, teams spend time on decisions rather than extraction.

What family offices are asking for now

Survey work across large samples shows rising expectations for timely, accurate reporting and better tooling as wealth transfers to the next generation. Recent reports from UBS, Citi, BNY, and EY highlight higher operational complexity, more private markets exposure, and the need for better data access across entities and partners. These studies also flag preparation for next-gen involvement and the demand for professional-grade processes and systems that can scale.

Power BI integration gives you real-time drill-down at your fingertips

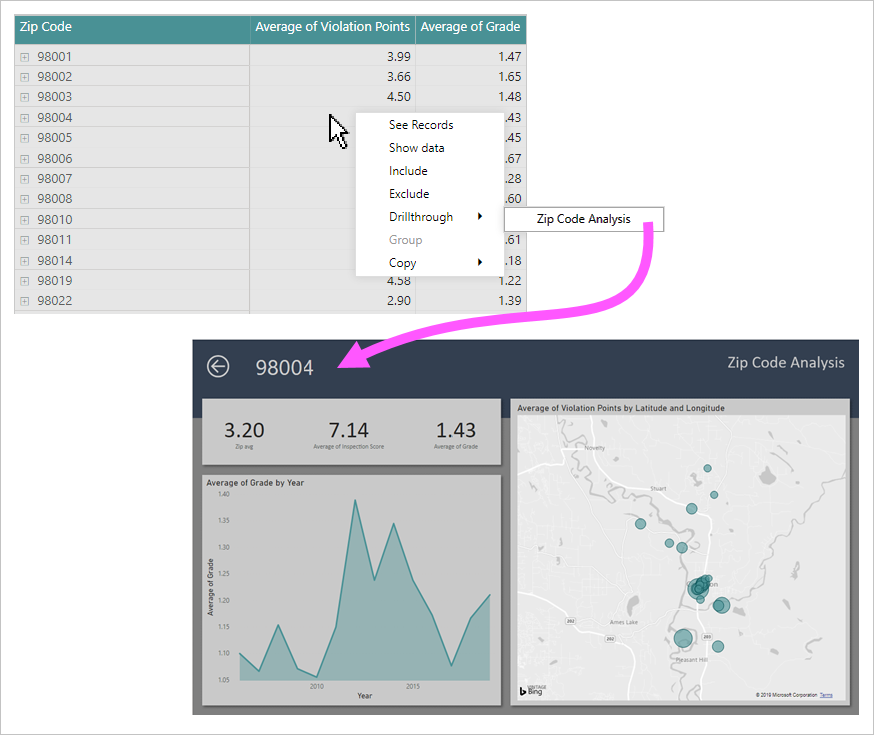

Power BI connects to a governed dataset and presents the same numbers on phone and desktop with consistent filters and security. The model organizes facts such as journal entries, cash movements, commitments, calls, distributions, and valuations under shared dimensions for entity, partner, asset, currency, and date. Users start with summary views for available cash and partner capital, then move to details through report drill through. The experience is the same across devices through the Power BI mobile apps, including offline viewing and secure sign-in.

Drill through example

Refresh patterns keep the dashboard responsive without reprocessing history. Incremental refresh loads only new or changed rows based on date ranges, which is well suited to journal and transaction tables. Dataflows can also use incremental refresh to stage curated tables when teams prefer an ELT step outside the report file. Composite models combine imported history with DirectQuery tables for frequently changing data such as cash balances or wire status. This mix gives fast analysis for long horizons and timely updates where it matters.

Security is applied in the model so one dataset can serve different audiences without separate copies. Row-level security filters restrict access by entity, partner, or other attributes. Object-level security can hide sensitive tables or columns when needed. These controls live with the dataset and are testable in Desktop and the service.

Drill through links summary balances to the underlying transactions and documents. Reviewers move from a capital account total to contributions, distributions, and allocations in context, then return to the summary page. This keeps review work inside one report rather than bouncing between exports.

The integration uses standard Power BI capabilities and FundCount’s published data structures, so teams avoid custom middleware and one-off spreadsheets. Licensing follows the normal Power BI plan in use. The result is a live interface that aligns with accounting dimensions, preserves auditability, and scales as data grows.

Practical benefits at a glance

-

- One dataset governs web and mobile with the same filters and timestamped refresh

- Incremental refresh for large history tables and composite models for current balances and status feeds

- Row-level and object-level security for role-appropriate views without duplicate models

- Report drill-down for a consistent path from summary to journal lines and attachments

Bringing it together

Power BI sits on top of the FundCount dataset and turns the ledger into a working view of the business. The same model serves web and phone. Filters match how accountants think about the world, by entity, partner, asset, currency, and date. Totals open into journals and documents, then fold back to summaries without leaving the report. Refresh plans bring in what changed and leave the rest alone, so large histories stay quick while cash and other hot facts stay current. Security rules travel with the data model, which means each person sees only what they should. There are no special tricks here. It is standard tooling set up carefully to match your daily work.