Data analytics is playing a growing role in how family offices manage their investments. Across North America, more than half of family offices now use analytics tools to consolidate market and portfolio data, monitor trends, and quantify performance to support more informed decision-making. These capabilities help identify risks and vulnerabilities in portfolios so that family offices can adjust to changing market conditions and use predictive forecasts to plan ahead. Although interest in artificial intelligence is rising, only a small minority of family offices currently report using AI-driven data analytics solutions.

How many family offices use data analytics to gain an edge

Family offices that are serious about data analytics are starting with the plumbing. They are pulling portfolio positions, cash balances, capital calls, benchmarks and third party market data into one environment, then treating that information as a product that investment and operations teams can trust and reuse. Phil Tattersall, partner for wealth and asset management technology consulting at Ernst & Young LLP, writes that firms are “transforming their use of data” with a focus on providing “trusted data to improve performance and efficiency.” In practice, that means fewer one off spreadsheets and more shared data sets that feed investment dashboards, risk reports and cash forecasts from the same underlying numbers.

Analytical tools are then used to push this data into day to day workflows. Tattersall points to the rise of managed data services and firm wide data meshes that decentralize data ownership but keep common standards in place. For a family office, that can translate into investment teams running on demand factor and scenario analysis on live positions, while controllers use the same platform to monitor fee leakage, counterparty exposure and liquidity buffers. Technology such as live data sharing allows service providers to grant secure access to their data instead of sending static files, which helps offices reconcile portfolios more quickly and gives principals near real time visibility into their total wealth. Self service data marketplaces let analysts and risk staff pull curated data products and models without waiting for IT, which shortens the cycle from question to answer and makes analytics part of routine decision making rather than a special project.

Regulation drives the need for big data analysis

ESG and regulatory reporting are often early test beds. Tattersall notes that pilot projects around ESG data can demonstrate the value of a better data model because the information is fragmented, sensitive and tied to reputational risk. Family offices use those pilots to build repeatable processes that aggregate ESG scores, controversies and impact measures across funds and private holdings, then feed them into both risk dashboards and family reporting. Once that pattern is in place, the same analytical engine is applied to other operational domains such as tax reporting, treasury management and service provider performance.

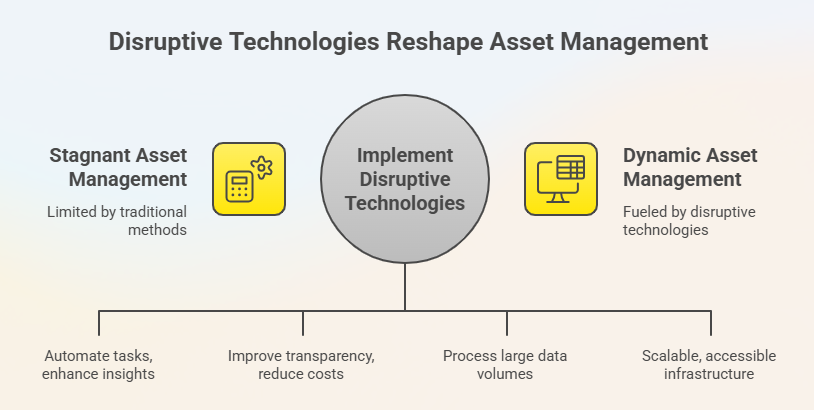

These efforts sit within a wider shift across asset and wealth management. PwC’s Asset and Wealth Management Revolution 2024 report highlights that disruptive technologies such as generative AI, distributed ledgers, big data and cloud are reshaping the industry, noting that “four out of five survey respondents report that this kind of tech is fueling revenue growth” and that it is moving from the back office into client interactions. PwC also observes that AI is increasingly used in portfolio management, trading and risk, where it “can produce better asset return and risk estimates” and process large volumes of data to generate trading signals and validate risk models. For family offices, the same tools support stress tests on liquidity and concentration, forward looking allocation reviews, and tighter monitoring of service providers, so analytics becomes part of how the office is run rather than just a way to look in the rear view mirror at performance.

Reporting and accounting systems incorporate data analytics into family office workflows

Firms that provide integrated portfolio accounting and reporting platforms, such as FundCount, are becoming the data backbone for analytics in family offices. They bring together positions, cash flows, capital calls, partnership statements, bank activity and reference data in a single general ledger and security master, and can store additional data points that matter to a particular family, such as deal notes, ESG flags or bespoke classifications. Open APIs make it possible to connect custodians, banks, CRM systems and analytical tools so that all of this information sits in one place, while the underlying data remains owned and controlled by the family office.

On top of this foundation, these platforms help turn raw data into something the office can actually use. AI document tools convert unstructured PDFs from alternative investments into structured fields that can feed exposure and performance analysis. Reconciliation and validation routines flag breaks before they affect reports. Connectors to tools such as Power BI allow family offices to build their own dashboards for allocations, attribution, cash forecasting and scenario analysis while drawing on the same curated datasets. In practice, this means data analytics is embedded in daily workflows for investment, risk and operations teams rather than treated as a separate, one-off exercise.