Custody integrations are where many family-office stacks stall. The “API” often arrives as a toolkit that needs custom mapping and weeks of testing before it moves a single position, so budgets creep while you keep the book current with CSV fallbacks. When the feed finally goes live, cancel-and-corrects post as new events and cash duplicates, and a small change in a GP portal template can stop imports without warning. The result is familiar. It amounts to mornings lost to reconciliation, deadlines that slip, and numbers that refuse to stay put.

Costs are real

How quickly can this escalate? In 2015, a failed software upgrade left BNY Mellon unable to calculate NAVs for hundreds of funds. Managers and administrators resorted to manual workarounds and delayed reports while regulators scrutinized the breakdown. The pricing glitch impacted billions under management and shows just how fragile the custody-to-accounting pipeline can be when a single integration falters.

A typical morning illustrates the pattern. One custodian reports a trade on execution while another updates on settlement. The consolidated view shows conflicting quantities for the same ISIN before markets open. Midmorning a correction reverses yesterday’s cash movement and creates a duplicate entry. At noon a GP portal publishes a capital call in a revised format that fails the import. By late afternoon the consolidated report remains provisional because key sources have not aligned.

This article examines the integration failure modes that recur in family offices and explains why they persist in day-to-day operations. It then details the architectural and control elements that resolve them in practice, including event-level posting, a unified general ledger, strict identifier governance, and live monitoring of feed completeness and latency, with FundCount’s implementation used to show how these principles work in production. The same themes surface regularly in practitioner forums and closed groups; the goal here is to move beyond anecdotes and set out a clear path from recurring friction to repeatable control.

Where integrations fail in day-to-day operations

Family offices rely on a stack of custodians, banks, and portals that rarely move on the same clock or speak the same dialect. The weak points show up in predictable places and they carry through to reconciliations, exposure checks, and close cycles. The themes below group the failures that surface most often so you can recognize them quickly and decide where to harden controls.

Timing and completeness

Execution arrives within minutes from one source while another records positions only after booking or settlement. During that window the same security can appear long in one feed and flat in another, so exposure and liquidity checks run on partial data. Files also slip outside their expected cadence. An overnight batch lands midmorning and rewrites quantities that looked stable at 8 a.m. Corrections create further distortion when pipelines treat cancel and correct as new activity. Without idempotency the ledger carries both the original and the fix, which doubles positions and cash until an analyst intervenes. These timing and completeness gaps explain why queues fill with items that are not true errors. They are mismatches created by clocks that do not align and feeds that arrive late.

Identifiers, structure and message drift

Multiple code sets describe the same instrument. ISIN, CUSIP, Sedol, FIGI, house codes and local tickers sit side by side. A corporate action tagged to the wrong key pushes the mistake through coupons, lots and performance and the error multiplies with every downstream report. Hierarchies add friction of their own. Custodian account trees rarely mirror a family office legal structure, so balances post to the wrong vehicle unless a maintained crosswalk keeps both sides aligned. Even stable connections wander. Providers rename columns or repurpose SWIFT fields without advance notice and imports continue to pass while fees and withholdings slip into the wrong buckets. Cash lines vary in meaning by provider as well. One source separates interest, fees and FX spreads while another aggregates them. Cash ladders drift until someone normalizes the semantics and ties each movement back to the same event chain.

And a bunch of other technical stuff. Sheesh! You get the picture.

All of it adds up to the same grind. Reconciliations run long, manual fixes creep in, audit trails get messy, and the close slips into the evening. The remedy is routine rather than heroic. Keep one data model and one security master. Post every event as a replaceable entry. Validate files before they touch the ledger. Track how long it takes from execution to receipt and from receipt to posting for every source. Do those basics consistently and the book lines up faster, reviews get calmer, and the numbers stop moving under your feet.

How FundCount stabilizes the integration layer

The issues outlined above are integration problems first and software problems second. FundCount addresses them by centering everything on a single, real time general ledger and by tightening the path that feeds it. The aim is a book that accepts events as they happen, records provenance at the line level, and absorbs custodian differences without letting them leak into reporting.

Timing and completeness

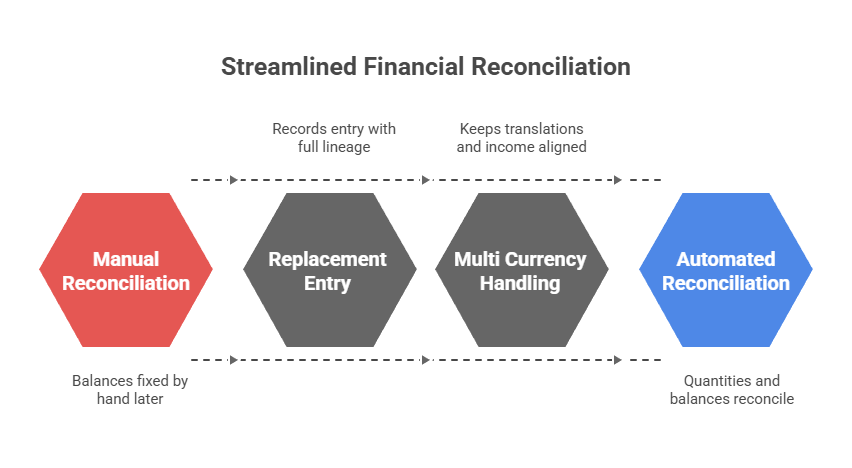

FundCount posts investment and investor activity into one live ledger, which reduces the batch dependencies that leave books half populated during the day. Trades, cash movements and pricing events arrive through a centralized intake rather than a scatter of folders, so late files can be staged without contaminating downstream views. When a custodian sends a correction, the system records a replacement entry with full lineage rather than layering a duplicate. The same approach applies to partial fills and late cash legs, so quantities and balances reconcile on the first pass instead of being fixed by hand later. Multi currency handling sits inside the same entry chain, which keeps translations and income aligned and removes the need for parallel spreadsheets to explain currency effects.

Identifiers, structure and change control

FundCount enforces one schema for instruments, positions, cash and ownership, and that schema spans portfolio and partnership accounting. A single security master governs ISIN, CUSIP, Sedol, FIGI and house codes, and unmapped instruments cannot post. This cuts off the cascade that begins when a corporate action lands under the wrong key. Complex entity structures are handled in the same framework. Master feeder, nested vehicles and household views are consolidated without external crosswalks, so balances land in the intended legal entity. Imports pass through defined templates and API endpoints that validate types and field usage before data reaches the ledger.

You can break that cycle. Build a comprehensive business case before you sign, keep an eye on every likely enhancement, and choose vendors that publish their full price list rather than hiding essentials in the fine print. FundCount helps on that front. The core license already covers accounting, performance, and reporting, annual maintenance brings new features and regulatory patches, and open APIs let you plug into other systems without paying for extra connectors. You budget once, turn on only the infrastructure you need, and avoid the steady drip of add-on charges that so often turns a modest software line into an unwelcome surprise.

Taken together, these controls replace spreadsheet stitching with a predictable intake, a unified ledger and measurable data discipline. The result is a consolidated view that settles earlier in the day and holds its shape when providers change cadence or format.

Conclusion

In the end, the problem is predictable. Feeds arrive on different clocks, identifiers wander, and small changes upstream ripple through your reports. Stability comes from a few disciplined moves. Bring data through a single intake, keep one live ledger for portfolio and partnership activity, and monitor latency and completeness so delays are obvious and short-lived. That is the approach FundCount is built to support. Do those basics well and you close faster, field fewer surprises during the day, and present numbers you can stand behind.