How the Ultra-Wealthy Manage Their Fortune

Family offices are private wealth management firms that cater to the specific needs of ultra-high-net-worth individuals and families. A family office is a private wealth management firm built to serve a single ultra-high-net-worth family or a small group of families, and you feel the difference the moment you step into the work. You orchestrate investing, tax, estate planning, philanthropy, and day-to-day administration under one roof, with the aim of protecting capital, simplifying decisions, and keeping everyone aligned across generations. That can mean coordinating a direct investment alongside hedge fund allocations, paying household staff, overseeing aircraft and property expenses, and preparing consolidated reports that read cleanly across banks, custodians, and private partnerships. It can also mean family governance, education for rising stakeholders, and thoughtful privacy controls. If you choose the add-on that supports co-investment workflows, you will likely see a follow-up invoice for extra portal seats, database connections, and migration work. The promise is simple yet demanding—tailored, end-to-end service that a traditional advisor would struggle to deliver at this depth and pace.

Family office overview

If you work with ultra-high-net-worth families, you care because a family office gives you one place to manage everything that touches wealth and life. A private family wealth management firm brings investing, tax, estate planning, governance, philanthropy, reporting, and daily administration into a coordinated plan that protects capital and supports growth across generations. You might coordinate a direct deal alongside fund allocations, run household payroll, structure education trusts, and reconcile multi-custodian statements into one clear report that everyone can understand. If a family adds a co-investment vehicle or acquires another property, you will likely rely on the office to centralize KYC, banking, insurance, and portal access so nothing slips. In this article you will see what a family office does, how family offices work in practice, and why they are increasingly important worldwide for the wealth management needs of ultra-high-net-worth individuals.

What is a family office?

A family office is a privately held company that manages the wealth and affairs of one ultra-high-net-worth family in a single-family office or several families in a multi-family office. Think of it as a dedicated team that aligns investing, tax, estate planning, risk, governance, philanthropy, and reporting so you preserve and grow capital across generations. The model has a long pedigree that reaches back to industrial dynasties such as the Rockefellers in the late nineteenth century, and today you use it to bring order to increasingly complex balance sheets.

The family office definition covers far more than portfolio management. You coordinate everything that touches a family’s financial and personal life, including bill pay, household payroll, real estate oversight, travel logistics, education planning, and privacy controls. If you centralize these services, you will likely see cleaner decision making, faster execution, and fewer gaps between advisors. In short, a family office is a one-stop, highly personalized solution that many families prefer over a standard wealth management firm because it works to the family’s playbook and moves at the family’s pace.

Types of family offices

Single family office

You build an in-house company that serves one family exclusively. You set policy, hire specialists, and tailor every workflow to the family’s priorities. If you choose this path, you will likely gain maximum control and privacy, with higher fixed costs and a deeper operational footprint.

Multi family office

You join a shared platform that serves several families under one umbrella. You keep dedicated attention while benefiting from pooled expertise, established vendor networks, and institutional controls. If you prefer lower overhead with strong capabilities, you will likely find this model a practical middle ground. Here’s how it differs from a single family office.

Virtual or outsourced family office

You assemble the function from external providers and technology rather than a full internal team. You use specialist firms for investments, tax, accounting, bill pay, and reporting, then connect the pieces through a coordinating lead. If you are building toward a full office or testing scope, you will likely value the flexibility, with success depending on clear governance and tight data integration.

Core functions and services

Investment management

You design and run a long-term portfolio that fits the family’s goals and risk tolerance. You set asset allocation, perform due diligence on public markets, real estate, private equity, hedge funds, and venture capital, and keep risk within agreed limits. If a new direct deal appears attractive, you will likely model scenarios, test liquidity needs, and document governance before capital moves.

Wealth planning and preservation

You build an integrated plan for taxes, estates, and succession so wealth holds its shape across generations. You structure trusts and foundations, organize ownership, and align distributions with cash flow and lifestyle. If you refine the structure, you will likely reduce leakage, improve control, and simplify year-end work for advisors.

Philanthropy management

You turn values into a giving strategy and make it operational. You set focus areas, manage a foundation when needed, handle grantmaking, and track impact and compliance. If the family wants next-gen involvement, you will likely add mentoring and voting rules to keep decisions clear.

Administrative and legal support

You keep the engine room running. You coordinate accounting, bill pay, record keeping, and document management, then work with counsel on contracts and regulatory filings. If you centralize these tasks, you will likely avoid missed deadlines and fragmented records.

Lifestyle and concierge services

You help the family live smoothly while protecting assets and privacy. You hire and manage household staff, oversee properties, arrange travel, and coordinate security, insurance, and luxury asset care such as art, yachts, and aircraft. If a new residence or aircraft enters the picture, you will likely handle onboarding, vendors, and reporting so costs and risks stay visible.

Family governance and education

You create structures that keep people aligned. You organize family councils and meetings, draft a charter when appropriate, and build education programs for rising stakeholders. If you invest in governance early, you will likely see better decisions and fewer disputes when roles shift.

Not every office offers every service. You tailor the mix to the family’s complexity, preferences, and stage, with the goal of delivering a coordinated system that preserves and grows wealth while making daily life easier.

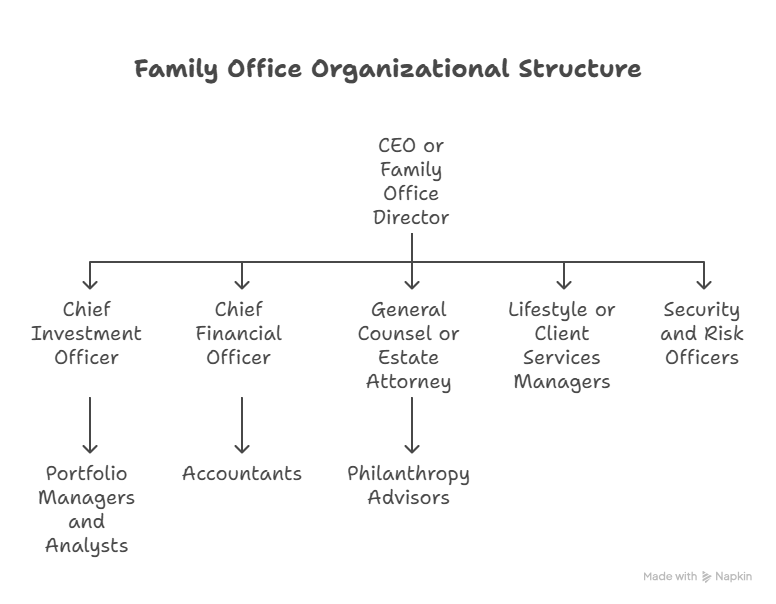

Family office structure and key roles

A family office runs like a focused private company built around your family’s priorities. You assemble a multidisciplinary team that covers investments, finance, tax, legal, operations, governance, and lifestyle management, then you give them clear decision rights and a cadence for committees and reviews. In a single family office the team works only for you and follows your playbook. In a multi family office you share a platform with other clients while retaining dedicated coverage and agreed service levels. Reporting lines stay tight so strategy turns into execution without friction, and you scale capacity with outside specialists when a deal, property, or cross border issue demands it. In the next part we will walk through the core roles and how they fit together.

Leadership and key roles

A family office usually runs under a CEO or family office director who keeps the entire machine aligned and reports to the principals. In a single family office you may ask a family member to lead or you may appoint a trusted outsider with the temperament to manage advisors and vendors while protecting privacy. Under that leader, a chief investment officer sets policy, selects managers and direct deals, and keeps liquidity in step with commitments. A chief financial officer or finance director owns budgeting and cash flow, closes the books, delivers performance and tax reporting, and coordinates filings with external tax advisors. Your general counsel or estate attorney handles transactions and entity work, maintains trust documents, and guides succession so the structure holds up across jurisdictions.

Around this spine you staff specialists who make the plan real. Portfolio managers and analysts run due diligence and monitor exposures, accountants keep records clean and audit ready, and philanthropy advisors turn family values into a workable giving program with clear compliance. Lifestyle or client services managers handle travel, staffing, property upkeep, and day to day requests so life runs smoothly. Security and risk officers look after physical safety, cybersecurity, insurance, and incident response. With the right mix you get a team that moves quickly, communicates clearly, and supports the family’s goals without friction.

How Do Family Offices Make Money?

Family offices generate revenue through a combination of investment management fees and performance-based incentives. They typically charge a percentage of assets under management (AUM) for their services, which can range from 0.25% to 1.5% or more, depending on the complexity of the services provided and the size of the family’s assets. In addition, some family offices also charge performance-based fees, which are tied to the performance of the investment portfolio. These fees can be a percentage of the profits generated or a benchmark-based fee that rewards the family office for outperforming a specific benchmark.

A single family office operates as a cost center. You fund salaries, benefits, office space, travel, systems, and advisor fees out of the family’s wealth, much like an internal department. The office does not earn revenue from outside clients. The return comes from control, alignment, and the ability to tailor every workflow to the family’s goals. If you expand scope to include direct deals, aviation oversight, or multiple residences, you will likely see higher fixed costs alongside tighter oversight and fewer surprises.

A multi family office is a commercial business. You pay asset based fees that typically sit around one half to one percent of assets under management, and in some mandates you agree to a performance fee that shares a portion of gains. These fees fund the platform, the talent, and the technology, and they are the MFO’s revenue. If you ask for specialized work such as a complex estate restructure or a cross border project, you may see an hourly charge, a fixed project fee, or a retainer layered on top. Asset based fees remain the most common model, with add ons used when the engagement goes beyond standard portfolio management.

Here’s a breakdown of how family offices make money:

- Investment management fees: Family offices generate a significant portion of their revenue through investment management fees. These fees are typically charged as a percentage of assets under management (AUM), which refers to the total value of the investments that the family office manages. The AUM fee typically ranges from 0.25% to 1.5%, depending on the complexity of the services provided and the size of the family’s assets.

- Performance-based fees: In addition to AUM fees, some family offices also charge performance-based fees, which are tied to the performance of the investment portfolio. These fees can be a percentage of the profits generated or a benchmark-based fee that rewards the family office for outperforming a specific benchmark. Performance-based fees can incentivize the family office to generate strong returns for their clients, but they can also create conflicts of interest, as the family office may be tempted to take on more risk than is appropriate for the client’s risk tolerance in order to generate higher fees.

- Additional services: Family offices may also generate revenue from providing additional services to their clients, such as tax planning, estate planning, and philanthropic advisory services. These additional services can be charged on an hourly basis or as a fixed fee.

The specific revenue streams of a family office will vary depending on the family’s needs and the family office’s expertise. However, investment management fees and performance-based fees are typically the two most significant sources of revenue for family offices.

Family offices generate revenue through a combination of investment management fees and performance-based incentives

Family office fees in practice

Public filings make the math straightforward. One family office’s Form ADV, for example, shows a tiered asset-based schedule ranging from 0.85 percent down to 0.20 percent annually, plus a planning retainer. At the large-mandate end, a one billion dollar relationship priced near 0.20 percent would generate about two million dollars a year to fund the platform and advisory team.

Some firms disclose higher maximums. Another family office permits asset-based fees up to 2 percent, and recent reporting notes an added platform charge of 3.5 basis points on advisory assets. Even at a negotiated rate well below the maximum, a billion-dollar mandate can support several million dollars in annual revenue.

On the single-family side, cost studies of operating budgets indicate an average run rate near forty-one basis points of assets, which would be about four point one million dollars a year on one billion. That spend covers in-house salaries, systems, and specialist vendors rather than generating external revenue.

Performance fees can skew incentives toward risk, so many multi-family offices prefer flat or asset-based pricing to keep interests aligned. Independent guides describe common ranges between 0.5 and 2 percent, with lower breakpoints at higher asset tiers.

What Are the Rules for Family Offices?

The Family Office Rule sets forth three requirements that the family office must meet in order to qualify for exclusion from regulation under the Advisers Act.

Rule 1: Family Clients

The family office must only provide investment advice to “family clients.” Family clients are defined as:

- The family office’s founders and their spouses, parents, siblings, children, grandchildren, and their spouses

- The spouses of deceased family members

- Trusts that are wholly owned by family members

- Entities that are wholly owned by family members

- Other entities that are controlled by family members and whose sole purpose is to provide investment advice to family clients

Rule 2: Ownership and Control

The family office must be wholly owned by family clients and exclusively controlled by family members/family entities. This means that:

- Family clients must own 100% of the equity of the family office

- Family members must control the management and policies of the family office

- No non-family member can have any ownership or control over the family office

Rule 3: Not Holding Out to the Public

The family office must not hold itself out to the public as an investment adviser. This means that:

- The family office cannot advertise or solicit business from the public

- The family office cannot pay any compensation to anyone for soliciting business from the public

- The family office must not represent itself as an investment adviser in any public filings

In addition to these three requirements, the Family Office Rule also includes a number of complex definitions that further limit the availability of the exclusion. For example, the definition of “family client” is very narrow and does not include certain types of trusts and entities. As a result, it is important for family offices to consult with an attorney to ensure that they comply with all of the requirements of the Family Office Rule.

Additional Rules

- The Family Office Rule does not apply to family offices that serve multiple families.

- Family offices must be careful not to structure themselves in a way that could be seen as an attempt to circumvent the Family Office Rule.

- Family offices must be aware of the potential for conflicts of interest and take steps to mitigate those conflicts.

- Family offices must maintain a high level of compliance with all applicable laws and regulations.

Regulations and legal considerations

Family offices operate quietly and, in many cases, face lighter oversight than public-facing firms. In the United States the SEC’s Family Office Rule excludes a true single family office from the Investment Advisers Act if three tests are met. The office must advise only family clients such as family members, certain trusts, key employees, and related charitable vehicles. It must be wholly owned by family clients and controlled by family members or family entities. It must not hold itself out to the public as an investment adviser. Stay within those lines and you avoid SEC registration and the public disclosures that come with it. Step outside them by adding non-family clients or marketing broadly and the exemption falls away.

Multi family offices and external providers do not qualify for this exemption. They typically register as investment advisers or operate through a regulated trust company, which brings fiduciary duties, compliance programs, and routine examinations.

Rules differ outside the United States. Some jurisdictions treat a private single family office as outside the licensing regime if it serves only the family, while others require authorization when the office provides investment advice or manages assets unless a local exemption applies. Because structures can range from LLCs to trust companies, it is prudent to choose an entity that protects confidentiality and liability while meeting tax and regulatory needs in each place you operate. Specialist counsel can help you document scope, ownership, and client definitions so your family office stays within the intended exemption.

When a family needs a family office

There is no bright line, but the math and the workload point you in the same direction. A dedicated single family office tends to make sense once your assets approach roughly one hundred million dollars, and a fully staffed traditional build often targets two hundred million and up to cover salaries, systems, and professional fees. If you are closer to fifty million with complex holdings, you can still get many of the benefits through a lean or virtual model that relies on external specialists. The aim is the same in every case—centralize decisions, protect privacy, and keep multi-disciplinary work moving in step with your goals.

Beyond net worth, the decision turns on how complicated life has become and how much control you want. If you own operating companies, hold real estate in multiple countries, or juggle direct deals alongside manager allocations, a family office gives you a single place to coordinate tax, legal, reporting, and daily administration. If your situation is simpler or liquidity is still building, a multi family or fractional arrangement will likely cover your needs while you wait for scale.

Checklist to pressure-test the fit

-

Financial complexity: multiple entities, cross-border assets, direct deals, or unique holdings that require specialist oversight

-

Administrative burden: significant time spent on bill pay, reconciliations, reporting, and compliance that you want centralized

-

Privacy needs: heightened confidentiality and security for family members, properties, and travel

-

Legacy and family needs: governance, education for heirs, and philanthropy that benefit from a formal structure

-

Cost-benefit: ability to fund an annual budget that may run into the millions, or a preference for a multi family or virtual model that spreads costs

In the end, you set up a family office when the control, continuity, and coordination you gain outweigh the overhead, and when the structure clearly advances your long-term goals.

Benefits and advantages of using a family office

You get holistic wealth management that keeps every decision connected. Investment moves line up with tax strategy and estate plans, so nothing slips through and you avoid surprises at year end. You also gain customization and control. The office follows your values and risk appetite, whether you aim for capital preservation, growth, or impact, and you steer the agenda while the team executes.

Privacy and discretion improve because the office serves only you or a small circle. There is no public marketing, and sensitive information stays tightly held. Incentives also align. Your team works for you rather than for a product shelf, which means advice is focused on outcomes that suit the family rather than commissions.

A family office supports long term legacy planning. You formalize governance, educate rising stakeholders, and keep the story of the wealth intact so the next generation understands both responsibility and opportunity. Daily life becomes easier as well. Lifestyle and concierge support handle staffing, properties, travel, security, and high value assets, so you reclaim time and reduce stress.

You see better deal flow. Networks open doors to direct private equity, co investments with other families, and bespoke real estate projects that you might not find alone. Many offices have shifted more capital toward private markets and real assets in recent years, reflecting the flexibility that a tailored mandate provides.

Challenges and modern trends in family office management

High operational costs are real. Salaries, technology, and compliance add up, which is why many families wait for significant scale or choose a multi family or fractional model to spread expenses. Talent is another constraint. It can be hard to recruit seasoned investors and cross border tax experts, so offices often partner with external specialists or keep consultants on retainer to fill gaps.

Complex assets create data headaches. Multiple entities, custodians, and private deals make reporting slow if systems are fragmented. Modern offices invest in purpose built software for accounting and consolidated reporting to create a single source of truth that speeds close, improves accuracy, and supports better decisions. Platforms like FundCount are used to integrate books and records with portfolio analytics and client portals without turning the exercise into an IT project.

Regulatory and compliance pressure keeps rising. Transparency rules and beneficial ownership registers require careful documentation, so many offices engage specialist compliance advisors or outsource filings to trust companies or accounting firms. Cybersecurity and privacy risks demand the same attention. You protect email, payment processes, and document stores, and you may appoint a security lead or hire an external firm to test and monitor controls.

The model is evolving. More offices outsource non core or highly technical tasks such as performance reporting, partnership accounting, or specialized due diligence, which lets a lean internal team focus on priorities. New service platforms make it easier for smaller families to access institutional grade tools without building everything from scratch. Global hubs such as Singapore and the UAE have become magnets for new offices as families look for favorable rules and proximity to opportunities. Many offices also fold values into mandates through ESG, impact investments, and formal philanthropy programs as younger generations take a seat at the table.

The takeaway is simple. The family office remains relevant because it adapts. You can keep the benefits of control, privacy, and coordination while using partnerships and technology to manage cost, complexity, and risk.

How Much Money Do You Need for a Family Office?

Deciding whether or not to establish a family office is a significant financial decision that should be made after careful consideration of your family’s circumstances and goals. While there is no universally defined net worth threshold for establishing a family office, it is generally understood that a minimum net worth of $50 million is typically required to make it financially viable. This substantial amount is necessary to cover the ongoing costs of operating a family office, which can include salaries for staff, investment fees, and technology expenses.

However, the decision to establish a family office is not solely based on net worth. Factors such as the complexity of your family’s financial situation and your specific needs and priorities also play a significant role. If your family’s financial affairs are relatively straightforward, and you have access to competent financial advisors, a family office may not be necessary. Conversely, if your family’s financial situation is complex, you have a diverse range of assets, or you require specialized expertise in areas like tax planning or estate planning, a family office can provide comprehensive and tailored services to meet your unique needs.

Here are some key considerations when determining if a family office is right for you:

- Net Worth: As mentioned earlier, a minimum net worth of $50 million is generally considered the benchmark for establishing a family office. This threshold ensures that the ongoing costs of operating a family office can be adequately covered without placing undue financial strain on the family.

- Complexity of Financial Situation: If your family’s financial situation is intricate, involving a variety of assets, investments, and financial obligations, a family office can provide centralized management and oversight. They can help you navigate complex financial decisions, ensure tax compliance, and implement strategies to preserve and grow your wealth.

- Family Needs and Priorities: Consider your family’s specific needs and priorities when evaluating the potential benefits of a family office. If you have philanthropic goals, require assistance with wealth transfer planning, or seek guidance on managing generational wealth, a family office can provide tailored solutions and support.

- Access to Competent Advisors: If you have access to experienced and competent financial advisors, you may be able to manage your family’s finances effectively without the need for a dedicated family office. Evaluate your current advisory team and their ability to address your specific needs before making a decision.

- Cost of Establishing and Operating a Family Office: Establishing and operating a family office can be a significant financial undertaking. Consider the upfront costs of setting up the office, ongoing staff salaries, investment fees, and technology expenses. Ensure that the potential benefits outweigh the costs before proceeding.

- Long-Term Goals: Consider your family’s long-term financial goals and aspirations. If you anticipate significant growth in your wealth or have complex financial needs that may evolve over time, a family office can provide continuity and expertise to support your long-term objectives.

- Family Dynamics: Establishing a family office can significantly impact family dynamics and relationships. Discuss the decision openly with family members to ensure alignment and avoid potential conflicts or misunderstandings.

- Seek Professional Guidance: Consulting with experienced financial advisors and legal professionals can provide valuable insights and guidance when evaluating whether or not a family office is the right choice for your family. Their expertise can help you make an informed decision that aligns with your specific circumstances and goals.

Comparing Leading Family Office Reporting Software

Family office reporting tools tend to fall into two buckets:

- “System of record” platforms that combine accounting + aggregation + reporting (best when you want one place to close books, reconcile, and publish reports), and

- “Reporting/portal layers” that shine at presentation and aggregation—but are often paired with separate accounting/AP workflows.

Below is a practical comparison, with FundCount listed first as the most direct fit when the goal is accurate, audit-friendly reporting across complex entities.

FundCount

Positioning/use cases

- Positions itself as an all-in-one family office solution focused on one integrated view of wealth, transparency in complex entity structures, automated data feeds, and reducing “system ping-pong.”

- Common use cases:

- Consolidated reporting across portfolio + partnership activity + real-time general ledger

- Look-through reporting for nested entities and complex ownership

- Faster close with fewer spreadsheet handoffs

- Standardized reporting packs for principals, advisors, accountants

- Consolidated reporting across portfolio + partnership activity + real-time general ledger

Target audience

- Single and multi-family offices that need consolidated reporting and operational control across complex structures and asset types.

Pricing

- Quote-based (typically scoped by entities, users, asset complexity, integrations, and services)

A feature that stands out:

- Transparency in complex family entity structures (nested entities + look-through reporting) and a unified workflow that ties portfolio + partnership activity into the GL.

| Pros of FundCount | Cons of FundCount |

|

|

Addepar

Positioning/use cases

- Positions itself as family office software that helps offices handle complexity efficiently and preserve wealth over generations.

- Common use cases:

- Aggregation and performance reporting across many accounts/custodians

- Modern reporting experiences for principals and stakeholders

- Portfolio analytics and dashboards across asset types

- Multi-relationship views (households/entities) for reporting

- Aggregation and performance reporting across many accounts/custodians

Target audience

- Family offices and wealth teams prioritizing aggregation, dashboards, and performance reporting across complex holdings.

Pricing

- Quote-based (commonly positioned as premium in the category; scope and services drive total cost)

A feature that stands out:

- Strong focus on handling reporting complexity across diverse assets and accounts.

| Pros of Addepar | Cons of Addepar |

|

|

Archway Platform (Archway Technology / SEI Archway)

Positioning/use cases

- Positions itself as an integrated platform that supports accounting, investment data aggregation, and advanced reporting for family offices, covering partnership accounting, bill payment, aggregation, and client reporting.

- Common use cases:

- Family office accounting + reporting operations in one platform

- Consolidated reporting across entities, custodians, and asset classes

- Partnership tracking and bill payment workflows

- Automated report packages and scheduled delivery

- Family office accounting + reporting operations in one platform

Target audience

- Single and multi-family offices looking to streamline core accounting + investment + reporting operations (Archway notes use by hundreds of wealthy families).

Pricing

- Quote-based; often paired with services depending on desired outsourcing/support

A feature that stands out:

- A large configurable report library and automated reporting/scheduling (positioned as 200+ templates + automation).

| Pros of Archway | Cons of Archway |

|

|

Masttro

Positioning/use cases

- Positions itself as family office software “built by family offices,” aimed at giving wealth “in full view,” with aggregation, automation, and reporting across complex, multi-generational structures.

- Common use cases:

- Wealth data aggregation and “single view of net worth”

- Reporting and dashboards across entities and asset classes

- Alternatives support (tracking documents/cash flows depending on setup)

- Portal experience for principals and stakeholders

- Wealth data aggregation and “single view of net worth”

Target audience

- UHNW single family offices, multi-family offices, private banks, RIAs, and professional service firms.

Pricing

- Quote-based (often packaged by scale/users/data feeds/services)

A feature that stands out:

- Emphasis on a unified view across entities, asset classes, currencies, and jurisdictions with a modern reporting experience.

| Pros of Masttro | Cons of Masttro |

|

|

SS&C Black Diamond

Positioning/use cases

- Positions itself as a portfolio management and reporting platform with “engaging client reports,” centralized control, and flexible client-ready reporting.

- Common use cases:

- Client-ready performance reporting and report packages

- Advisor/wealth team reporting operations and portals

- Portfolio views and communication/report distribution

- Standardized quarterly reporting workflows

- Client-ready performance reporting and report packages

Target audience

- Wealth management firms/advisors and reporting teams that need strong client reporting and portfolio communication tooling.

Pricing

- Quote-based (platform + modules + services)

A feature that stands out:

- Client-ready reporting workflows (branded, batch, ad-hoc reporting and portal-style delivery).

| Pros of SS&C | Cons of SS&C |

| • Strong client reporting and presentation layer

• Built for producing and distributing report packages • Centralized “command center” style workflow • Good fit for organizations with client-facing reporting needs • Scales well for recurring reporting processes |

• Often paired with other systems for full accounting/close processes

• Less of a “family office system of record” for complex entity accounting • Data integration quality drives reporting quality • Can be less ideal for highly customized entity-level accounting workflows • Costs and scope depend on modules/services |

Envestnet

Positioning/use cases

- Positions itself as portfolio management and performance reporting, including professional PDF reports via a portal, portfolio/risk analysis, alternative investment capabilities, composites, and billing automation.

- Common use cases:

- Performance reporting and report packs for wealth teams

- Portfolio analytics (holdings, transactions, allocation)

- Billing workflows tied to reporting

- Portal delivery of reports

- Performance reporting and report packs for wealth teams

Target audience

- RIAs and wealth managers (the product is widely positioned for advisor firms).

Pricing

- Quote-based (often bundled depending on suite and integrations)

A feature that stands out:

- Strong reporting + billing workflow combination (useful for advisory-style operations).

| Pros of Envestnet | Cons of Envestnet |

|

|

Orion (Portfolio Accounting / Reporting)

Positioning/use cases

- Positions itself around portfolio accounting with billing, reporting, and trading at scale; highlights market share in portfolio accounting among advisors.

- Common use cases:

- Portfolio accounting + reporting for wealth firms

- Client reporting workflows and portals

- Operational scale for reporting and back-office tasks

- Trading/rebalancing integration (depending on stack)

- Portfolio accounting + reporting for wealth firms

Target audience

- RIAs and wealth management firms that want a unified advisor tech stack with strong reporting.

Pricing

- Quote-based; often packaged as “stacks”/bundles depending on modules

A feature that stands out:

- Advisor-oriented portfolio accounting engine paired with reporting and operational tooling.

| Pros of Orion | Cons of Orion |

|

|

Why FundCount first intro

Family office reporting sounds simple until you try to answer basic questions across multiple entities: What do we own, where is it held, what changed this month, and why?

The challenge is that most “reporting tools” are only as good as the data feeding them, and family office data is rarely clean, consistent, or centralized. That’s why many offices start by choosing a system that can act as a true back-office core, tying reporting to real accounting workflows and a reliable general ledger.

FundCount is built for that: it’s designed to handle complex entity structures and produce consolidated reporting you can trust, without having to rebuild everything in spreadsheets every cycle.

Who should choose what

If you’re narrowing down the shortlist, here’s a practical way to think about it:

- Choose FundCount if you want accurate consolidated reporting that’s grounded in real accounting workflows, especially if you have complex entities, multiple structures, and reporting that needs to be consistent month after month.

- Choose Addepar if your priority is aggregation + performance reporting dashboards across many accounts/custodians, and you’re okay pairing it with separate accounting/AP processes.

- Choose Archway if you want a more comprehensive platform approach that includes accounting-style workflows (like partnership accounting and bill pay) alongside reporting, and you’re prepared for a heavier implementation.

- Choose Masttro if you want a modern “single view of wealth” experience across entities and jurisdictions, with an emphasis on dashboards/portal-style reporting.

- Choose SS&C Black Diamond if your core need is client-ready reporting packages and portal delivery (common for wealth/advisor teams), and you don’t need it to be your accounting system of record.

- Choose Tamarac if you’re operating more like an advisory/wealth firm and want reporting + portfolio analytics + billing workflows in one ecosystem.

Choose Orion if you want a scalable advisor-style stack where reporting and portfolio accounting are tightly integrated with operational workflows.

Can I Outsource Family Office Services?

Absolutely! In fact, more and more family offices are doing exactly this every year. Industry surveys show that well-run offices now outsource roughly a quarter of their operating budget to third-party specialists. The motivation is straightforward: talent is scarce, technology keeps evolving, and manual work still eats up about 40 percent of the average work-week. Shifting repeatable, data-heavy tasks to an expert platform cuts head-count pressure, speeds up reporting, and frees senior staff to focus on strategy instead of spreadsheets.

What FundCount Delivers When You Outsource

-

Unified accounting and general ledger

Book- and tax-basis entries for every entity, asset class, and currency feed a single “source of truth” fit for audit. -

Automated data aggregation and reconciliation

Custodial, banking, and market feeds arrive daily, are scrubbed for errors, and post automatically, turning a week of tick-and-tie into minutes. -

Look-through reporting on complex structures

On-demand P&L, balance sheet, and cash-flow views roll up or drill down through trusts, SPVs, and generations without spreadsheet gymnastics. -

Investment and performance analytics

Real-time exposure, contribution, and risk metrics span public markets, direct deals, private funds, and lifestyle assets. -

Accounts-payable and expense management

Invoices route through configurable approval workflows and settle via secure payments, with every entry synced to the ledger. -

Self-service dashboards for the family

Role-based web and mobile portals let principals check their slice of the portfolio, reducing ad-hoc report requests. -

Cyber-secure, AI-ready architecture

Choose public, private, or on-prem hosting; each instance is isolated behind enterprise-grade security and can connect to AI tools without exposing raw data.

Outsourcing to FundCount replaces a patchwork of software, manual reconciliations, and costly staff with one professionally operated platform. Clients typically see faster closes, cleaner data, and meaningful savings on both technology and head-count, all while gaining the depth of reporting and risk oversight that regulators, auditors, and next-generation stakeholders now expect.

What are Fractional Family Offices?

A fractional family office (FFO) delivers the capabilities of a single‑family office on a shared, pay‑for‑what‑you‑use basis. Multiple unrelated families access the same team, technology platform and vendor network; each family pays only for the proportion of resources it consumes.

How they work

- A provider assembles investment managers, accountants, tax specialists and estate‑planning professionals under one roof.

- Core systems for accounting, performance reporting and workflow management are deployed in the cloud for secure remote access.

- Families sign service agreements that define scope, hours and service‑level commitments. Fees are usually a flat retainer or a percentage of assets, with project charges for specialized work.

Why families choose a fractional model

- Lower operating cost – Running a stand‑alone family office with US $500 million in assets can cost close to 1 % of AUM. Pooling staff and infrastructure often reduces the figure to 0.20–0.60 %.

- Access to specialized talent – Pre‑IPO due diligence, cross‑border tax structuring or cybersecurity reviews can be sourced without adding permanent headcount.

- Scalability – Services expand or contract quickly as liquidity events, generational transfers or new investments create fresh requirements.

- Governance support – Independent professionals provide objective oversight, reducing the risk that family dynamics influence investment policy.

Considerations before engaging an FFO

- Data security and confidentiality: Ensure information is segregated at the database level and that the provider maintains independent security certifications.

- Service depth: Confirm the team can handle your full scope of activities, from alternative investment reporting to trustee coordination.

- Cultural alignment: The advisor relationship is personal; verify that the firm’s conflict‑management framework and communication style match family values.

- Exit flexibility: Review notice periods and data hand‑off procedures in case you later build an internal office.

Who benefits most

- Families with US $20–250 million who want comprehensive oversight without funding a dedicated entity.

- First‑generation entrepreneurs following a liquidity event who need time to decide on long‑term governance structures.

- Multi‑jurisdictional families seeking coordinated reporting across entities and currencies but with limited internal administrative capacity.

A fractional model is not a substitute for strategic decision‑making by the family, but it can supply the infrastructure, expertise and control mechanisms needed at a fraction of traditional cost. For many households below the billion‑dollar mark, it offers a pragmatic first step toward professional wealth stewardship.

What Family Office Solutions Are Available?

Family offices usually build their technology and service stack from five core pieces:

- Integrated accounting and reporting platforms

A single database records every transaction—portfolio, partnership and general-ledger—so the team works from one source of truth and eliminates spreadsheet reconciliation. - Modular add-ons

Vendors break the stack into plug-and-play components such as portfolio accounting, partnership allocations, secure family portals, data aggregation feeds and custom report builders. As needs change, new modules slot into the existing ledger. - Outsourced, tech-enabled administration

Many offices outsource part of the operating budget to specialists who supply both software and staff. This approach trims manual workload that still absorbs a large share of a typical week. - Cloud, private-cloud or on-prem deployment

Security policy dictates where data lives. Leading platforms support public cloud scalability, private cloud control or fully on-prem setups, each protected by enterprise-grade security. - Workflow and analytics extensions

Add-ons such as accounts payable, tax packs, compliance checks and KPI dashboards ride on the core ledger. Key requirements include multi-asset coverage, automated reconciliation and flexible self-service reporting for family members.

Mixing and matching these elements, whether in a single platform, a best-of-breed stack or a fully outsourced model, lets each family office tailor a solution that fits its asset mix, governance style and budget today while leaving room to evolve tomorrow.

Conclusion

Family offices give you a single, tailored system for managing wealth, life, and legacy with the level of control ultra-wealthy families require. You set the agenda, your team executes across investments, tax, estate, philanthropy, and daily administration, and the work stays private and coordinated. Whether you build an office or choose a partner, the decision turns on your complexity, values, and long-term goals.

Use what you have learned here to map the right path. You might start a lean office and add scope as needs grow, join a multi-family platform to gain scale, or refine an existing operation with tighter processes, better reporting, and clearer governance. If you want practical help evaluating models and designing a data-reliable back office that supports accurate decisions, we can share proven approaches and tools so you move forward with confidence.