The quarter closed three weeks ago. Your principals want an updated allocation view before the next investment committee call. On your screen sit twelve PDFs from ten managers, eight layouts, four currencies, and a blinking cursor waiting for numbers that still aren’t final.

Capital account statements trickle in on the GP’s schedule, not yours. One arrives by portal upload, another by email with “please see attached,” a third with an invitation to download after resetting a password that expires in fifteen minutes. The files look familiar until they don’t. Contributions are on page two this time, fees are tucked into a footnote, and the distribution that was “pending” yesterday is now netted against management fees. You start keying line by line because there is no other way to get the ledger moving.

Where the valuation delay starts

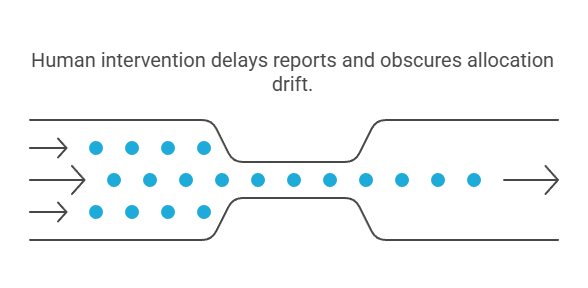

Family offices live on schedules set by investment committees and principals; GPs report on schedules set by their own close processes. That mismatch turns quarter-end into a waiting game. Statements arrive in batches, often with different schema between managers and even between quarters. Contributions, distributions, carry, and fee offsets can move pages or change naming. Pages break mid-table. One credit fund rounds to dollars while a venture fund extends four decimals. Staff translate each statement into the office’s chart of entities and accounts, then repeat the translation when version two lands. Every rekey and rebook adds cycle time and a fresh chance to miss a sign.

The operational hit is real. Allocation views age by the day, cash and public marks move under them, and placeholders creep into reports to keep meetings on track. Small inconsistencies multiply across trusts and SPVs, especially when statements land across four currencies and multiple banks. Reconciliation absorbs hours that should be spent on oversight. Confidence takes a knock too. You can defend the math, but it is hard to defend the vintage of inputs when a GP can shift an ending capital balance by a few basis points with a late-breaking file.

Underneath it all is a data problem. The ledger needs structured fields and final balances; the source arrives as unstructured documents scattered across portals and email. Each manager uses a different dialect for the same economics. Without a standard, the team becomes the adapter layer that turns PDFs into bookings and turns bookings into reports. That human translation is careful and professional, but it is slow. And slow is the part that dulls timing, masks drift in allocation, and leaves everyone working from a quarter that has already moved on.

Solving valuation lag

Quarter-end moves when five things happen in sequence. First, documents get collected from portals and monitored inboxes without staff chasing links. Second, the PDFs are turned into structured fields that match capital accounts, cash flows, fees, carry, and FX. Third, those fields get validated against rules and prior periods so exceptions surface early. Fourth, postings hit the general ledger with the right entities and accounts. Fifth, balances and source documents reach stakeholders in a portal that they will actually use. Miss any step and the lag returns.

Two design choices drive speed. The first is how quickly the system turns unstructured statements into reliable fields. The second is how directly those fields post to the ledger and investor portal. The more handoffs between tools, the more calendars creep.

How FundCount covers the steps

FundCount connects intake, document intelligence, ledger, and portal in one flow. GP statements land through monitored inboxes, secure uploads, SFTP, or API. A document-intelligence service classifies each file, recognizes the template, and extracts structured fields—beginning and ending capital, contributions, distributions, fees, carry, FX rates, and any recallable amounts—along with metadata such as period, version, and “final” status. Each extracted field is mapped to your entities, classes, and accounts, and every value is anchored to its source page so reviewers can click back to the exact line in the PDF.

Validation is rule-driven rather than heroic. FundCount checks deltas against prior periods, enforces tolerance thresholds, and ties cash flows to commitment balances and unfunded amounts. FX translation follows your policy with clear disclosure of rates and dates. Once approved, the system posts journals to the real-time general ledger—capital activity, fee accruals, carry allocations—without rekeying. Versioning preserves the full audit trail: who changed what, when, and why, with the original document always in view.

The investor portal closes the loop. Updated capital balances, cash-flow history, commitment and unfunded views, and the source documents appear for principals and advisors as soon as entries post. Users can drill from a reported balance to the underlying postings and then to the statement itself. Permissions keep family, entity, and advisor access clean. Alerts flag new statements or corrections, and exports give stakeholders the numbers in the format they prefer. The practical outcome is simple: the moment a GP’s PDF is turned into validated data, the ledger reflects it—and the people who need the numbers can see them.

How others solve it

Canoe

Focuses on ingestion and extraction for alternatives at scale—collects manager docs, classifies them, and outputs standardized fields for downstream systems. It shortens intake and manual parsing; posting and investor presentation live in whatever accounting/reporting stack you connect. Canoe

AltExchange

Automates PDF-to-data for alts, syncs into portfolio systems, and provides a unified portal for statements, calls, distributions, and tax docs. It compresses turnaround from document arrival to portfolio view; general-ledger close remains in your core system. (Note: pending/closed corporate moves into iCapital can influence roadmap, but the positioning remains data/portal-centric.) SEI Investments Company

Archway (SEI)

A full family-office platform with integrated GL, partnership accounting, reporting (200+ templates), and a client portal. For alternatives data ingestion, Archway integrates Canoe to automate capture of valuations, capital calls, and distributions into the Archway environment. In practice, Archway spans more of the end-to-end chain than Canoe/AltExchange alone and overlaps with FundCount at the accounting/portal layers. archwaytechnology.net+2archwaytechnology.net+2 PR Newswire

| Vendor / Solution | Category (per article) | Asset‑class focus (as stated) | Key differences / limitations (claimed by the articles) |

|---|---|---|---|

| SEI Archway | Integrated platform (multiple products tied together) | Not specified beyond broad back‑office coverage |

|

| Allvue | Integrated platform | Not specified |

|

| Asset Vantage | Discussed alongside integrated options | Good capability around secondary‑market assets; less for alternatives |

|

| Addepar | Best‑of‑breed component paired with separate GL (e.g., QuickBooks/Sage) | Market assets (not PE‑centric) |

|

Notes: The points above summarize claims made in FundCount’s own articles and may not reflect each vendor’s latest capabilities.

Sources: Article 1 &

Article 2.

| Tool | Role in the stack (per article) | Asset‑class focus (as stated) | Notes from the articles |

|---|---|---|---|

| eFront | Point solution | Private‑equity‑centric | Example of an asset‑specific system; used to illustrate that not all tools cover every asset class. |

| Investran | Point solution | Private‑equity‑centric | Same context as eFront. |

| QuickBooks | Generic GL used in best‑of‑breed stacks | — | Article 1 says traditional GLs like QuickBooks may lack processing capability for full family‑office needs; promotes a unified GL instead. |

| Sage | Generic GL used in best‑of‑breed stacks | — | Mentioned as a GL often paired with portfolio systems in best‑of‑breed approaches. |

The practical difference

All three competitors compress the intake step. They collect manager statements and turn PDFs into fields that can flow downstream. That removes some of the waiting and most of the retyping.

FundCount goes further by collapsing the last mile. Document intelligence feeds straight into the real-time general ledger, and the investor portal updates as soon as entries post. There is no shuffle between systems, no duplicate mapping of entities or accounts, and no second round of validations after an export. One pipeline, one audit trail, one place to approve and publish.

This matters at quarter-end because handoffs create delay and drift. Every export, file drop, and import adds calendar time, new versions of the same number, and another place an exception can hide. An integrated path shortens the posting cycle, keeps allocation views fresher, and preserves lineage from reported balance to journal to the exact line on the GP’s PDF.

For family offices, the impact is operational rather than flashy. Fewer tools to coordinate. Fewer reconciliations across systems. Clearer governance for reviewers and auditors. Principals see current balances with the source documents a click away. The work moves from chasing files to closing the books.