Family offices migrating from legacy systems frequently encounter a predictable pattern of disruptions, according to industry reports.

Onboarding begins with defined timelines and scopes, but often spirals as new data fields emerge, mappings shift unexpectedly, and historical records arrive incomplete, requiring extensive manual corrections. Support tickets remain open for weeks, prompting teams to rely on temporary spreadsheets for reporting. Vendor meetings increase amid dwindling confidence in the process.

These problems hit you hard and fast in everyday operations. Suddenly, you’re racing against the clock to close out the quarter, watching deadlines slip by as data inconsistencies pile up. Investor statements come back riddled with errors, forcing you to rework them because last period’s balances just don’t match what’s in the records. Your audit trails fall apart, with transaction entries scattering across systems and leaving you without a clear paper trail when regulators or stakeholders come knocking. Your team ends up hunched over keyboards, manually retyping transactions to make the numbers add up, burning through hours on fixes that feel like they should’ve been automated from day one. In the end, you grow weary of the new platform and slip back into those familiar old shortcuts—the very ones you migrated to escape no less!

Headache-free migration plan

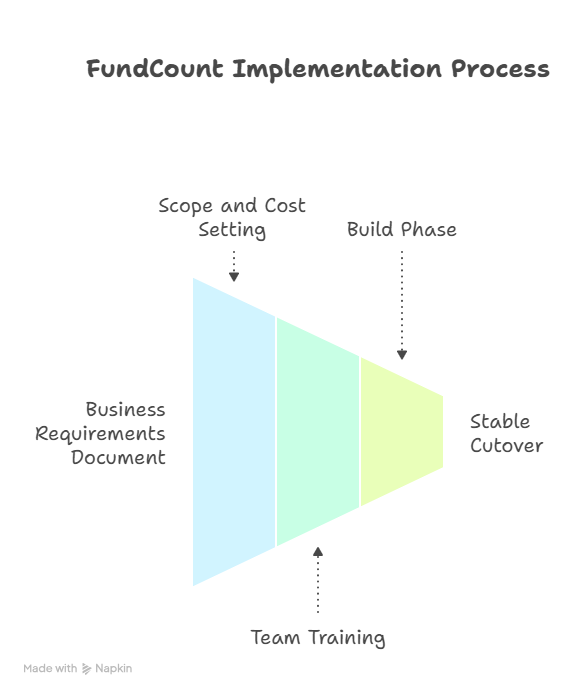

FundCount addresses the problem through a formal, staged implementation process that starts with analysis and ends with a stable cutover. The work begins with a business requirements document that captures workflows, reporting needs, and custom functionality, and it sets scope and costs before any build starts. Teams can train through FundCount Academy during this phase to shorten the learning curve.

- Start with business analysis and a requirements document. Capture entities, data sources, workflows, reporting needs, and any custom functions. Fix scope and produce an implementation estimate before any build begins.

- Make a gate decision. Use the requirements and estimate to decide go or no go so the project does not drift into open-ended work.

- Design the data model and mappings. Audit source files, charts of accounts, positions, transactions, and reference data. Define field mappings, transformation rules, and naming standards so history loads stay consistent.

- Prove the approach with a pilot entity. Load one entity without feeds or add-on modules, run daily workflows on real data, reconcile to third-party statements, and clear exceptions while the surface area remains small.

- Scale the rollout. Onboard the remaining entities, connect banks and custodians, switch on integrations, and reconcile each connection as it comes online to keep a clean audit trail.

- Configure outputs and controls. Build required reports and automations, set validation checks, and run a parallel period using production-grade samples. Accept only when outputs match source truth.

- Train the team in role-based paths. Provide hands-on sessions for daily operators, approvers, and reviewers, supported by short job aids and recorded walk-throughs.

- Go live with a stabilization window. Track close time, ticket age, and reconciliation breaks. Keep a named owner on each issue until resolved, then transfer to standard support with clear runbooks.

Advice for bigger operations

For larger clients, with more complex structures, multiple asset classes and many data sources, assigning a project manager to oversee and command internal resources is also key. Where investment analysts and accountants have competing demands and operate under different constraints, this is essential.

The reality of any implementation, even the best planned, is to expect the unexpected, and be cooperative and flexible in finding solutions. This is a particular necessity where there are third parties, such as custodians, brokers, banks and alt managers, directly or indirectly involved. They do not march to the client’s or FundCount’s orders and a well managed, well planned team will be able to handle the constraints this imposes.

FundCount has learned many implementation lessons over the years, and the greatest of these is that it is human resources that make the difference, not the software!