If your firm has been operating for years, you have probably added systems as you grew. Each new mandate brought another tool. Today you may run credit in Geneva and private equity in Investran or Allvue. Or, maybe you’re still doing it with spreadsheets. Because you’re working with multiple platforms, at the end of the month you end up exporting, mapping, and checking the same investors twice. You track support in different places, and reviews take longer because teams rely on separate files.

Fund administration and top tier financial professionals face challenges such as managing diverse asset classes across multiple platforms, high transition costs, operational risks, and the potential loss of key personnel in a competitive labor market. A fund administration solution is needed that can streamline operations, reduce costs, and enhance the client experience across multi-asset classes.

Recent migrations show 30 to 60 percent lower core software fees and fewer vendor contracts to manage. You also recover time because allocations and consolidations are not repeated across systems. Key person risk drops because spreadsheet logic moves into controlled configurations that others can review and approve.

Challenges of multi-asset class fund administration

Managing a varied mix of assets and clients is inherently complex. Many platforms still fall short of delivering a consistent workflow across strategies, which forces duplicate processes, extra reconciliations, and higher support costs. The gaps between systems slow close and audit work, increase operational risk, and leave clients with a fragmented experience.

For instance:

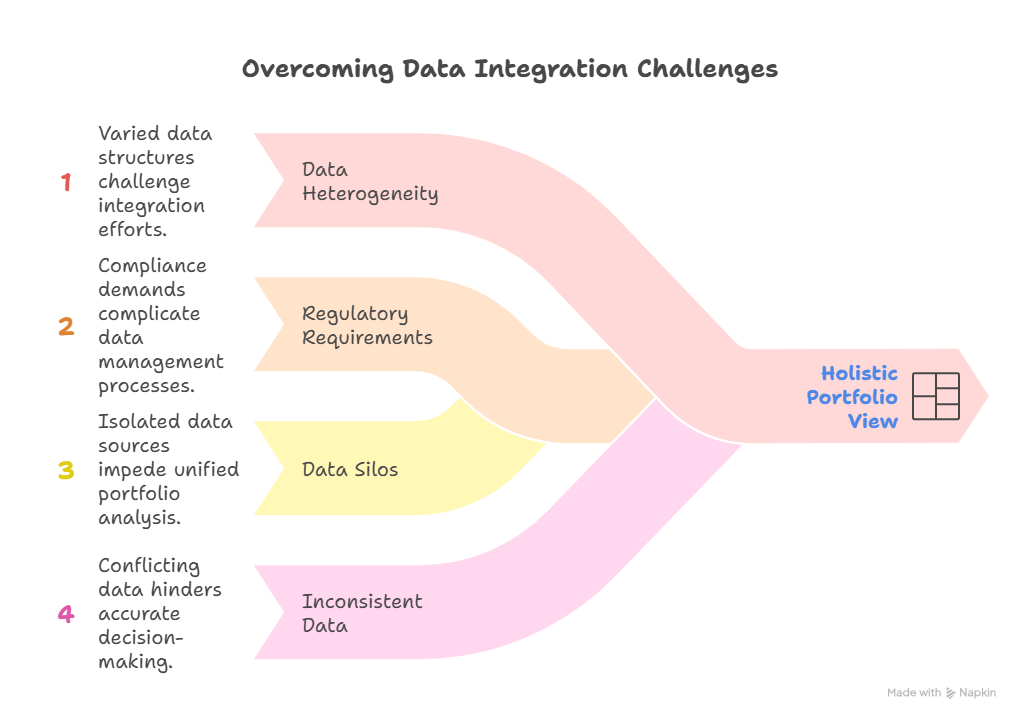

Data Management and Integration Challenges: Multi-asset class management involves handling a wide range of asset types, each with its own unique data structures, terminology, and regulatory requirements. This heterogeneity of data can pose significant challenges in data management and integration. Existing solutions often struggle to effectively integrate data from various sources, leading to data silos and inconsistencies. This can hinder the ability of fund administrators to gain a holistic view of their portfolios and make informed investment decisions.

Regulatory Compliance Complexity: Each asset class is subject to its own set of regulatory requirements, which can vary in complexity and scope. Existing solutions may not be fully equipped to handle the nuances of these regulations, leading to potential compliance breaches and legal liabilities for fund administrators. This can increase the risk associated with multi-asset class management and deter fund administrators from expanding into new asset classes.

Operational Efficiency Bottlenecks: The diversity of asset classes and the complexities of their management can lead to operational inefficiencies. Existing solutions may not be able to automate tasks effectively across different asset classes, requiring manual intervention and duplication of effort. This can hinder the efficiency of fund administrators and increase the risk of errors.

Fragmented Client Experience: With a diverse range of asset classes and clients, fund administrators may struggle to provide a consistent and unified client experience. Existing solutions may lack the flexibility and customization to cater to the specific needs of different clients and asset classes. This can lead to customer dissatisfaction and hinder the ability of fund administrators to build strong client relationships. A unified platform which manages multiple asset classes solves for this by creating a consistent client experience.

Legacy Systems and Limited Functionality: Many fund administrators rely on legacy systems that were not designed to handle the complexities of multi-asset class management. These systems may lack the necessary functionality and integration capabilities to support the diverse needs of fund administrators. This can limit their ability to adapt to changing market conditions and expand their product offerings.

Inadequate Support and Training: Existing solutions may not provide adequate support and training to fund administrators, making it challenging for them to fully utilize the platform’s features and address any issues that arise. This can hinder the adoption of new features and prevent fund administrators from realizing the full potential of the solution.

Tier 1 Fund Administration Solution

While we recognize that top-tier managers often run different strategies on different systems, our goal is simple. Bring any asset class into one fund administration solution so you can run operations in one place instead of many.

We built the Tier 1 Fund Administration Solution in response to demand for true multi-asset coverage on a single platform. It is anchored by a continuous general ledger that keeps one set of books across strategies, entities, and investors.

The result is a unified cloud platform that streamlines fund administration. Workflows are automated, data management is centralized, and investor records stay consistent. You can manage any asset class and every client on one platform with a single audit trail and a single version of the numbers.

Benefits include:

-

Lower cost and lighter ops with one license and one data model, typically 30 to 60 percent lower core software fees and minimal transition effort

-

Any-asset coverage on one ledger that lets you add mandates without adding systems, creating room for new revenue

-

Consistent client and auditor experience from a single source of truth with faster closes and fewer handoffs

How it stacks up against leading alternatives

For most administrators considering a move, the practical alternatives to FundCount Tier 1 are Pacific Fund Systems PAXUS and SS&C Geneva. Each has a strong market presence and a clear design philosophy, so it’s worth understanding where they fit.

Geneva is a mature portfolio accounting engine that handles trading and credit workflows with depth and speed. Many firms pair it with separate partnership accounting and a corporate GL, which works well when strategies are concentrated in liquid or credit books. Pacific Fund Systems PAXUS combines fund accounting with transfer agency and registry features, which suits administrators that emphasize investor servicing at scale. Both products can be part of a reliable operating model when you accept a multi-system stack and the reconciliations that come with it.

FundCount approaches the problem differently. The Tier 1 solution runs any asset class on one platform and posts everything to a continuous general ledger. Portfolio events, investor allocations, waterfalls, and financial statements live in the same books, so you do not maintain parallel registries or map entries across engines. The benefit shows up in fewer handoffs, a single audit trail, and reporting that ties out without extra stitching. Firms that run mixed mandates for the same clients tend to see the most impact because the cross-system work is what disappears first.

There are trade-offs to weigh. If your operation is built around high-volume trading with an established reporting layer, Geneva can remain efficient within a multi-system design. If transfer agency throughput and registry functions drive your model, PAXUS remains a strong fit. If the priority is to manage private equity, private credit, hedge, and real assets in one place with one set of numbers, FundCount reduces reconciliation effort and vendor overhead by design. The fair test is simple. Map the processes you run twice today, estimate the time and control risk tied to those duplications, and see which architecture removes the most work without creating new gaps.

Conclusion

If you are weighing a move, judge the architecture on the work it removes. A single platform with a continuous general ledger replaces duplicate allocations, registry reconciliations, and cross-system mapping with one set of books and one audit trail. Recent migrations show 30 to 60 percent lower core software fees. Some firms report three to seven times faster processing for recurring close tasks, depending on scope and baseline.

A practical next step, list the processes you run twice, estimate the time and control risk in those handoffs, and test a limited migration with a parallel close. If the duplicate work shrinks without creating gaps, you have a credible path to lower cost, shorter closes, and a cleaner experience for clients and auditors.