A multi-asset class portfolio is a single investment portfolio that holds more than one type of asset, managed as a coherent whole to meet a defined objective such as growth, income, or capital preservation. Instead of concentrating exposure in one market, the portfolio combines assets that behave differently through the cycle, for example equities for long term growth, bonds for income and ballast, cash for liquidity, and often real assets or alternatives for inflation sensitivity and diversification.

Multi-asset class portfolios come with their own unique set of challenges when it comes to client reporting and accounting, but we’ll address those concerns further down. For now, let’s take a look at types of asset classes.

Types of asset classes

Public equities

Common stock represents a residual claim on cash flows after everyone else is paid, so equity returns are dominated by growth in earnings, changes in the multiple investors are willing to pay for those earnings, and the cost of capital. Factor exposures such as size, value, quality, momentum, and low volatility explain a meaningful share of cross-sectional performance. Liquidity is daily, but liquidity at a fair price is not guaranteed during gaps or halts. Valuation anchors include discounted cash flow, dividend discount, and relative metrics such as EV/EBITDA; each breaks at the extremes, so regime awareness matters. Emerging-market equities add currency and policy risk that can overwhelm local operating performance.

Investment grade credit

You are paid a spread over government curves to bear default and downgrade risk plus mark-to-market volatility from rates. Most total return comes from carry and roll rather than price moves, which makes curve shape and index rebalancing mechanics surprisingly important. Spreads compress in benign conditions and gap wider in recessions, with the worst drawdowns driven by forced selling from ratings-constrained holders. Pricing is via spread to benchmark or option-adjusted spread; be precise about callability and structure because optionality often dominates.

High yield and leveraged loans

Below-investment-grade bonds and floating-rate loans pay you for default risk and weaker covenants. Recovery rates and sector mix drive outcomes as much as headline yields. Loans reduce duration risk but introduce refinancing and documentation risk, particularly in covenant-lite structures. Distress cycles are lumpy. In benign cycles you harvest coupon and upgrades. In stressed cycles a few points of incremental default can erase years of carry if recoveries disappoint.

Government bonds and inflation-linked bonds

Sovereign nominal bonds are the cleanest expression of duration and term premia, with flight-to-quality behavior in risk-off episodes. Inflation-linked bonds convert most nominal duration into real duration plus an inflation accrual; break evens isolate the market’s priced inflation path. Central bank reaction functions and supply dynamics matter more than textbooks suggest. In the tails, liquidity premia appear even in “risk-free” markets.

Securitized credit

Mortgage-backed securities, asset-backed securities, and commercial MBS slice cash flows and embed borrower behavior into the asset. Negative convexity from prepayment options makes returns path dependent. Specialty ABS such as autos, credit cards, equipment, and whole-business deals hinge on collateral performance and servicer behavior. The analytics are rich and model risk is real. Senior tranches can look safe until vintage or sector exposures line up the wrong way.

Emerging market debt

Hard-currency sovereigns and corporates behave like spread products with event risk layered on top. Local-currency bonds add FX beta, real yield differentials, and policy credibility. Liquidity can vanish quickly around elections, commodity shocks, or IMF negotiations. Pay close attention to index inclusion rules and technicals from benchmark-tracking capital.

Cash and short duration

Bills, high-grade commercial paper, and short-dated notes provide liquidity, dry powder, and a reference rate for opportunity cost. In a world with money market reforms and bank balance-sheet constraints, operational details like settlement timing, collateral eligibility, and gates are part of the asset’s true risk.

Real estate

Public REITs and private core, value-add, and opportunistic funds all monetize rent and appreciation, but their risk and valuation mechanics differ. Cap rates move with real rates, growth expectations, and capital availability. Private marks lag and smooth; public REITs lead and can overshoot. Property type and geography segmentation matters more than most asset allocators admit. Debt structure at the asset and fund level is often the hidden driver of outcomes.

Infrastructure

Contracted or regulated cash flows from assets like utilities, renewables, and transport provide duration and inflation sensitivity with operational complexity. Return streams decompose into yield, inflation pass-through, and periodic re-rating as regulation or contracts reset. Political and permitting risk substitute for market beta. Private vehicles often employ meaningful leverage and face refinancing cliffs that can dominate IRR math.

Commodities

Spot commodities are not cash-flow assets. In listed form you own collateral plus roll yield plus any spot move. Term structure regimes determine whether futures curves pay or tax you over time. Energy is driven by supply discipline and geopolitics. Metals pair industrial demand with inventory cycles. Agriculture layers weather and seasonality onto cost curves. Gold is a monetary commodity with a different demand stack. Position sizing should reflect that correlations to equities flip sign across inflation regimes.

Hedge funds as strategy bundles

Equity long-short, event driven, relative value, and global macro are not asset classes so much as risk packages assembled out of directional, factor, carry, and volatility premia plus manager skill. Look-through to the underlying exposures and financing terms. The return you keep is gross alpha minus fees, borrow costs, financing, and slippage. Capacity and crowding are hard limits. In crises, many “uncorrelated” books become correlated through liquidity.

Private equity

Buyout and growth strategies lever operating improvement and multiple expansion with balance-sheet leverage and timing. Value creation is unevenly distributed across managers and vintages. PMEs help compare to public markets but depend on the chosen index and cash flow timing. Realized MOIC and DPI matter more than paper IRR. Sector specialization and sourcing advantage are more predictive of persistence than fund branding.

Venture capital

Venture pays for exposure to power-law outcomes. A small subset of investments drives most returns, which makes manager selection and access paramount. Marks are path dependent and cyclic. Deployment pacing through booms and droughts is a governance decision. Secondary markets provide liquidity options but at a price.

Private credit and special situations

Direct lending, mezzanine, NAV loans, and opportunistic credit target illiquidity and complexity premia. Documentation quality and workout capability determine loss-adjusted returns when the cycle turns. Floating-rate structures reduce duration risk and increase sensitivity to interest coverage. NAV facilities introduce fund-level cross-collateralization and require robust monitoring of asset marks and covenants.

Insurance-linked securities

Cat bonds and collateralized reinsurance transfer catastrophe risk for a spread over money market yields. Returns hinge on model accuracy, peril mix, and event clustering. Correlation to equities is often low on average and spikes around liquidity squeezes if investors need to raise cash after large events. Seasonality and trapped collateral complicate compounding.

Real assets beyond property and infra

Timberland and farmland generate biological growth plus price appreciation with inflation linkage. Operational skill, water rights, and local regulation drive dispersion. These assets are slow to transact and sensitive to climate and policy shifts that evolve over decades.

Currencies and volatility as investable exposures

Currencies can be treated as an overlay that harvests carry, value, and momentum across pairs or as hedges against local shocks. Volatility can be owned implicitly or explicitly through options. Short-vol harvests carry during calm periods and pays out catastrophically when stress hits. Long-vol bleeds until it doesn’t. Both are tools to reshape portfolio convexity if you respect path dependency and financing.

Digital assets

Crypto tokens introduce a distinct mix of technology adoption, network effects, reflexive flows, and regulatory risk. They trade twenty-four seven with equity-like drawdowns and commodity-like narratives. Custody, key management, and venue risk are first-order. Position sizing should assume fat tails and liquidity that disappears exactly when you want out.

Account and client reporting challenges for multi-asset class portfolios

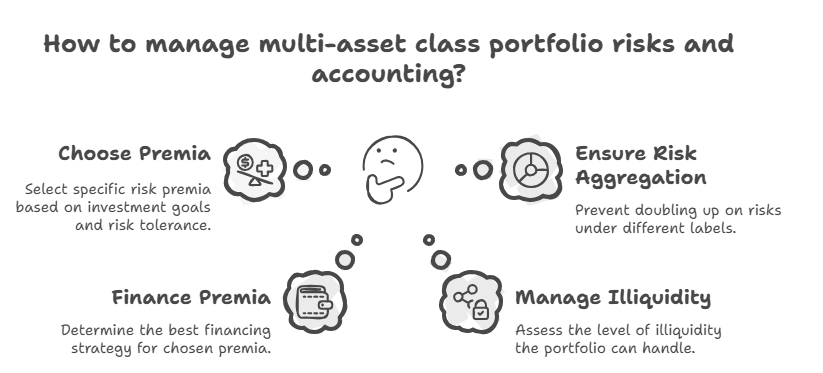

Each of these categories contributes a different blend of cash flow, term, credit, liquidity, inflation, currency, and convexity exposures. The practical job is to choose which premia you want, how to finance them, and how much illiquidity you can actually carry given spending, capital calls, and governance. Pricing models tell you expected return components. Scenarios tell you how those components behave when the world refuses to be average. The art is recognizing when you are being paid enough for the specific risks embedded in each sleeve and making sure the aggregation does not silently double up the same risk under different labels.

Short portfolios are easy to live with because the data behaves. You have daily prices from one or two custodians, a single benchmark per sleeve, clean tax lots, and straightforward accruals. Once you expand into real estate, private funds, direct deals, infrastructure, hedge strategies, and derivatives, the entire accounting surface area changes. The work stops being about closing the books and starts being about making unlike things comparable without losing the detail auditors and investment teams need.

Data ingestion and valuation

The first challenge is data ingestion. Public assets arrive as files with identifiers, trade dates, and custodian balances that reconcile each morning. Private assets arrive as capital call notices, PDFs of capital account statements, side letter amendments, and quarterly marks. The accountant has to translate narrative documents into transactions that post to a ledger with the right dates, partners, and classes. If you run fund of funds or co-investments, you need look-through to underlying holdings or at least to sector and geography, otherwise you cannot answer basic risk questions. The second challenge is timing. Public marks are daily.

Private marks are quarterly and sometimes late. If you aggregate them at calendar month-end, the private side is on a lag, which means reported volatility and correlations are flattering. You need a policy for back-solving interim marks, spreading cash flows, and retroactively updating performance when the official statements arrive, with a clear audit trail showing what changed and why.

Valuation and pricing governance gets harder. With listed securities, you can specify a hierarchy of sources and capture exceptions. With real assets and venture you are in ASC 820 or IFRS 13 territory and must document methods, comps, and impairment considerations. Funds that own a mix of Level 1 through Level 3 assets need a controlled process to move items up and down the fair value hierarchy and to version the working papers so the external auditor can rerun the numbers. The more illiquid the mix, the more your internal controls around model inputs, manager marks, and overrides determine whether your financials are defensible.

Multi-currency problems

Multi-currency is another pressure point. Traditional portfolios might hedge a single foreign equity sleeve and call it a day. Multi asset mixes inherit FX from every direction: foreign equities, non-USD private fund commitments, infrastructure revenues linked to CPI in local currency, and derivative overlays. Performance reports must separate local returns, currency effects, and active hedging so the investment committee can tell whether a bad month was security selection, basis risk on the hedge, or simple FX. On the accounting side, you need consistent functional currency choices, remeasurement rules, and realized versus unrealized FX tracking that rolls cleanly into investor capital accounts and tax.

Cash and liquidity management turn into real work. Illiquid assets call capital irregularly, distribute on their own clock, and sometimes send givebacks. At the same time, listed overlays and margin accounts pull variation margin daily. To avoid forced sales, you need a forward cash view that stitches together custodian cash, pending trades, scheduled capital calls, expected distributions, and credit lines at both the portfolio and entity levels. When structures include SPVs, AIVs, and blockers, intercompany movements must eliminate in consolidation and still tie to bank statements.

Entity complexities and performance management

Entity complexity multiplies once you are running family office structures with trusts, partnerships, and operating companies. Each line of ownership has its own tax posture, fee terms, and rights. The general ledger must support multi-entity, multi-book, and multi-basis accounting so GAAP, tax, and management views can coexist. Partner accounting pushes this further. Capital commitments drive unfunded schedules and default provisions. Contributions, distributions, preferred returns, and waterfalls need to post in a way that supports both daily NAV and year-end K-1 production. If carry, claw back, and equalization are in play, your allocation engine has to be exact down to the day and robust to restatements when managers correct prior-period errors.

Performance measurement stops being a single number. Public sleeves want time-weighted returns with daily pricing. Private sleeves require IRR, DPI, TVPI, and public market equivalents. If you publish a consolidated track record, you must reconcile how you blend TWR and IRR, how you treat cash, and how you weight contributions from assets that report on different schedules. Attribution becomes a project in its own right because you need to explain results by allocation, selection, currency, and financing, with derivatives and overlays assigned to the exposures they hedge or replicate rather than left as a miscellaneous bucket. Benchmarks are no longer plug-and-play. You might need a custom blend for private credit, property type and region benchmarks for real estate, sector stacks for venture, and inflation-linked references for infrastructure. Each must be documented with rule sets for rebalancing, free float, and currency.

Fees and expenses

Fees and expenses introduce subtle drag that is easy to miss in simple systems. You have management and performance fees at the fund level, look-through fees inside commingled vehicles, admin fees for SPVs, property-level debt service, and hedging costs. If the ledger does not capture them at the right level and link them to the exposures they support, performance reports overstate manager skill and understate the cost of liquidity and leverage. In a multi asset class book, financing is everywhere. You borrow against pledged liquid assets to fund capital calls. You use subscription or NAV facilities. You have margin on futures and swaps. Interest accruals, haircuts, and covenants need to sit in the same system that holds investments so you can see your true net exposure and your headroom before a stress event.

Taxes make or break systems

Tax is harder by an order of magnitude. Wash sales and holding periods are table stakes. Now add PFIC and CFC rules for foreign funds, blocked structures for UBTI management, state apportionment from real assets, and withholding reclaim across jurisdictions. K-1s arrive late and change prior year taxable income. If the accounting platform cannot maintain tax lots and basis adjustments by entity and carry them through reorganizations and transfers, your preparer will spend spring rebuilding history and your estimates will be fiction.

Reconciliation at scale is a different animal. You reconcile positions, cash, and accruals across multiple custodians, administrators, and general partners. You reconcile what the GP says your capital account is to what your ledger shows after translating documents into entries. You reconcile model portfolios driving overlays to the actual exposures that show up in risk. The only way this works is if the system of record is genuinely integrated, with transactions flowing once into a unified ledger, not copied into spreadsheets that drift apart. Spreadsheets are great for analysis; they are terrible as shadow books for a complex, multi-entity, multi-currency portfolio because they hide breaks until they hit capital statements or the audit.

Reporting

Finally, reporting expectations rise. Investment teams want real-time sleeves and look-through. Principals want a single view across entities with net worth, liquidity, and risk in one place. Banks want covenant reporting. Auditors want clean tie-outs, versioned workpapers, and evidence of controls. Regulators and counterparties want consistent data for filings. When the portfolio is genuinely multi asset class, you are only as good as your ability to move from a consolidated story down to the journal line that created it, and then back up again, without rekeying or reconciling by hand. The gap between a tidy two-asset portfolio and a diverse multi asset mix is not a matter of more entries. It is the difference between static bookkeeping and a living data system that supports valuation, liquidity, tax, and governance at once.

How FundCount takes on the challenges

FundCount helps you run a truly multi asset class book by centering everything on a single, real-time general ledger that natively handles multi-currency, multi-book, portfolio and partnership accounting. Positions, cash flows, investor capital, and performance live in one system, so public assets with daily prices sit alongside private funds, direct deals, property and infrastructure with proper fair-value support and audit trails. From there you can publish consolidated and look-through reports, manage complex waterfalls, and keep GAAP, IFRS, tax and management views aligned without spreadsheet shadow books.

On top of the core ledger, FundCount gives you the data and presentation layers needed for modern reporting. AI Document Intelligence converts capital calls, distributions, capital account statements and K-1s into structured fields that flow straight into the books, with controls that preserve client privacy. Interactive analytics come through native Power BI connectivity and more than 70 built-in reports, plus an investor portal for secure statement delivery and communications. The result is faster closes, fewer breaks, and portfolio, entity and investor views that stay in sync.