The sales demo feels like a breeze. The dashboards are polished and the price fits your spreadsheet. The sales managers is sitting at your desk and your signatures are all but dry. This is when the shoe drops and the footnotes start to bloom.

Need the IFRS module? Extra.

ESG drill-downs? Extra.

Regulatory patching on a set schedule? That’s a service tier two clicks above “standard.”

The purchase starts to resemble a dealership up-sell, right down to the ceremonial slide across the table where the real number replaces the sticker.

Worse yet, a year slips by and the goalposts shift again. A new tax rule appears, investors ask for deeper ESG look-through, and the platform you installed last spring suddenly needs a “feature pack.” The quote lands in your inbox with the gentle insistence of a margin call. You learn that there are higher seat prices, data-migration fees, and a required hop to the latest cloud tier. Decline, and you’re the firm still sending PDFs while peers offer real-time dashboards. Accept, and the back-office budget lets out another weary sigh.

This article takes a closer look at that squeeze, showing how hidden add-ons and rolling upgrades can turn essential software into an open-ended meter. It then explores the tactics administrators use to keep expenses in line and explains why FundCount’s single-client approach often lands on the more affordable end of the market.

From Sticker Price to Drive-Away Cost

A software estimate often looks friendly at first glance. Geneva’s QuickStart sheet, for example, lists a single number that covers core installation and a starter portfolio, so it feels safe to assume you’re set. Then the scope meeting starts. There you learn that investor-servicing tools such as World Investor, the expense module, real-time P&L, and custom reports, all sit in a different column labeled “billed separately.” When you ask for extra data feeds, a bespoke interface, or an additional prime-broker reconciliation, you find new rows get added to the bottom line. The total climbs not because anyone is hiding fees, but because each requirement pushes the project beyond the bare-bones starter pack.

The story repeats when you reach investor relations. Allvue’s accounting engine, for example, handles daily postings, yet the Investor Portal—the screen your limited partners expect to log into—lives outside the core license. Choose it and a follow-up invoice arrives for portal seats, database connections, and the migration work that stitches everything together.

You are not alone in feeling squeezed. One popular industry forum recently filled with posts calling upgrade fees “exorbitant”; several members urged a united front to push vendors toward clearer pricing. The frustration signals a wider truth. Regulations shift, asset mixes evolve, and clients ask new questions, so software must keep up. The cost hurts only when it surprises you.

These examples aren’t intended to point fingers. Rather, they give an idea how most enterprise platforms price their flexibility. Regulations shift, asset mixes evolve, and clients ask new questions, so the software must keep up. The cost hurts only when it surprises you. Map out every likely enhancement—regulatory modules, new asset classes, integrations you know are coming—before you sign. Work those numbers into the business case, and you spare yourself the mid-project scramble for budget while protecting margins and peace of mind.

Fundcount’s Cost Clarity And Open Design

When you scope a FundCount deployment, you see the entire menu up front. The core license already includes general ledger, portfolio accounting, performance, and client reporting, so you are not paying piecemeal each time a new workflow surfaces. Annual maintenance covers upgrades, which means the invoice you sign today still unlocks tomorrow’s regulatory patches and feature releases without a surprise line item.

Because the platform runs as a single-tenant build—on-premise, in your own cloud, or in FundCount’s hosted environment—you control the database, the encryption keys, and the schedule for moving to a new version. If your compliance team asks for evidence that an upgrade will not disturb historical NAVs, you can stage the release in a sandbox at no extra cost.

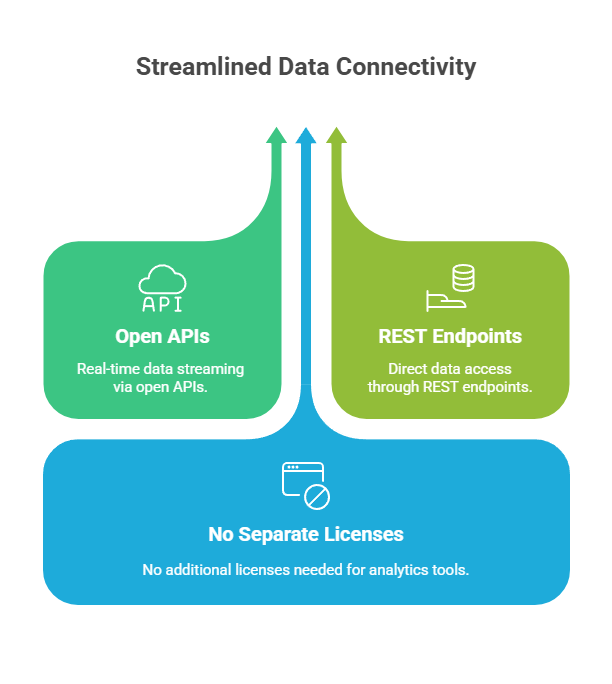

Integration work also stays predictable. Open APIs stream real-time balances to treasury tools and pull positions from prime-broker feeds without proprietary adapters. Should your data team prefer Power BI over the native dashboards, you invoke the REST endpoint and go live; there is no separate “analytics connector” license waiting in the wings.

Conclusion

Software upgrades will never slow down. New regulations, fresh asset classes, and evolving client demands will keep pushing your back office to do more. The real risk lies in unexpected costs that surface after you approve the initial quote—those incremental fees that chip away at budget and patience in equal measure. We walked through how common that pattern has become, from base licenses that exclude investor portals to feature packs that add core functionality long after you go live.

You can break that cycle. Build a comprehensive business case before you sign, keep an eye on every likely enhancement, and choose vendors that publish their full price list rather than hiding essentials in the fine print. FundCount helps on that front. The core license already covers accounting, performance, and reporting, annual maintenance brings new features and regulatory patches, and open APIs let you plug into other systems without paying for extra connectors. You budget once, turn on only the infrastructure you need, and avoid the steady drip of add-on charges that so often turns a modest software line into an unwelcome surprise.

That clarity lets you focus on the real work—closing books, meeting deadlines, and serving clients—without losing sleep over the next invoice.