ESG reporting has shifted from a ‘nice‑to‑have’ marketing insert to a regulated deliverable—fast. Europe’s Corporate Sustainability Reporting Directive (CSRD) is phasing in alongside the Sustainable Finance Disclosure Regulation, while the International Sustainability Standards Board’s S‑1 and S‑2 rules are already shaping investor questionnaires. In the US, the SEC’s climate‑risk rule may be in court, yet global sponsors know they must still quantify Scope 1‑2 emissions, board‑diversity ratios and supply‑chain risks if they want capital from large LPs. Each line item flows straight through the fund administrator’s back office: if you cannot tag portfolio‑company data, audit it and roll it up into a GAAP‑compliant statement, the GP’s quarterly package is suddenly non‑compliant.

The problem? Most shops admit their tooling isn’t ready. A Deloitte sustainability survey found that 57 percent of executives rank poor data quality as the single biggest hurdle to ESG disclosure, and 88 percent place it in their top three challenges. A KPMG poll shows nearly half of large organizations are still stitching ESG numbers together in spreadsheets, while a PwC CSRD study pushes that figure above 90 percent for firms facing the new European rules. Asset owners feel the gap: 72 percent want standardized ESG reports, but only 18 percent of managers can deliver them today. As compliance costs mount—private‑equity managers are already passing ESG‑consultant fees back to LPs—administrators risk becoming the choke point. Without purpose‑built ingestion pipelines, audit trails and metrics libraries, every new greenhouse‑gas datum or board‑diversity update requires a manual override, inviting errors, frustrating investors and inviting regulatory scrutiny.

Where Today’s Fund‑Admin Software Falls Short on ESG

Legacy fund‑accounting platforms were designed for debits, credits, and time‑series valuations—single‑dimension numbers that slot neatly into a general ledger. ESG data ignores those constraints. Scope 1 emissions arrive as monthly tonnage; Scope 3 often shows up as supplier‑level estimates; board‑diversity ratios and gender‑pay gaps change mid‑year. Most systems have nowhere to store that mix of units, time granularity, and nested relationships. The result is a patchwork of ad‑hoc fields, comment boxes, or worse—external spreadsheets that break audit trails the moment they’re exported.

Data ingestion is equally brittle. Energy‑meter readings live in building‑management portals, supply‑chain risk scores sit behind API paywalls, and portfolio companies e‑mail carbon‑intensity numbers in PDFs. Typical back‑office tools can’t pull those feeds automatically, let alone validate the units or reconcile them with historical baselines. Controllers end up hand‑keying figures and using VLOOKUPs to align fiscal and calendar periods—an error‑rate minefield when regulators now ask for year‑on‑year deltas to one decimal place.

Reporting Issues

Reporting exposes a final seam. Standard engines can generate GAAP footnotes or ILPA capital‑call notices, but they choke on multi‑dimensional roll‑ups. Need a fund‑level emissions‑intensity chart that weights each portfolio company by fair value? Expect Python scripts outside the core system. Want to tag those figures with the EU taxonomy or IFRS S‑2 codes? Most platforms have no lookup tables for ESG classifications, forcing manual mapping every quarter. Even rudimentary assurances—timestamps, sign‑off workflows, version control—are missing for non‑financial data, leaving compliance teams to chase signatures through e‑mail threads.

In short, the current generation of fund‑admin software treats ESG numbers as second‑class citizens: they’re stored loosely, ingested manually, and reported through workarounds. Until those limitations are engineered out, administrators will keep fighting a losing battle against spreadsheet creep and late‑night reconciliations every time an LP or regulator asks, “Show us your emissions breakdown.”

FundCount’s Custom‑Field and API Playbook for ESG Reporting

FundCount plugs the ESG data hole with two purpose‑built tools that include custom fields and open APIs.

Custom fields that are flexible enough for any metric

Add a field once—“Scope 1 CO₂e (tonnes)” or “Board Gender Mix”—pick its data type, and the value sits in the same database that stores NAV and capital calls. The field retains its own validation rule, time stamp, and audit log, which means restatements never overwrite history and quarter‑end roll‑ups run without manual workarounds. Because the field lives inside the ledger, every existing permission, consolidation rule, and report template treats the ESG number as native data. Few rival systems let administrators attach fully typed, versioned attributes to any object (fund, investment, investor) without schema rewrites or shadow tables.

APIs allow for automate feed‑in and feed‑out

FundCount exposes REST and OData endpoints that accept batch “upserts,” so an overnight job can pull supplier‑level emissions from a third‑party service and post them straight into the custom fields. The same endpoints stream aggregated ESG outputs—weighted by fair value, tagged with taxonomy codes—to BI dashboards, LP portals, or regulator upload sites. Token‑based scopes keep ingestion scripts away from investor PII, and update calls leave the original record intact for audit comparisons.

What this means day‑to‑day

-

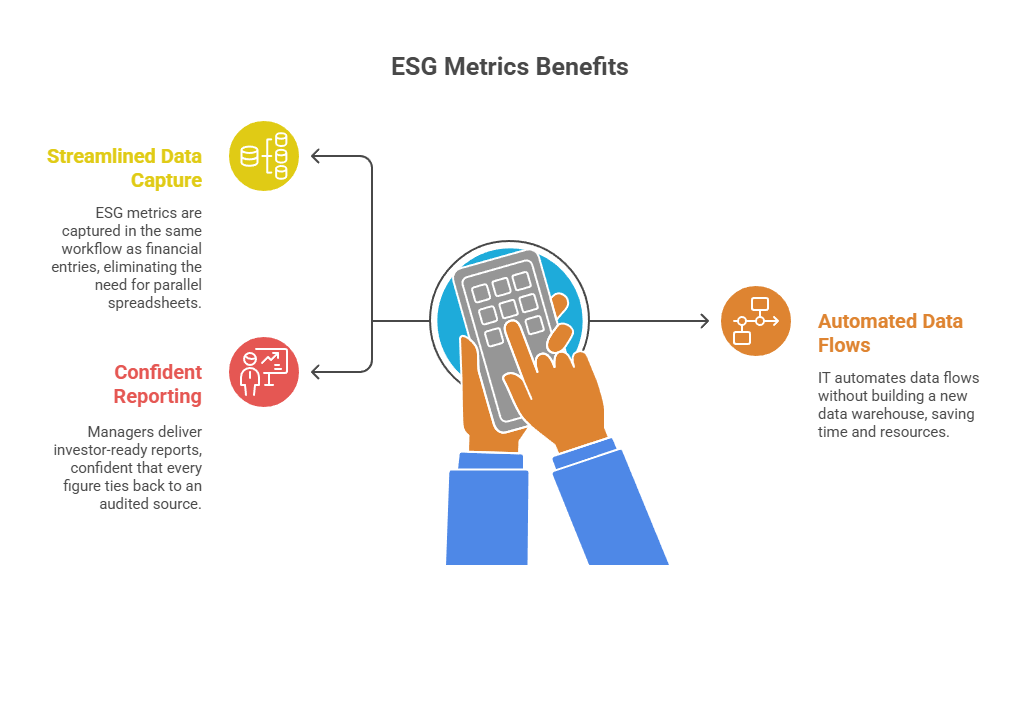

Controllers capture ESG metrics in the same workflow as financial entries, meaning no need parallel spreadsheets.

-

IT automates data flows without building a new warehouse.

-

Managers deliver investor‑ready carbon and diversity reports alongside the financial package, confident that every figure ties back to an audited source.

Conclusion

ESG is now a core accounting output, not a sidecar. If those metrics live outside your ledger—in spreadsheets, ad hoc databases, or vendor portals—you’re exposed to errors, audit gaps, and stalled closings. FundCount closes that gap by letting you model ESG data as native, versioned fields and move it automatically through APIs, so carbon figures, diversity ratios, and governance flags travel the same rails as NAV and allocations. The practical next steps are straightforward. Define the ESG metrics you must report, map them to custom fields on the right objects, stand up scheduled API jobs to feed and extract the data, and retire the parallel spreadsheets. Do that, and ESG stops being a compliance fire drill and becomes just another reconciled, auditable number in your reporting stack.