This Guide is for GPs, Fund Admins, and Institutional LPs

If you have ever tried to explain an alternatives book to an LP on a tight deadline, you already know the hard part is not the investment. It is the reporting.

Alternative funds reporting is the disciplined work of producing fund level financials and investor level statements for private equity, venture, hedge, and real asset vehicles, then delivering them in a form that holds up under review. In practice, that means NAV and capital account outputs that tie back to the books, plus supporting detail that helps stakeholders understand what changed and why.

This reporting is structurally different from traditional funds because the data does not arrive like clockwork. Valuations are inherently delayed, fair value gets revised, and key inputs show up as PDFs, portal extracts, administrator files, and one off notices. Add complex ownership, allocations, and fee logic, and a small inconsistency can ripple into investor statements, fee and expense reporting, and performance views like IRR versus TWR.

LPs still want timely transparency and consistent formats they can normalize across managers. GPs and administrators are trying to deliver that while managing valuation lag, capital activity, and reconciliations that never fully go away. The offices that do this well treat reporting as an operating workflow with controls and data lineage, not as a quarterly scramble.

Below, we lay out the core deliverables and cadence, the GP versus LP responsibilities, and a close process that stays audit ready. You will also get practical checklists and a clear view of what belongs in the tech stack versus what belongs in policy and review.

What is alternative funds reporting

Alternative funds reporting is the systematic production and delivery of fund financials, performance reporting, and investor statements for alternative vehicles such as hedge funds, private equity, venture capital, and real assets. The output is not just a quarterly package. It is the set of reports and supporting detail that lets stakeholders rely on the numbers.

This work spans two layers that have to stay aligned. One is the fund level books, meaning the accounting records that support NAV reporting, expenses, and audit support. The other is investor level allocations, meaning how results, fees, and capital activity roll into each LP’s capital account statement.

When those layers do not match, the impact is immediate for the people doing the work. The controller ends up fielding questions about why the investor statement total does not reconcile to the fund financials. Investor relations gets asked for explanations that require a full trace back through allocations and fee calculations. LP operations teams cannot normalize the data cleanly because the package is internally inconsistent. Strong alternative funds reporting reduces that friction by keeping the books and investor allocations connected, with clear support for how each number was built.

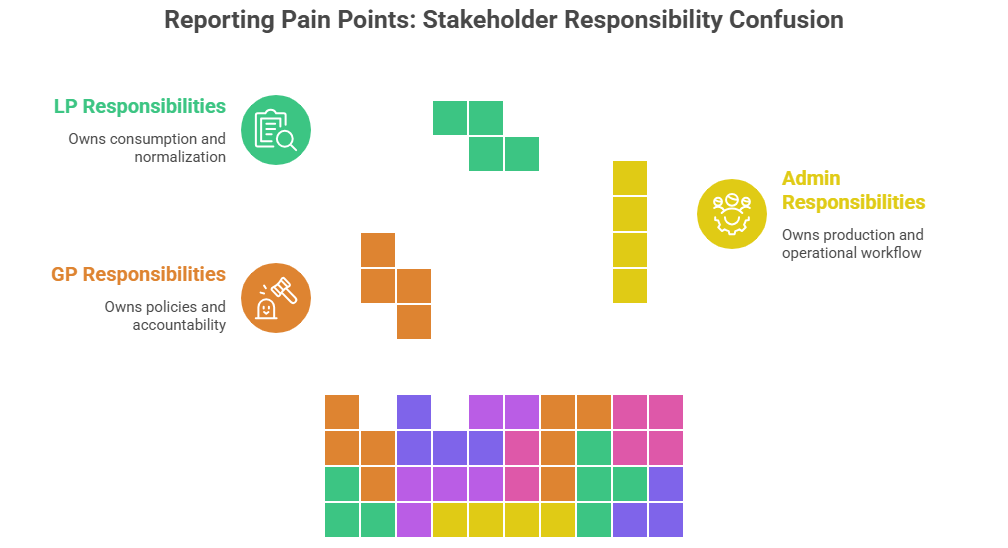

Stakeholders and responsibilities GP vs admin vs LP

Alternative funds reporting works best when everyone is clear on who owns which part of the process. A lot of reporting pain comes from gray areas, especially when a number is questioned and the team has to figure out who is responsible for explaining it, fixing it, and documenting the change.

GP responsibilities

The GP owns the policies and the accountability. That includes valuation policy, fee and expense policy, allocation methodology, and the controls around review and sign off. The GP also owns investor communications, meaning what gets disclosed, how timing gaps are explained, and how exceptions are handled when inputs arrive late or change after initial reporting.

Fund administrator responsibilities

The fund administrator typically owns production. That includes calculating NAV, maintaining investor accounting, producing investor statements such as the capital account statement, and supporting the reporting package with schedules and backup. Admin teams also run much of the operational workflow, including intake of source documents, reconciliation steps, and responding to routine LP questions.

LP and family office responsibilities

LP and family office teams own consumption. They intake the package, normalize it into their internal model, and aggregate it across managers and vehicles. They also set the rules for how they treat versioning and “as of” dates, and they decide what look-through assumptions to apply when the underlying fund does not provide full transparency. In practice, this is where LP reporting requirements get translated into portfolio level reporting that investment teams and committees can use.

Note:

The GP is the source of truth for policies, disclosures, and final sign off. The administrator is usually the source of truth for calculated outputs such as NAV reporting, allocations, and statement production based on the agreed policies. The LP is the source of truth for how that reporting is mapped, classified, and used inside their own reporting environment, including any normalization assumptions they apply.

The core reporting deliverables what gets produced

At the operational level, alternative funds reporting is a set of deliverables that have to tie together. Some are built for the fund’s books and audit readiness. Others are built for investors who need a clear, defensible view of what happened during the period.

Fund financial reporting

This is the fund level package that supports the official record and the close. It typically starts with the trial balance and the general ledger detail that backs it up, then rolls into the financial statements, meaning the balance sheet, income statement, and cash flow statement. Notes and supporting schedules matter here because alternatives often require explanation around valuation methods, material accruals, and classification choices, especially when inputs arrive late or fair value changes after an initial mark.

This package also supports audit work. A clean audit support trail usually includes the reports themselves, the schedules that bridge key numbers to source data, and the documentation that shows review and approval occurred under the fund’s policies.

Investor reporting

Investor reporting is the LP facing layer, and it is where small inconsistencies become big problems fast. Most LPs are trying to answer basic operational questions. What is my ending balance. What changed this period. What cash moved, and why. The core deliverable is the capital account statement, supported by detail that makes capital activity and allocations understandable.

For hedge funds and other subscription based vehicles, that includes subscription and redemption activity, along with any gates, side pockets, or special terms that affect timing. For private equity and venture, the reporting center of gravity shifts to capital calls and distributions, including what was called, what was returned, what remains uncalled, and how those events affect the investor’s position.

Allocation notices sit alongside these statements because they explain how income, expenses, gains, losses, and fees were allocated for the period. When LP operations teams load the data into their own systems, these notices are often the difference between clean normalization and a long back and forth with the GP or administrator.

Performance reporting

Performance reporting needs to match the strategy and the data reality. Private vehicles often report IRR and MOIC because cash flow timing is central to how results are experienced, while hedge funds and public sleeves lean on TWR to isolate investment performance from subscriptions and redemptions. The key is consistency and clear definitions, so LP teams can compare periods and managers without having to reverse engineer the methodology.

Benchmarking also needs context. Many alternative strategies do not map neatly to a single benchmark, and valuation lag can make period comparisons misleading if you do not disclose the “as of” dates and what is stale. Net versus gross performance should be explicit as well, since fees can be material and LPs rely on that distinction for internal reporting.

Fee and expense reporting

Fee and expense reporting is where transparency expectations have increased the most. LPs want to see management fees, incentive or performance fees, and fund expenses in a format they can track over time, not buried as a single net number. Offsets and special terms matter too, because two investors in the same vehicle can have materially different economics.

This is also where templates and disclosure discipline pay off. A consistent structure makes it easier for LP operations teams to normalize the data and for investor relations teams to answer questions without reopening calculations each quarter.

Risk and exposure reporting where relevant

Not every fund needs a deep risk book in the reporting pack, but many LPs expect at least a high level view of concentrations, leverage, and liquidity. Liquidity buckets help LPs understand timing risk, especially when capital is locked or redemption terms are constrained. Stress notes can be brief and qualitative, but they are most useful when they tie back to the portfolio’s actual exposures and any material changes during the period.

Cadence and timelines monthly quarterly annual

In alternatives, cadence is not just a preference. It is constrained by how quickly pricing, valuations, and administrator inputs can be produced and reviewed. LPs still want timely transparency, so the reporting job becomes setting realistic timelines, then communicating what is final, what is preliminary, and what is subject to revision.

Hedge funds are often built around monthly cycles. Monthly NAV reporting is common, with investor statements and performance reporting produced on a consistent schedule shortly after month end. Even here, the operational challenge is keeping inputs and approvals tight enough that the timeline holds without sacrificing controls.

Private equity and venture capital are structurally different. Valuations are typically quarterly, and many of the most important events, like capital calls and distributions, happen between reporting periods. That is why LPs often receive notices and capital activity updates on an event driven basis, then get the fuller accounting and valuation picture as part of the quarterly close.

Annual reporting brings audit and tax into the workflow. The annual financial statements and audit support package need to align with the same underlying data used for investor reporting, and tax packages add another layer of deliverables and deadlines. For LP operations teams, this is also when reporting quality is tested hardest because discrepancies tend to surface during audit and tax tie outs.

Common timing gaps are predictable. Valuation inputs arrive late. Fair value gets revised. Administrator files and custodian data do not always align on the first pass. The clean way to communicate this is to be explicit about “as of” dates, versioning, and what changed since the last package, so LP teams can load and normalize the data without guessing.

The hard problems in alternative fund reporting

If alternative funds reporting feels harder than it should, it is usually because a few structural issues keep showing up no matter how good the team is. These are not edge cases. They are the recurring problems that drive rework, LP questions, and late nights during close.

Valuation lag and pricing hierarchy

Fair value is delayed by design. Private assets do not have continuous market pricing, so valuations depend on company updates, appraisals, comparable data, and committee review. That is why the “as of” date matters. It tells the LP what point in time the valuation represents, which may be different from the reporting period end, especially when information arrives after quarter end.

Pricing hierarchy is how you decide what input wins when there are multiple sources or methods. For example, you might prioritize administrator calculated values for certain assets, third party pricing for others, and internal models when neither is available. Versioning becomes critical because valuations can be revised, and LP teams need to know whether they are looking at a preliminary mark, a final approved mark, or a restatement.

Capital activity and allocations

Alternatives reporting lives and dies on capital mechanics. Commitments set the outer boundary, but day to day reality is capital calls, distributions, and how those cash flows change investor ownership and economics. Uncalled capital needs to be tracked cleanly because it drives liquidity planning for LPs and sets expectations for future funding.

Allocations add another layer. Some distributions are recallable, and private equity structures often include waterfalls that determine how proceeds get split between LPs and the GP’s carried interest. When these rules are handled inconsistently, small errors can show up as discrepancies in the capital account statement and trigger lengthy questions from LP operations teams trying to reconcile what they received to what they booked.

Fee complexity

Fees are rarely just a line item, and the logic differs by strategy. Hedge funds may involve performance fees tied to a high-water mark, while private equity fees often include management fees plus carry economics that depend on the waterfall. Expense allocation adds more variability because costs can be fund level, deal level, or shared across vehicles, with offsets and special terms that change what an investor actually pays.

This is why fee and expense reporting is a constant source of LP questions. LP operations teams need the fees to tie to policy, tie to the capital account statement, and be explainable across periods, even when the underlying terms differ investor by investor.

Data fragmentation and normalization

Most reporting problems start as a data problem. Alternative fund data shows up across PDFs, portals, administrator templates, emails, and custodian files, and the fields do not line up cleanly. Two administrators can describe the same concept in different ways, and even within one shop, formats change over time.

Normalization is the work of mapping those inputs into a standard model so the numbers can be compared, aggregated, and reported consistently. For LP teams, this is the difference between loading a quarterly package quickly and spending days rebuilding it by hand because each manager uses a different template.

Audit trail and data lineage

An institutional reporting process has to be reproducible. When an LP asks where a number came from, or an auditor asks what changed between versions, the team needs to answer with evidence, not memory. That is the role of data lineage, meaning a clear trace from the reported output back to the source inputs, with controls that show what was reviewed, approved, and when.

A practical audit trail includes version history for valuations, documented assumptions, and sign offs on key calculations such as NAV reporting and fees. When those controls are in place, questions become faster to answer and the reporting process becomes less dependent on a few individuals who know the backstory.

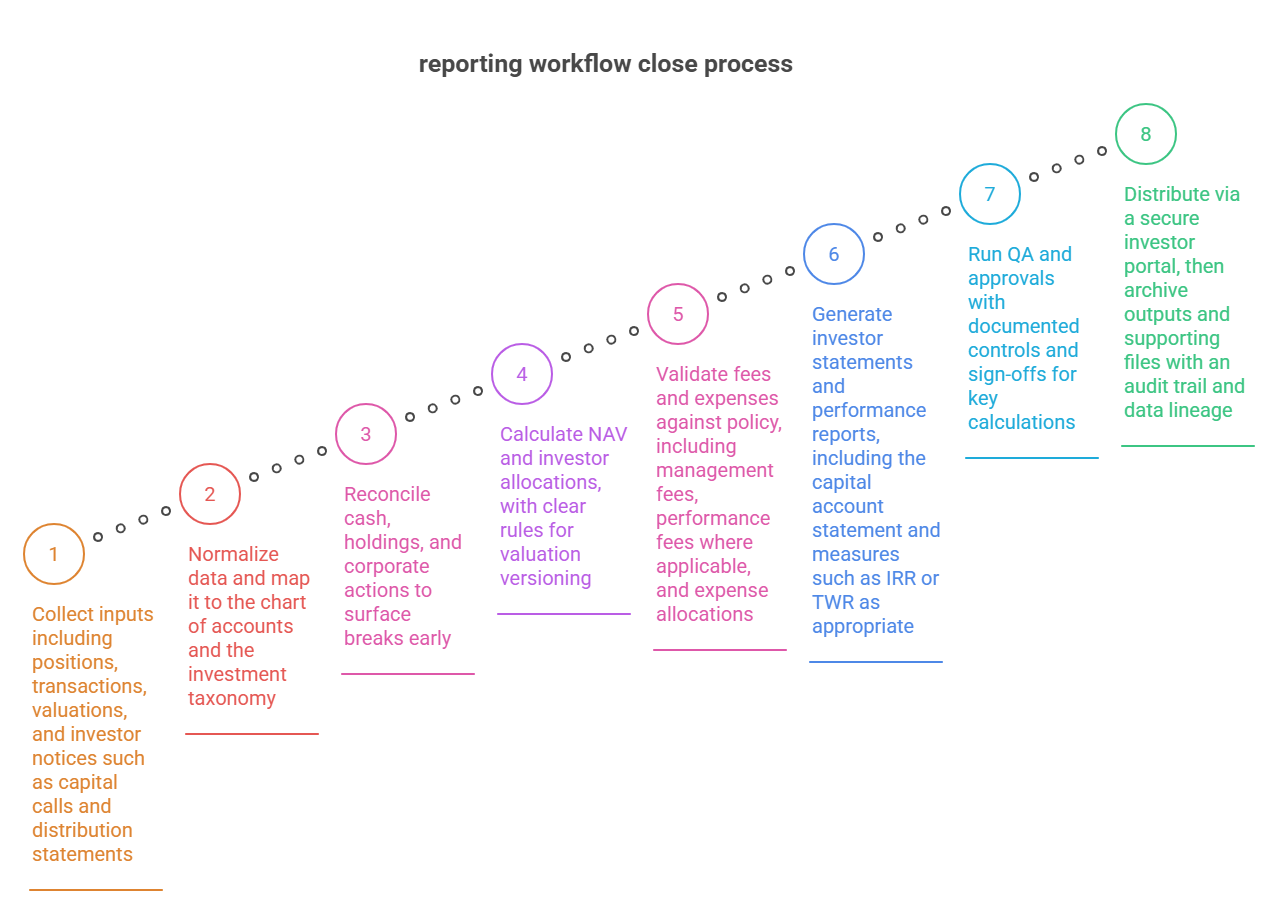

Best-practice reporting workflow close process

A quarterly close is easiest to run when everyone can point to the same sequence of steps and the same handoffs. This workflow is a practical baseline for alternative funds reporting that keeps NAV and investor outputs tied to controlled inputs.

- Collect inputs including positions, transactions, valuations, and investor notices such as capital calls and distribution statements

- Normalize data and map it to the chart of accounts and the investment taxonomy

- Reconcile cash, holdings, and corporate actions to surface breaks early

- Calculate NAV and investor allocations, with clear rules for valuation versioning

- Validate fees and expenses against policy, including management fees, performance fees where applicable, and expense allocations

- Generate investor statements and performance reports, including the capital account statement and measures such as IRR or TWR as appropriate

- Run QA and approvals with documented controls and sign-offs for key calculations

- Distribute via a secure investor portal, then archive outputs and supporting files with an audit trail and data lineage

Common failure points are usually versioning and timing issues. Valuation marks change after a draft package is produced, statements arrive late, and mapping errors create classification inconsistencies that ripple into investor reporting.

LP view how to consume alternative fund reporting without losing control

LP teams are not just reading reports. They are turning GP packages into portfolio level data that can survive investment committee questions, audits, and internal reporting deadlines. The discipline is keeping intake and normalization consistent, even when every manager uses a different template and every quarter brings a new version.

Intake checklist

Start by being explicit about what you need to ingest, not just what you receive. Minimum data fields should cover fund identifier, investor identifier, reporting period, “as of” date for valuations, starting and ending capital account balances, and the period’s capital events. Versioning rules belong here too. If you accept revised packages, define how you label them, how you store prior versions, and who approves replacing numbers that were already booked.

Document handling sounds mundane, but it is where many teams lose time. A consistent naming convention and centralized storage for statements, notices, and backup files makes later reconciliation possible, especially when questions surface months after the close.

Normalization rules

Normalization is the work of mapping each GP’s reporting into your internal model so you can compare managers and roll up across vehicles. That includes mapping NAV components, fee categories, expense classifications, and cash flow types into standard buckets. It also includes defining how you treat items that are presented differently across funds, such as recallable distributions or expenses netted in performance.

Reconciliation should anchor this step. Your normalized view should tie back to the investor’s capital account statement. If it does not, you need a repeatable way to flag the break, identify whether it is timing, classification, or versioning, and document what you did to resolve it.

Portfolio-level consolidation

Consolidation is where LP reporting requirements meet reality. Look-through is helpful when it exists, but it is not always available or comparable, so many LPs use exposure approximations that are good enough for governance without pretending to be perfect. Performance aggregation has limits too, especially when private assets report IRR and MOIC on lagged valuation cycles while other sleeves use TWR. The goal is not to force everything into one metric. It is to present a portfolio level view that is consistent, clearly labeled, and defensible.

Technology stack considerations what to automate

In alternative funds reporting, automation works best when it is aimed at the repeatable parts of the workflow. The goal is not to eliminate judgment. It is to reduce manual rework, keep mapping consistent, and preserve data lineage so the reporting pack can be reproduced and defended. Data aggregation and ETL mapping are usually the first leverage point. If inputs arrive from administrators, custodians, portals, and PDFs, the practical win is creating a controlled intake layer that standardizes identifiers, dates, and field mappings before the close begins. Without that, every quarter becomes a custom project.

Investment and partnership accounting is the system layer that keeps NAV and investor allocations aligned. When investor accounting is disconnected from the books, teams end up reconciling outputs after the fact. When the accounting layer is integrated, allocations, fees, and investor statements can be produced from consistent underlying data. Reconciliation workflows should be built into the process, not handled in side files. The teams that scale alternative investment fund reporting make breaks visible early, route them to an owner, and document resolution so the same issue does not recur every quarter.

On the output side, report builders and templates matter because LP reporting requirements are consistent even when input formats are not. A standardized reporting pack structure also reduces investor relations friction because answers become repeatable. Distribution should run through a secure investor portal that supports versioning, access controls, and consistent archiving. Finally, audit trail and permissions are not optional at institutional scale. You need to know who changed what, when it changed, and what was approved. That is what turns reporting into a controlled workflow instead of a scramble.

Teams that need NAV, investor accounting, multi-entity books, and alternative asset reporting in one workflow often use integrated platforms such as FundCount so reporting outputs tie back to the same underlying accounting data.

Common pitfalls and how to avoid them

These issues show up in high quality teams because they are structural, not personal. The fix is usually a tighter workflow, clearer ownership, and a few controls that prevent the same failure from repeating every quarter.

We rely on PDFs and manual entry as our system

PDFs are fine as source documents. They become a problem when they are also the data layer. Manual entry scales poorly, and the risk is not just typos. It is inconsistency, because two people can interpret the same statement differently. The fix is to standardize intake. Capture the minimum fields you need in a structured model, link them to the source document, and reuse the same mappings period to period.

We don’t control versions of valuations

Valuation changes are normal in alternatives. Confusion about versions is not. If the team cannot tell which fair value is final, LPs cannot load the data confidently and investor relations cannot answer basic questions without rework. The fix is version discipline. Label each package clearly, track “as of” dates, and define who can approve a change that replaces numbers already reported.

Fees are calculated outside the ledger and don’t tie out

When fee logic lives in spreadsheets or separate calculators, it becomes hard to reconcile fee and expense reporting back to NAV reporting and investor allocations. The pain usually surfaces during close when a fee number looks right on its own but cannot be traced cleanly. The fix is to tie fee calculations to policy and to the accounting workflow, with documented inputs and review steps so the results can be reproduced.

Investor statements and financial statements drift

This drift is one of the fastest ways to lose confidence. LP teams see a capital account statement that does not reconcile to the fund financials, and now every question becomes a special case. The fix is to treat investor reporting and fund reporting as linked outputs, driven by the same underlying data and controlled mapping rules, not parallel processes.

No audit trail for changes

Without an audit trail, every revision turns into a credibility issue. Teams end up relying on memory to explain what changed, who approved it, and why the number moved. The fix is basic control hygiene. Preserve history, log changes, document approvals, and keep the supporting backup with the distributed package so questions can be answered months later without reconstructing the close.

FAQ

What is private fund reporting?

Private fund reporting is the set of financial and investor deliverables a GP and administrator produce so LPs can understand results, cash activity, and ending positions. It typically includes fund financials, NAV reporting, investor statements, and supporting disclosures that help LPs load and normalize the data.

What is hedge fund investor reporting?

Hedge fund investor reporting is the recurring investor package that explains period performance, subscriptions and redemptions, and ending balances, often tied to monthly NAV. It usually emphasizes timeliness, clear “as of” dating, and consistent presentation of fees and net performance.

What is private equity fund reporting?

Private equity fund reporting is the quarterly investor package that tracks commitments, capital calls, distributions, valuations, and investor economics across the reporting period. It often requires more narrative and support because valuation updates and deal level activity do not follow public market timing.

What is alternative mutual fund reporting?

Alternative mutual fund reporting generally refers to reporting for ’40 Act funds that use alternative strategies while still operating under mutual fund structures. It tends to be more standardized and frequent than private funds, but investors still expect clear disclosure around liquidity terms, holdings transparency, and performance drivers.

What is waterfall reporting and carried interest reporting?

Waterfall reporting explains how proceeds and returns are allocated between LPs and the GP under the distribution waterfall terms. Carried interest reporting focuses on the GP carry economics, showing when carry is earned and how it was calculated under the applicable methodology and assumptions.

What is alternative investment performance reporting?

Alternative investment performance reporting is how a fund communicates results using measures that fit the asset type and cash flow reality, including IRR and MOIC for private vehicles and TWR where appropriate. The key is consistent definitions and clear treatment of fees, timing, and valuation lag.

What is valuation reporting and fair value reporting?

Valuation reporting / fair value reporting is the disclosure of how fair value was determined, the “as of” date it represents, and what changed from prior versions. LPs rely on this to interpret quarter end numbers correctly and to manage versioning when updated marks are issued.

What is an investor portal for alternative funds?

An investor portal for alternative funds is a controlled distribution channel for statements, notices, and reporting packs with access permissions and version history. It reduces email based leakage, improves traceability, and makes it easier for LP teams to retrieve the right package later.

What should we look for in fund accounting and reporting software?

Fund accounting and reporting software should support fund level books, investor allocations, and repeatable reporting workflows with an audit trail. The practical test is whether reporting outputs, including capital account statement and NAV reporting, can be traced back to consistent underlying accounting data without manual rework.