Main AI Document Intelligence for Alternative Investments

AI Document Intelligence for Alternative Investments

Transform Unstructured Alternative Investment Data into Actionable Insights – Instantly

"FundCount AI Document Intelligence extracts so many more data points from more types of statements – compared it’s competitors!"

CFO, Multi-Family Office, New York

Benefits

Increased Efficiency

Turn unstructured GP documents into structured, investment-ready data so you can see exposures, performance drivers, and cash needs without waiting on manual rollups. Faster, cleaner inputs mean fewer “surprises” at quarter-end and more confidence in portfolio decisions.

Stop chasing PDFs across portals and email by automating extraction into consistent, tie-out-ready data for capital activity, fees, and allocations across funds and entities so your team works exceptions instead of re-keying, reduces reconciliations caused by format drift, closes faster, and keeps an audit trail back to source documents.

Standardize the inputs that feed tax and regulatory workflows, even when every manager’s statements look different. Improve completeness and traceability so you can validate figures quickly and support filings with clear source documentation.

Works with Funds and Co-Investments

Eliminate time-consuming, manual data entry and document management workflows, and allow team to focus on high-value tasks like analysis and strategy.

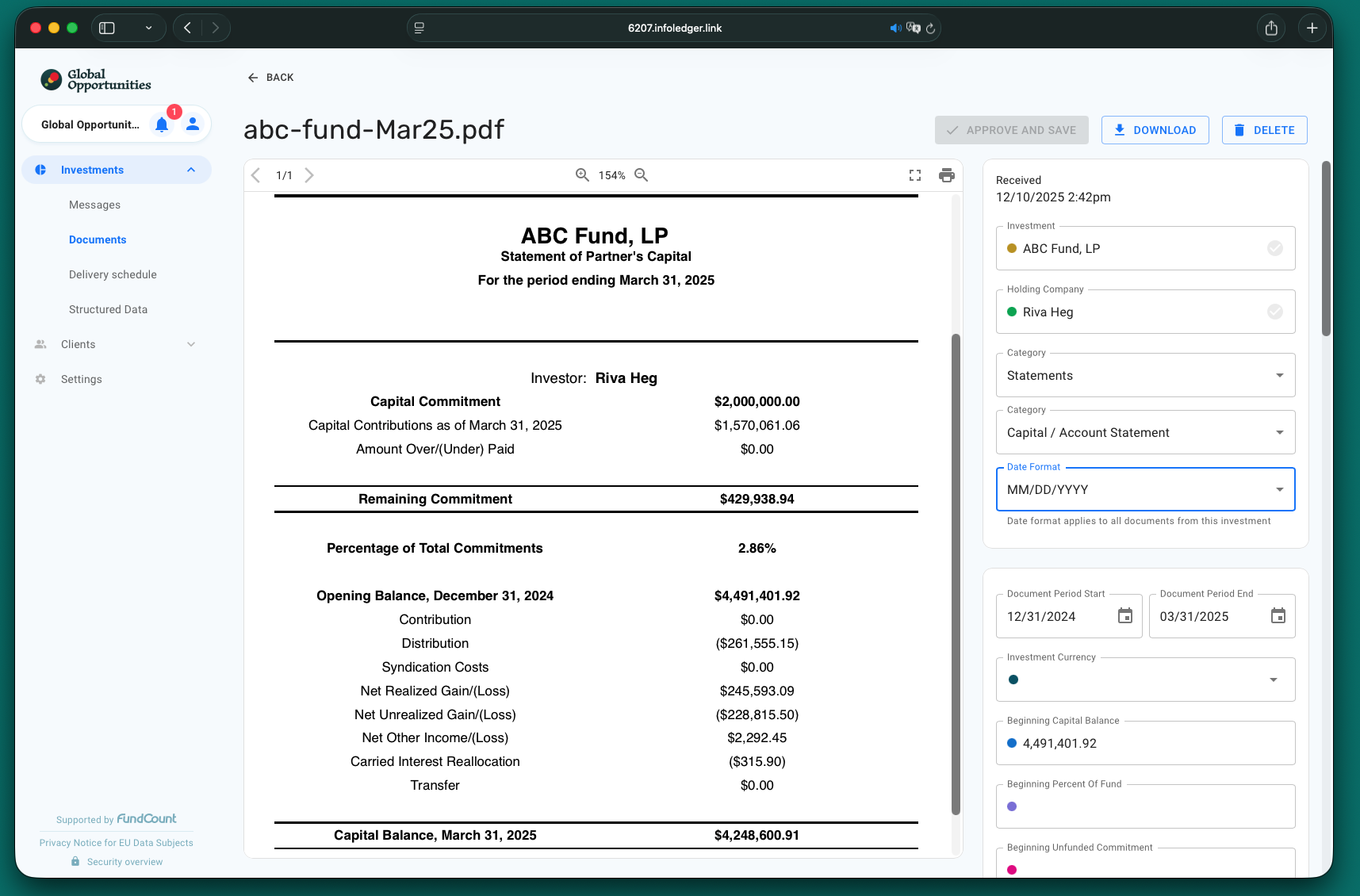

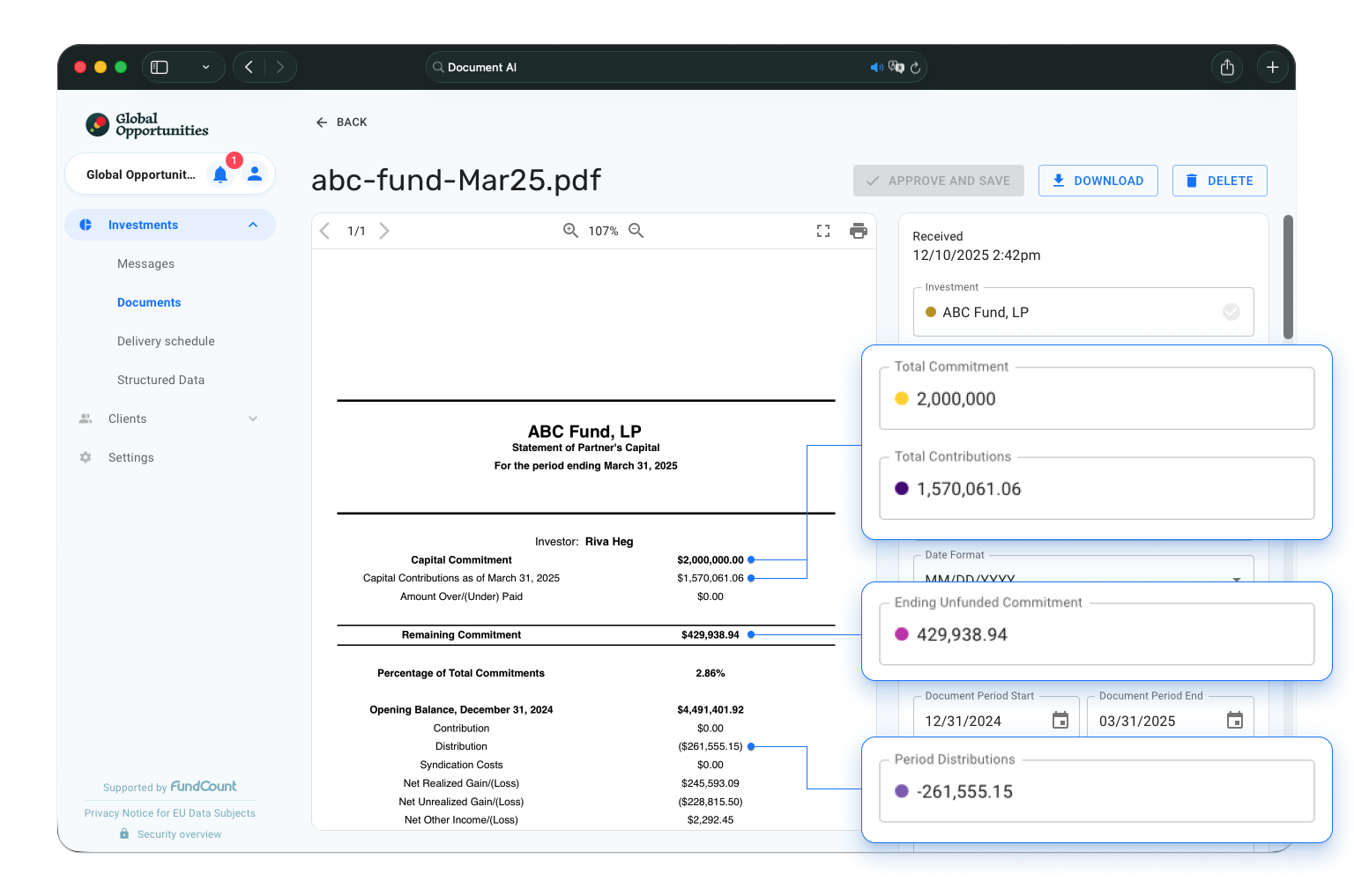

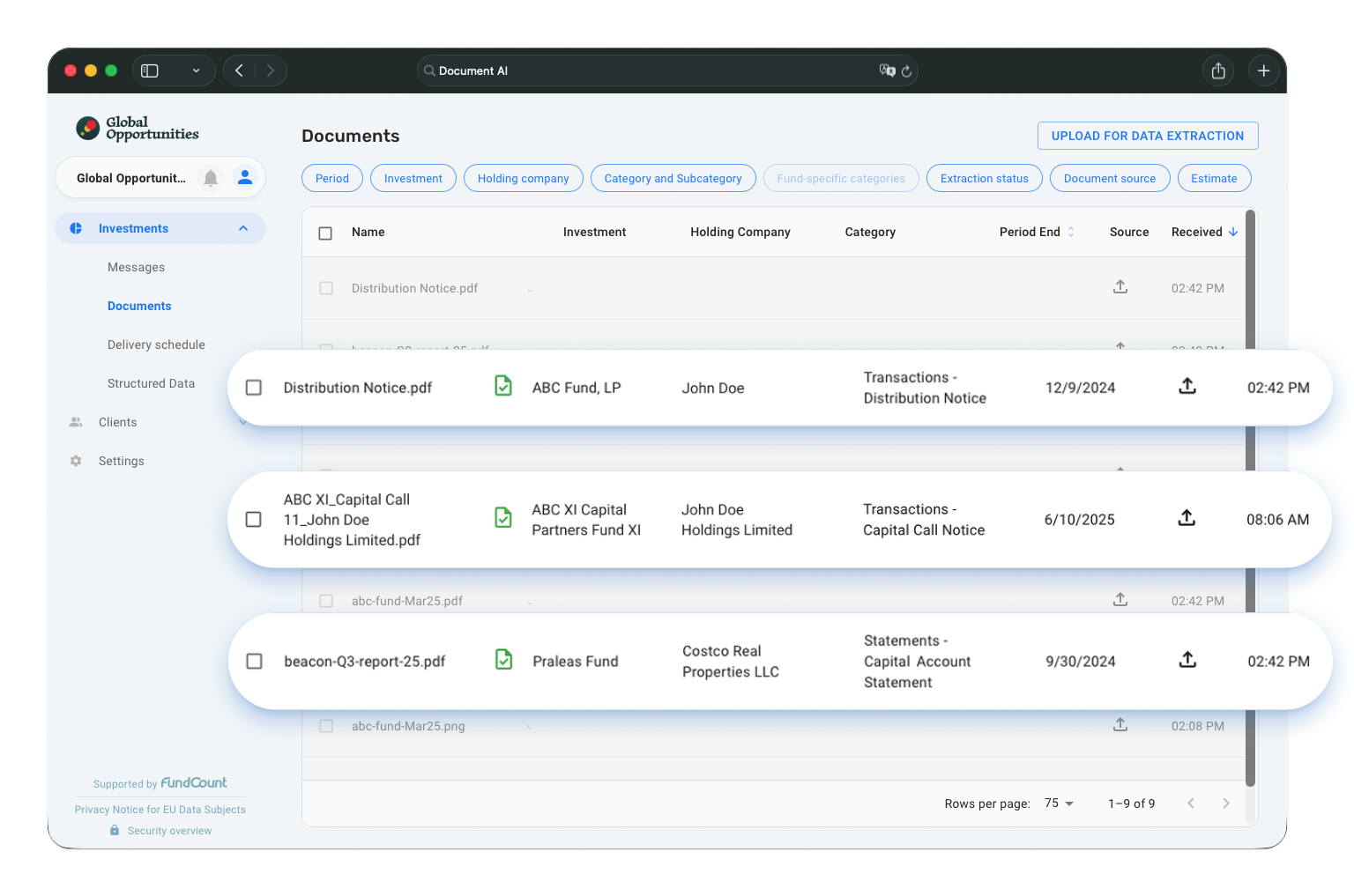

Rich set of data points is extracted from sophisticated Capital account statements, Calls, Distributions, K-1s and Co-Investments Financial statements into a standardized format and displayed on a dashboard for review – by your clients or accounting teams in real time.

Direct data feed into FundCount or other accounting systems facilitates fast automated data delivery for recording and analysis. Original Documents are one click away within reports in FundCount investment accounting and reporting software

Enhanced Data Details and Accuracy

Automated extraction with modern LLM and verification processes significantly reduce the risk of human error associated with manual data handling.

Unlike old machine learning and OCR technologies, the new AI-driven approach is able to overcome issues like watermarks in PDFs, sensitivity to change in statements’ formats and unstable elements positioning in complex documents like combined call and distribution notices.

Leveraging LLMs allows extraction of a very rich book and tax data set from previously un-seen statements of any complexity without additional model training. Coupled with minimum involvement of people, new technology allows to reduce errors, cut time and operational costs.

Scalability of Expertise

AI Document Intelligence platform provides a scalable foundation for firms to manage a growing volume and complexity of alternative investments without proportionally increasing human resources.

Private equity professionals in investment, accounting and tax could be hard to find and retain.

Allocating time of these costly human resources from time consuming routine operations to the higher value analytical and decision-making tasks becomes a game changer and competitive advantage for asset managers, family offices and fund administrators globally.

FundCount AI Document Intelligence for Alternative Investments in combination with it’s investment accounting and reporting platform automate data collection and reporting and save hours of manual work.