Unveiling Operational Strengths and Unlocking Improvement with the Family Office KPI

Family offices, entrusted with managing the wealth of families across generations, face unique challenges in ensuring efficiency, accuracy, and cost-effectiveness in back-office operations. These challenges are further amplified by the evolving landscape of financial technologies and best practices.

Key Takeaway:

- Benchmarking with the Family Office KPI reveals your family office’s strengths and weaknesses compared to industry peers.

- Family offices often struggle with data management, automation, and skills gaps in data analysis.

- Investing in data solutions, automation, and data analysis expertise empowers family offices to achieve Family Office 3.0: transparency, efficiency, and sustainable wealth management.

To address what is a critical need for performance measurement, in 2022, FundCount, developed the Family Office Key Performance Indicator (KPI) Report. This industry-wide methodology provides family offices and the families they serve with an objective benchmark to evaluate their back-office operations against industry peers.

We have been steadily gathering data from the submitted evaluations for the past two years. Today, we take a closer look at what these have revealed. Some of the findings were quite surprising.

Key Findings and Industry Trends:

Are Family Office’s Reporting Capabilities Geared for the Future?

A careful review of data gathered over the past two years uncovered some interesting trends that have significant impact on family office performance.

The maximum score for the Reporting Excellence KPIs is 100. Anything above 80 is considered excellent, and anything under 19 means that the family office in question really needs to focus on updating its back-office operations. Previously, we diligently gathered data for over 18 months from over 500 family offices and family members served by these institutional investors. This data shows that the average score for the Reporting Excellence KPIs was 60. What does this mean?

It means that the family office sector has some serious thinking to do about where its weak spots are in terms of data presentation, reports agility, business insight, reports accuracy, and reporting efficiency and speed. These five items are called the “excellence categories” of the Reporting Excellence KPIs. Let’s dive deeper into the data and see exactly what were the industry’s strong points and where family offices should focus to invest in their back-office operations.

The family office sector has some serious thinking to do about where its weak spots are in terms of data presentation, reports agility, business insight, reports accuracy, and reporting efficiency and speed

In-depth Analysis of Family Offices’ Reporting Excellence KPIs

In terms of data presentation, the strongest two areas were presentation of dashboards and presentation of internal/operational reports. Meanwhile, the weakest area in this category was online reporting tools. Today, when digitalization is synonymous with good infrastructure, lacking online reporting tools can be a real hindrance.

Looking at the reports agility category, family offices seemed well equipped when it came to speed and ease of altering/creating new reports. However, they were lacking in capabilities when they had to demonstrate their ability to create new data points by applying filters and formulas to the data. In other words, family offices seemed to be lacking the right analytical tools.

However, the industry was not lacking in its data extraction software. This was the strongest point under the business insight “excellence category.” This suggested that family offices could get the data that they needed but they did not have the right tools to dissect it. That said, they could access this necessary data up to a point: the survey showed that family offices were struggling with multi-entity and cross-investor aggregate and look-through reporting.

When it came to report accuracy, the weakest area was controls over changes in data structures, fields and values. This is linked to the above point regarding the need to improve their data analysis tools. However, family offices’ report accuracy was strong when it came to progressing toward the “single source of truth” concept for reporting.

Finally, in terms of reporting efficiency and speed, family offices’ strongest point was the ease of creating and merging reports. On the other hand, it did not help that the industry was struggling with the time and resources needed to prepare periodic reporting packages. This goes back to the lack of online reporting tools – the use of cloud technology could greatly improve this weak point.

Do Family Offices Know where Their Money Is?

The maximum score for the Financial Control KPIs was 100. The same analytical approach applies here as it did for the previous category. After normalizing the data, the average score for the Financial Control KPIs was just over 62.

Let’s dive deeper into the five “excellence categories” of Financial Control to find out more about the industry’s strengths and weaknesses. These categories were: costs, governance, people, processes, and controls.

In-depth Analysis of Family Offices’ Financial Control KPIs

In terms of governance, the weakest spot across the industry was the systems and data disaster recovery plans. This was, and is, a critical element of back-office operations which can make the whole difference between protecting or recovering your money or losing it. However, family offices did appear to compensate for this weak spot with contingency plan(s) to minimize key person risks and with accurate and trustworthy data in reports.

Looking at the controls category, family offices reported that changes in operational processes were being properly documented. This is obviously a good thing. So it is the fact that most family offices stated that liquidity management controls were in place. However, these strong points were diminished, to some extent, by the fact that Excel was still used for overall data management and reporting work, albeit for a small amount.

Moving on to costs, the area in which the family office industry excelled was in keeping employee costs low. Nevertheless, this advantage was counterbalanced by the costs of systems being used to support operations. The survey data showed that only some family offices manage to keep down the costs of these systems, while many did not.

For the processes category, the industry seemed to be split between three things which family offices appeared to do very well and three visible weak spots. In terms of strengths, the respondents stated that reconciliation processes were streamlined and automated, that the company was committed to continuous process improvement, and that the legal entity’s structure was plain and easy.

On the negative side, data collection and aggregation from external sources was not well-automated for the majority of family offices. Also, the other two weak aspects were the number of disparate systems to move data and reconcile between, and the lack of clarity and procedure when it came to operational and approval processes.

Finally, in the people category, the strongest aspect across the industry was that family offices benefited from a high level of experience in investment and accounting operations. However, there appeared to be a skill gap in the area of systems and data management, as this was the weakest point based on the survey responses.

Steps You Can Take Now

Regularly measuring and benchmarking performance using the Family Office KPI is crucial for family offices to stay ahead of the curve and navigate the evolving financial landscape. By identifying strengths and weaknesses, family offices can embark on a continuous improvement journey, ultimately achieving Family Office 3.0 and ensuring the long-term sustainability of their wealth management efforts.

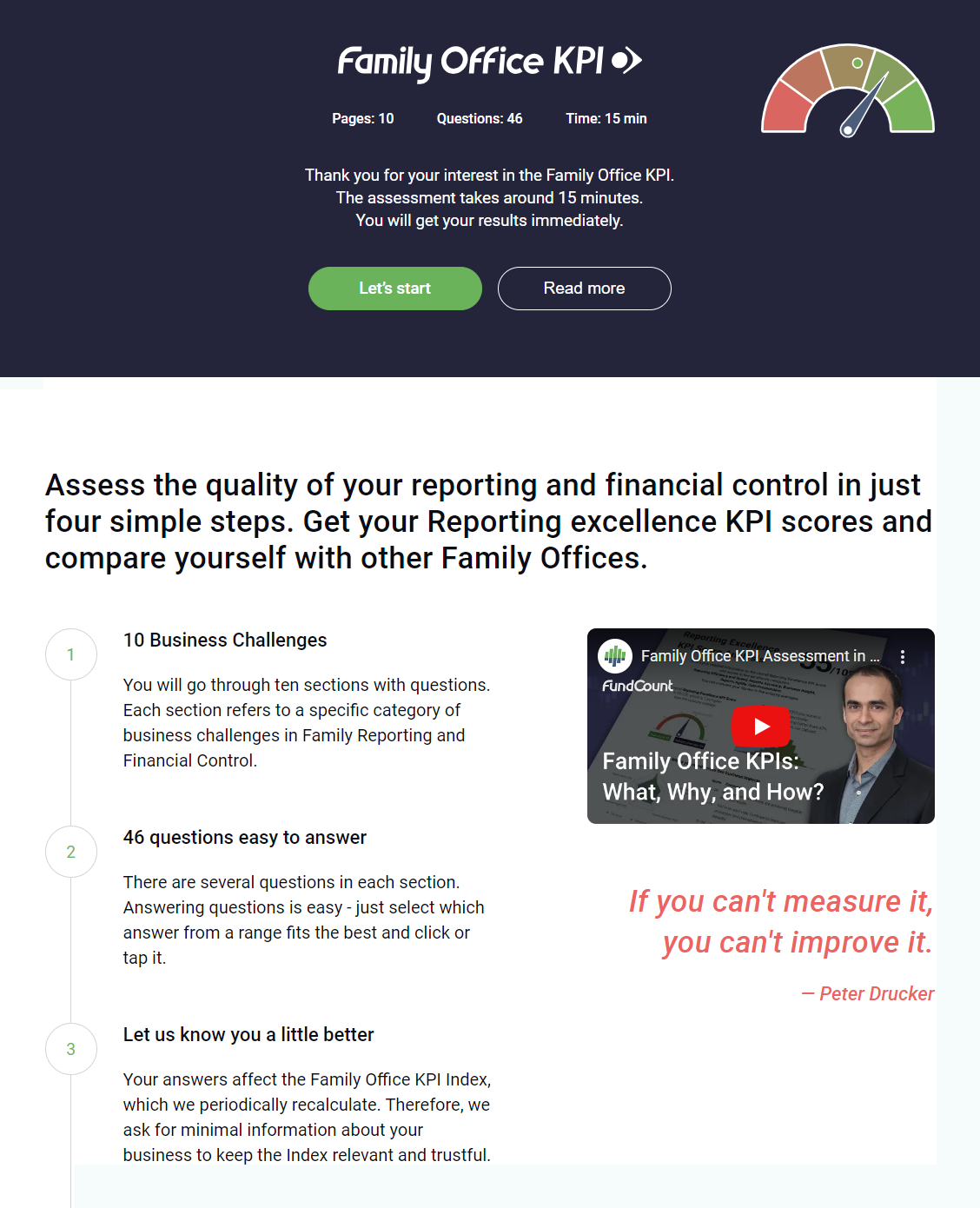

The Family Office KPI assessment, completed online in just 15 minutes, offers valuable insights into three fundamental areas:

- Client Reporting: Gauges the effectiveness of reporting practices, ensuring clarity, timeliness, and actionable insights for family members.

- Financial Control: Evaluates the robustness of financial management processes, focusing on cost control, governance, and risk mitigation.

- Operational Excellence: Assesses the efficiency and effectiveness of back-office workflows, identifying areas for streamlining and optimization.

What to Expect from the Report

Upon completion of the assessment, participants receive a tailored report with:

- Overall scores: A score for both Reporting Excellence and Financial Control, indicating the family office’s overall performance relative to industry averages.

- Category-specific scores: Scores for five key categories within each area, including Accuracy, Efficiency & Speed, Controls, and Processes. This provides a deeper understanding of strengths and weaknesses.

Comparing these scores to industry benchmarks, gives invaluable insight into the relative position of your family office and identifies areas for improvement so that you know exactly where to start and aren’t simply left grasping in the dark for answers.

Take the first step towards Family Office 3.0 by completing the Family Office KPI assessment today: