Accounting and investment reporting are notorious pain points for family offices, but this needn’t be the case if technology is configured specifically for their needs. Ashley Whittaker, President, Global Sales at FundCount, explains why family offices really can achieve a single source of truth if their data and systems are organised in the correct way.

Accounting and investment reporting are notorious pain points for family offices, but this needn’t be the case if technology is configured specifically for their needs. Ashley Whittaker, President, Global Sales at FundCount, explains why family offices really can achieve a single source of truth if their data and systems are organised in the correct way.

Ask any single or multi-family office what their primary accounting and reporting challenges are and you are likely to hear a litany of similar issues – gathering data is time-consuming; we are too dependent on spreadsheets; managing multiple legal entities is cumbersome; timely consolidated reporting is a constant challenge.

We see this time and time again. And it’s not surprising. One thing that jumps out when you look at a family office’s IT ecosystem is the number of different systems needed to cope with the many and varied data sources. Even more noticeable, is that most accounting software that is deployed is designed for manufacturing and service companies, not the investment industry. It’s no wonder that family offices spend so much time on spreadsheets gathering data, checking accuracy, reconciling information and compiling reports.

In searching for that single source of truth, family offices must pay close attention to how data is gathered and organised in their accounting system as that directly impacts accessibility for reporting. To avoid the common pitfalls that can undermine success, I suggest starting with the following considerations.

Get the General Ledger Right

Family offices that rely on a general ledger that is not baked into their investor and investment accounting and reporting solution run into all sorts of issues. One of our clients, for example, had been using general ledger software that was not integrated within their portfolio management system. Reporting was incredibly difficult. There was often a three-month delay in generating reports to family members and the information changed constantly.

Answering basic questions from the family such as, “Where am I invested?” and, “What is my performance?” was more complicated than it needed to be. Even with a staff of 25 to manage reconciliation, accounts payable and reporting, questions still couldn’t be answered in a timely fashion.

We provided them with a back-office accounting solution that unified their portfolio, partnership and general ledger activities on a single platform. Our system is based on a general ledger that is also the data warehouse. That means data isn’t in separate silos, it is intrinsically linked to everything in the system and easily accessible. All activity passes through the general ledger, which updates and reconciles automatically in real time.

With one data source and data all in one place, the client could write ad hoc reports or schedule reports “out-of-he-box” and quickly respond to family member requests. Accuracy improved as well. Most impactful, however, were the enormous efficiency gains. With our solution, the client only needed five people to handle reconciliation and reporting, freeing the rest of the team to focus on other tasks.

Invest in Fit-For-Purpose Solutions

Another stumbling block to achieving that single source of truth is relying on spreadsheets and other general-purpose systems, particularly for general ledger accounting. A study on family office efficiency by Family Wealth Report and sponsored by FundCount, found that 74% of family offices rely on a general purpose system for general ledger accounting, which unfortunately shows just how prevalent this issue is.

While these systems may sound like a good idea upfront because they are often less expensive than specialised wealth management solutions, family offices pay the price in time and lack of accuracy. There are complexities – such as consolidating ledgers for multiple entities – that simply cannot be accounted for in these systems without time-consuming workarounds.

We had a single family office client with just this issue. They had a complex environment and were looking for a way to become more efficient. Their goal was to bring together partnership accounting, performance reporting, private equity, real estate, performance metrics and marketable securities on a single platform.

Our solution was a game-changer for them. Not only do they now have a consolidated financial picture for family members, but they can drill down to view ownership and run reports by individual entity, asset, investment, geography and other parameters. Reviewing the family offices’ partnerships to verify underlying data on the various entities is easily accomplished by toggling between partnerships rather than logging into each entity individually. What used to take three days can now be done in a single day.

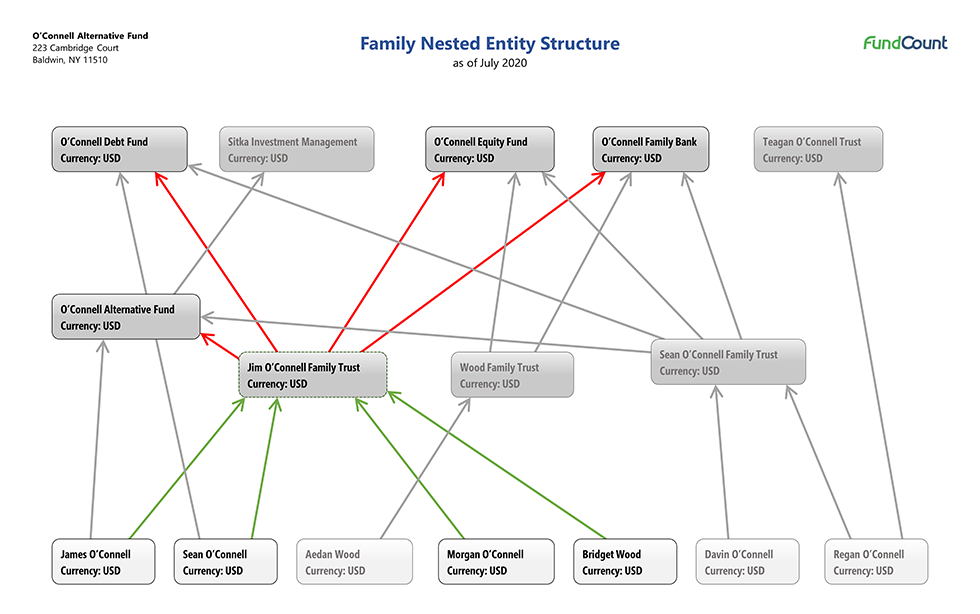

Another client, a multi-family office, gained similar efficiencies from FundCount’s ability to look through nested entities and complex structures. After transitioning from spreadsheets, which could not effectively track the individuals, trusts, corporations, partnerships or other structures, the client now has all information readily available. They can look through entities and instantly view performance, holdings, net worth and other investment information either individually or by groups, knowing the numbers are accurate and current. FundCount also enables the client to run up-to-date allocation schedules, including all related details such as side pockets.

Don’t Skimp on Resources

When speaking with clients, we find that they often not only underestimate what is needed for a project, but assume that the vendor can do everything. A vendor should have open architecture for flexibility and a rigorous process for implementation, but clients need to ramp up with resources on their end as well. That includes project management, enterprise resource planning experts, and other specialists to ensure the project runs smoothly. Penny pinching with internal or external resources and tools often delays projects and causes more disruption.

Keep in mind that multi-page RFPs and expensive consultants do not necessarily guarantee success. Be sure to work closely with your consultants, understand all options and ask questions about implementation.

Stay Focused On Results

Thanks to the availability of today’s powerful business intelligence and visualisation tools, creating charts and graphs is easy. But tread carefully. When assessing solutions, don’t get carried away by visualisations that have a “wow” effect in presentations only to ring hollow with little substance behind the pretty graphs and charts. Dig deeper to ensure what you see provides the underlying information you need. If you understand the potential pitfalls, you can quiz vendors effectively.

The most important thing for a family office, however, is to understand why they are undertaking the project in the first place. I recommend that the family office start by focusing on outcomes and what they wish to achieve. Is efficiency important? Reporting flexibility and improvements? Timely response to family member requests? Managing risk? Our checklist for qualifying vendors and technology, which starts with a self-assessment, has been a helpful tool in guiding clients embarking on a technology project.

After everything is taken into account, only a unified platform with accounting, general ledger and reporting on a single system will provide the accuracy, data accessibility and timely information needed to achieve that ever-important single source of truth.

Published in Technology Traps Wealth Managers Must Avoid, 2021