A practical playbook for family offices RIAs and funds

If you are responsible for the management of investment portfolios, you know the job is bigger than picking investments and checking performance charts. On any given week you are trying to answer basic questions that should be simple, but rarely are. What do we actually own across all entities and custodians. How much cash is truly available. What changed since last month. Why does the portfolio reporting number not match what accounting shows.

The pressure has gotten worse as portfolios have gotten more complex. Alternatives come with valuation lag, capital calls, messy statements, and timelines you do not control. Add multiple entities, multiple custodians, and multiple stakeholders who want clean answers on demand, and the portfolio management process can start to feel like a constant reconciliation project.

Below, we will walk through the inputs you need, how teams process and reconcile the data, what good portfolio reporting looks like on a monthly and quarterly cadence, and which controls prevent the common mistakes that quietly destroy credibility. We will also cover how to manage alternatives without losing control, and we will close with a straightforward tool checklist to help you evaluate software based on how your office or firm really works.

What management of investment portfolios actually means

Management of investment portfolios is the ongoing process of turning real world investment activity into reliable decisions and trustworthy portfolio reporting. It covers how you gather data, reconcile it, account for it, and use it to make choices, not just what you buy.

In practice, the job includes investment selection, but it quickly expands into monitoring positions and cash, tracking alternatives, handling corporate actions, understanding exposure, planning liquidity, and making disciplined changes over time. It also includes the operating work that makes the numbers credible, like defining a single source of truth for holdings and transactions, reconciling what custodians report against what the books say, and producing performance reporting that stakeholders can trust.

It is not just picking managers. It is not a dashboard that looks clean while the underlying data is still messy. And it is not a monthly ritual of copying numbers from statements into spreadsheets and hoping they tie out. A solid portfolio management process gives you repeatability, so the office can answer basic questions quickly and make decisions without arguing about whose numbers are correct.

The operating model from inputs to decisions

A portfolio management process works best when you treat it like an operating model, not a collection of ad hoc reports. The goal is simple. Take messy investment reality from multiple sources, turn it into a single source of truth you can stand behind, then use it to make decisions with confidence.

Portfolio management flow

Inputs

This is everything coming in from the outside world and from your own activity. Transactions, positions, cash movements, and valuations are the obvious ones. In real life you also need the context that makes the data usable, such as entity structure, ownership, benchmarks, and any special rules around allocations, fees, or restrictions. If inputs are incomplete or inconsistent, portfolio reporting will always feel fragile.

Processing

This is where teams earn credibility. Data gets normalized so it is comparable across custodians, managers, and entities. Classifications get applied consistently so an asset is treated the same way across reports. Cost basis and FX need to be handled in a way that fits your structures and reporting requirements. Most importantly, this is where reconciliation happens so you can explain differences instead of hiding them. For many teams, this step also includes accounting entries because the cleanest operating model is one where investment activity ties to the books.

Outputs

Outputs are what stakeholders actually consume. Performance reporting, allocation views, exposure summaries, cash flow, capital activity for private investments, and statements that can be shared without caveats. Good consolidated portfolio reporting is not just a prettier presentation. It is a defensible view that stays consistent across audiences and time periods.

Decisions

This is where the work pays off. Rebalancing, manager changes, liquidity planning, and tax aware actions all depend on whether the underlying information is reliable. When inputs and processing are sound, the decisions get faster and less emotional because people stop arguing about whose numbers are right and start focusing on what to do next.

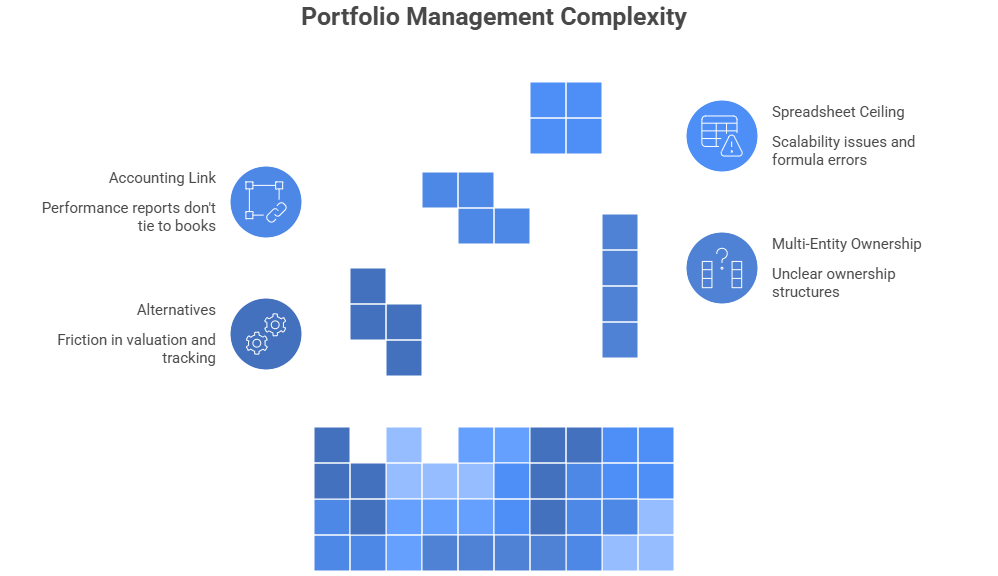

Where portfolio management breaks in real life

Most breakdowns happen when the portfolio gets more complex than the process that supports it. Nothing fails all at once. You just start seeing more exceptions, more manual fixes, more time spent explaining numbers instead of using them.

With multiple custodians, you end up juggling inconsistent data formats and different definitions for what should be the same thing. One statement shows cash one way, another breaks it out differently, and suddenly investment data aggregation turns into translation. If you do not define a single source of truth, portfolio reporting becomes a debate instead of a deliverable.

Alternatives and multi-entity complexity

Alternatives add their own kind of friction. Valuations arrive late, capital calls and distributions tracking lives in emails and PDFs, and documents drive the workflow as much as the numbers do. The data is not wrong, it is just slow and messy, which makes it hard to run a clean portfolio monitoring and review cadence.

Multi-entity ownership is where even strong teams get tripped up. Who owns what is not always obvious once you have trusts, partnerships, SPVs, and layered allocations. If your process cannot connect positions and transactions back to entity level reality, consolidated portfolio reporting will always feel like it has footnotes.

The accounting link is another common fault line. Performance reports look reasonable, but they do not tie to the books, so you burn time reconciling instead of deciding. Over time, this becomes a credibility problem because stakeholders start to wonder which number is real.

And then there is the spreadsheet ceiling. Spreadsheets can be fine for analysis, but as the system scales, key person risk and quiet formula errors start showing up at the worst times. That is usually when teams realize they are running an enterprise grade process on a tool built for personal work.

Reporting cadence what great looks like

Good portfolio performance reporting is less about fancy visuals and more about rhythm. When the cadence is clear and consistent, stakeholders stop asking for one off reports, and the team stops living in reactive mode. The goal is to produce a small set of outputs that are reliable enough to drive decisions, and predictable enough that nobody has to wonder what is coming next.

Monthly

Monthly reporting should keep the office oriented and safe. Cash position and near term liquidity get the most attention because they drive what you can actually do. Exposure views should highlight material concentrations, big moves, and anything that changed meaningfully since last month. This is also where exceptions belong, such as breaks, missing data, stale valuations, and unresolved reconciliations, so problems do not quietly roll forward.

Monthly reporting pack checklist includes cash and liquidity summary, allocation and exposure snapshot, exceptions log, reconciliation status, and key activity highlights.

Quarterly

Quarterly reporting is where you tell the full story. This is the performance package, with returns, attribution at the level you can support, and allocation views that are consistent with the investment policy. Fees and expenses deserve a clear view because they are one of the few guaranteed drags in any portfolio. Private investment updates belong here too, including capital calls and distributions tracking, valuation timing notes, and any material changes in risk or liquidity assumptions.

Quarterly reporting pack checklist includes consolidated performance reporting, allocation and exposure detail, fee and expense summary, private investment activity and valuation updates, and risk notes with notable changes.

Annual

Annual reporting is where you make the work usable for tax and audit cycles, and where you tighten the operating model for the next year. Tax ready summaries should be complete enough that advisors are not rebuilding data from scratch. Audit support is easier when you can show clean reconciliations and a consistent source of truth. This is also the right time to review policies, benchmarks, and reporting definitions so the portfolio management process does not drift.

Checklist

Annual reporting pack checklist includes tax ready summaries and supporting schedules, year end consolidated statements, audit support package, policy and benchmark review notes, and a process improvement log for the coming year.

Managing alternatives without losing control

Private investments can be great assets. They also break weak processes faster than anything else because the workflow is driven by documents, uneven timing, and terms that vary deal by deal. If you want alternatives to behave like part of the portfolio instead of a separate universe, you need a routine that keeps the basics clean even when valuations arrive late.

The controls that keep alternatives manageable

Start with capital calls and distributions tracking because that is where operational surprises usually begin. The practical question is not only what you committed. It is what is funded, what is still unfunded, what is expected next, and what that means for cash planning across entities. A simple log that ties each notice to the right entity, bank instructions, approvals, and booked entries prevents the Friday afternoon scramble.

Then there is valuation lag, which is not a flaw so much as a reality. The mistake is pretending it does not matter. Good portfolio reporting makes the timing visible and communicates what is stale, what changed, and what assumptions you are making until new marks arrive. Stakeholders usually accept imperfect timing. They lose confidence when the report acts like the data is real time when it is not.

Performance measurement is another area where teams get tripped up. IRR can be useful for private investments because it reflects the timing of cash flows, while TWR is better for comparing managers and strategies without cash flow timing distorting the picture. You do not need to turn this into a math lecture. You just need to be consistent about which metric you use where, and to explain it in one plain sentence when it appears.

The visibility layer that protects reporting credibility

Fees and expenses deserve their own visibility. Fee and expense visibility is often the difference between a portfolio that performs and a portfolio that looks like it should have performed. Management fees, performance fees, fund level expenses, deal expenses, and admin costs can hide in statements unless you treat them as trackable data.

You also have to accept look-through limitations. Some funds will not give you position level transparency, and some will only do it intermittently. The workaround is to be clear about what you can see, categorize exposure using the best available information, and update it on a cadence that matches the reality of the data instead of forcing false precision.

Finally, alternatives live on document workflow. Statements, notices, and K-1 coordination drive the calendar. When those documents are centralized, tagged to the right entity and investment, and connected to the accounting and reporting process, the alternatives book becomes easier to manage and far less dependent on someone’s inbox.

The accounting link why portfolio numbers must tie to the books

If you have ever had a portfolio report that looks right, but cannot be explained when someone asks a basic question, you have felt this gap. The numbers are not necessarily wrong. They are just coming from a different universe than the books, so every close turns into a reconciliation project.

“Performance only” systems tend to create loops because they are built to calculate returns and produce views, not to serve as the record of what actually happened. Transactions get interpreted one way in reporting, another way in accounting, and the team spends time translating instead of deciding. Over time, the issue is not effort. It is credibility. When portfolio reporting does not tie to the books, stakeholders start to wonder which numbers are real.

Multi-entity and partnership structures make this worse. Allocations, ownership changes, and entity level activity do not behave like a single taxable account. If those allocations sit outside the ledger, you are forced to recreate them in spreadsheets or side calculations, and the complexity compounds each month.

This is where portfolio accounting matters in practice. It means investment activity is captured with the same discipline as accounting activity, so positions, transactions, allocations, and reporting roll up from one set of data. Some teams reduce reconciliation and reporting risk by using an investment accounting platform such as FundCount where portfolio activity, multi-entity accounting, and reports come from the same underlying ledger.

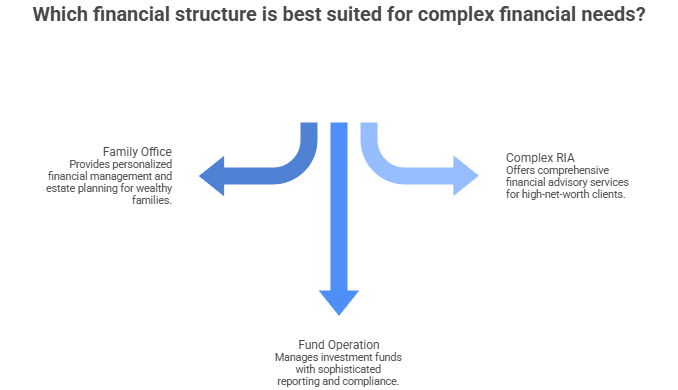

Portfolio management technology stack patterns

Most teams end up in one of two technology patterns. Neither is inherently wrong. The right choice depends on how complex your entities are, how much alternatives activity you have, and how much time you can afford to spend reconciling numbers every cycle.

Reporting layer plus separate GL and partnership accounting

In this pattern, investment data aggregation feeds a reporting tool that produces dashboards and portfolio performance reporting, while the GL and partnership allocations live elsewhere. It can work well when the entity structure is simple and the portfolio is mostly liquid assets, especially if your priority is a strong client experience layer and you can tolerate some reconciliation effort. The tradeoff is that integrations multiply and the team often has to explain differences between reporting and accounting, which shows up as extra work and occasional credibility stress.

Best fit is usually an RIA or family office with lower entity complexity, fewer private investments, and a clear operational owner who can manage data mapping and reconciliations without creating a monthly fire drill.

Unified investment accounting and reporting

In this pattern, the system of record is an investment accounting ledger that supports reporting from the same underlying data. You still need feeds and data cleanup, but there are fewer handoffs and fewer places for numbers to diverge. It is typically easier to maintain a single source of truth, preserve an audit trail, and tie portfolio reporting back to the books, which matters more as alternatives and multi-entity ownership expand.

Best fit is usually a family office, fund operation, or complex RIA dealing with alternatives, multi-entity structures, and higher expectations for reconciled reporting, where the cost of manual reconciliation and key person dependency is starting to outweigh the convenience of a lighter reporting layer.

Software selection checklist

Choosing investment portfolio management software gets easier when you stop shopping for features and start shopping for outcomes. You want clean inputs, a defensible processing layer, and outputs you can stand behind without a reconciliation marathon every month.

Here are the areas worth evaluating first:

-

Data aggregation across custodians, banks, and administrators

-

Asset class coverage with strong alternative investment tracking

-

Multi-entity and ownership support, including portfolio accounting needs

-

Portfolio performance reporting flexibility and consistency across audiences

-

Audit trail and permissions that match real roles and approval needs

-

Portfolio reconciliation workflow that makes breaks visible and fixable

-

Exports, API, and integration options that match your stack and reporting obligations

-

Implementation reality including data migration, timeline, and a clear internal owner

A common way teams handle multi-entity complexity in FundCount is to record investment activity at the entity level and let consolidated portfolio reporting roll up from the same ledger that supports the books. For example, when an alternative investment issues a capital call, it can be booked to the correct entity with the supporting documentation attached, then reflected consistently in entity statements and consolidated views without re-entering the data in a separate reporting tool or rebuilding it in spreadsheets. The practical benefit is that reporting and accounting stay aligned, and it is easier to trace how a figure was produced when someone asks for backup.

Common pitfalls and how to avoid them

Most problems in portfolio operations are not mysterious. They come from a few repeat patterns that show up when complexity grows faster than the process, and the fixes are usually straightforward once you name what is happening.

We bought software but didn’t change process

The tool gets implemented, then the team keeps running the old workflow because it feels faster and safer. Portfolio reporting still gets rebuilt manually, reconciliations still happen in side files, and the system becomes a place to store data rather than run the process. The way out is to pick a small number of high impact workflows, usually monthly reporting and reconciliation, and make the new process the default with clear ownership and a cutoff date for the old way.

We never defined the source of truth

This is when every meeting starts with a quiet argument about whose numbers are right. Custodian statements, administrator files, and internal spreadsheets all disagree a little, and nobody has the authority to declare which one wins when they conflict. Avoiding this comes down to a simple rule. Decide what is authoritative for positions, for transactions, for valuations, and for ownership, then document it and revisit it when the stack changes.

Alternatives live in a spreadsheet forever

At first it is a temporary workaround. Then the spreadsheet becomes the system of record for capital calls, distributions tracking, fees, and valuations, and the office ends up with two parallel portfolios, one in the platform and one in a file. The fix is to treat alternatives as first class assets in your operating model. Centralize documents, record capital activity in the same system you report from, and accept that valuation lag needs clear communication rather than manual patchwork.

Reports don’t tie to accounting

This is the credibility killer. The performance report looks fine, but the books tell a different story, so every close becomes a reconciliation loop and every stakeholder question turns into a scramble. The way out is to strengthen the accounting link. Either build a disciplined reconciliation workflow between reporting and the books, or move toward portfolio accounting where investment activity and reporting are tied to the same underlying ledger so differences become exceptions instead of the default.

FAQ

What is the management of investment portfolios?

The management of investment portfolios is the ongoing process of turning investment activity into reliable decisions and trustworthy portfolio reporting. It includes data aggregation, accounting alignment, performance reporting, monitoring, and the controls that keep the numbers consistent across entities and custodians.

What’s the difference between portfolio management and portfolio accounting?

Portfolio management is the full operating process that drives decisions, including monitoring, rebalancing, liquidity planning, and reporting. Portfolio accounting is the accounting backbone that records investment activity in a ledger so positions, transactions, and allocations can tie cleanly to the books and support reconciled reporting.

How do family offices track private investments?

They track private investments by treating them as a workflow, not a spreadsheet project, with consistent handling of capital calls, distributions tracking, valuation updates, and document intake. The key is to keep entity level ownership, cash movements, and supporting documents connected so private assets do not become a parallel portfolio living in someone’s inbox.

What reports should an RIA deliver monthly vs quarterly?

Monthly reports should give clients and the team a clear view of cash, exposure, exceptions, and key changes, with reconciliations kept current. Quarterly reports should deliver the fuller performance package, including allocations, fees, and private investment updates where relevant, so the story is consistent and comparable over time.

When should we move beyond spreadsheets?

You should move beyond spreadsheets when they become the system of record instead of an analysis tool, especially once you have multiple entities, multiple custodians, or meaningful alternatives activity. If your close depends on one person maintaining a complex file, or if errors and version drift are starting to show up, the spreadsheet ceiling has already arrived.