Managing multiple family offices involves juggling dozens of accounts and various asset classes. Our client, a Canadian-based Family Office and Investment Fund Managerial firm, had earlier adopted FundCount as their technological solution to help them manage, organize, analyze and report on these accounts.

FundCount solved a ton of issues, yet there was still a problem for the family office that sat outside the FundCount solution. Their data originated from a wide range of sources. Gathering data from multiple sources and dozens of accounts required a labor-intensive and time-consuming manual process that was prone to error.

An Evolving Landscape at the Office

The type of work we do today and the demands on how we spend our time have continued to evolve. As old problems are solved, new types of tedium have emerged that demand even more modern solutions. Our client found themselves faced with just such a situation and turned to FundCount to see if they could come up with an answer.

Human Error

One of the errors that cursed the client was mis-entering passcodes. Getting locked out of a bank account because of user error is no simple matter to resolve. Typically, it involves getting on the phone with a bank representative and then having to convince them that you are who you say you are and that you aren’t a fraudster trying to gain illegal access to the account. Sometimes they were locked out of accounts they needed access to for days as a result.

How do you explain to the client that their report is delayed because you have been locked out of their account? It’s difficult to maintain a professional appearance under conditions outside your control.

Investigating the problem

FundCount analysts approached the situation by gathering information about the family office’s regular processes and workflow to help them gain a better understanding of the issues.

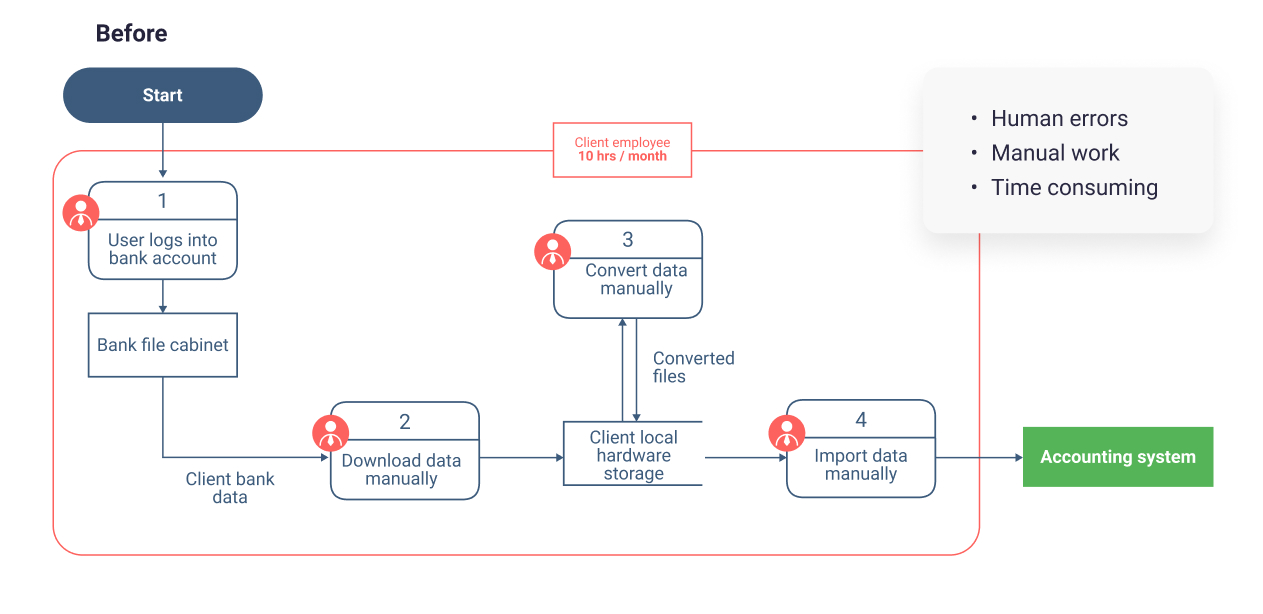

Analysts learned that in addition to risking error, the process was taking an inordinate amount of time. After logging in to multiple accounts, the user followed a sometimes-complex path to the bank’s file cabinet where they accessed a data file for each account. Files must then be manually downloaded and saved to a local storage folder, then converted to a useable format. After converting, the data must then be manually imported into FundCount.

Robots to the Rescue

To overcome the family office’s issues, this is just one of the problems the FundCount implementation team needed to find a solution to.

Robotic Automation Process (RPA) offers a way through just such a predicament. RPA is a smart robot that is designed to save countless hours of repetitive tasks and contribute to overall employee happiness. RPA uses a combination of artificial intelligence (AI), machine learning, process analytics and other technologies. The result is a hyper-automation remedy that fully automates data processing originating outside a solution like FundCount.

The tool can be implemented seamlessly so that the grueling task that led to the call for help simply disappears from the perspective of our client.

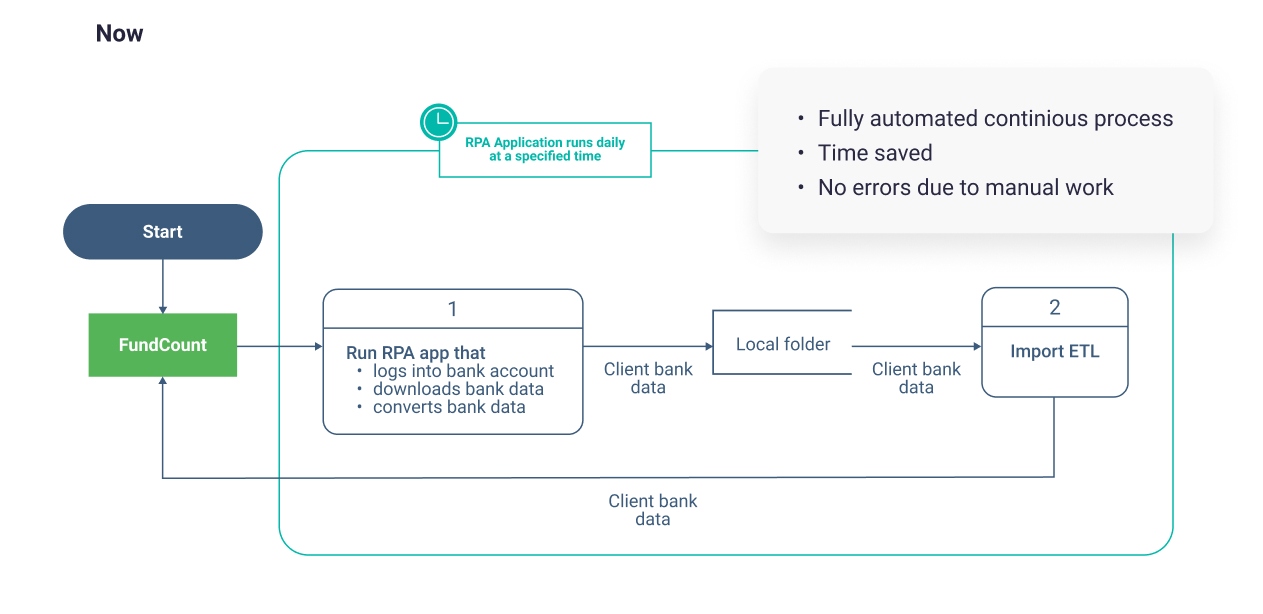

As such, the team at FundCount concluded RPA was the perfect answer and proposed it to the client. In just 5 short days, the family office would have a fully-automated solution that would eliminate the time-consuming and error-fraught access, download, convert, and then import headache they regularly had to deal with.

Outcome

After implementing the RPA solution, the office simply saw the workload disappear on their end. Data pulled from the banks automatically appears in FundCount, to be automatically crunched, analyzed and fed into reports. Internally the process now starts and ends with FundCount. FundCount, via its scheduled task manager, now runs an RPA app, which uses robots to log in to each account, download and convert the data, save it to a special destination folder and then upload it all into FundCount. The user now enjoys a hands-off, no-more-pain procedure.

This freed up 10 or more hours a month and removed a whole lot of boring grunt work. To our client’s satisfaction, user errors disappeared and their clients no longer faced delays. Moreover, their FundCount system is now exponentially more robust as systems and processes that previously sat outside the solution have now been brought in. FundCount now works more efficiently with regular bank updates.

FundCount commitment to their Clients

FundCount is a reliable partner from start to finish that works with your staff to maximize efficiency on your workflow and processes. Open clear lines of communication with us and implementation all the way through to daily operations is guaranteed to go smoothly.