A private equity corp is incredibly valuable for businesses and investors. Companies get access to low-interest loans, and venture capitalists (VCs) can sometimes get better annual returns than the S&P 500.

However, before anybody decides to try and reap the benefits of a private equity corp, they must first understand the basics. Becoming knowledgeable on the topic will increase your chances of success and, most importantly, enable you to start utilizing the investment/funding strategy.

To get going, let’s start from the beginning. Understanding the corp-side of private equity is simple. However, private equity itself is much more challenging. Therefore, read below to develop an understanding of private equity and its use.

What is private equity?

The easiest way to understand private equity is by looking at the first keyword, “private.” In essence, it’s an investment class that acquires or invests in private companies that aren’t listed on the public stock exchange.

Typically, private equity funds are accumulated from retail and institutional investors, which can be used to make acquisitions, fund new technology, and expand working capital. A private equity corp is an organization that helps bring investors together (for a small fee) to make the initial investment.

Understanding private equity

As we know, private equity is primarily funded by accredited and institutional investors. These investments typically have a long holding period, ensuring a turnaround for distressed companies, a sale to a public company, or until it’s possible to enable liquidity events like an initial public offering (IPO).

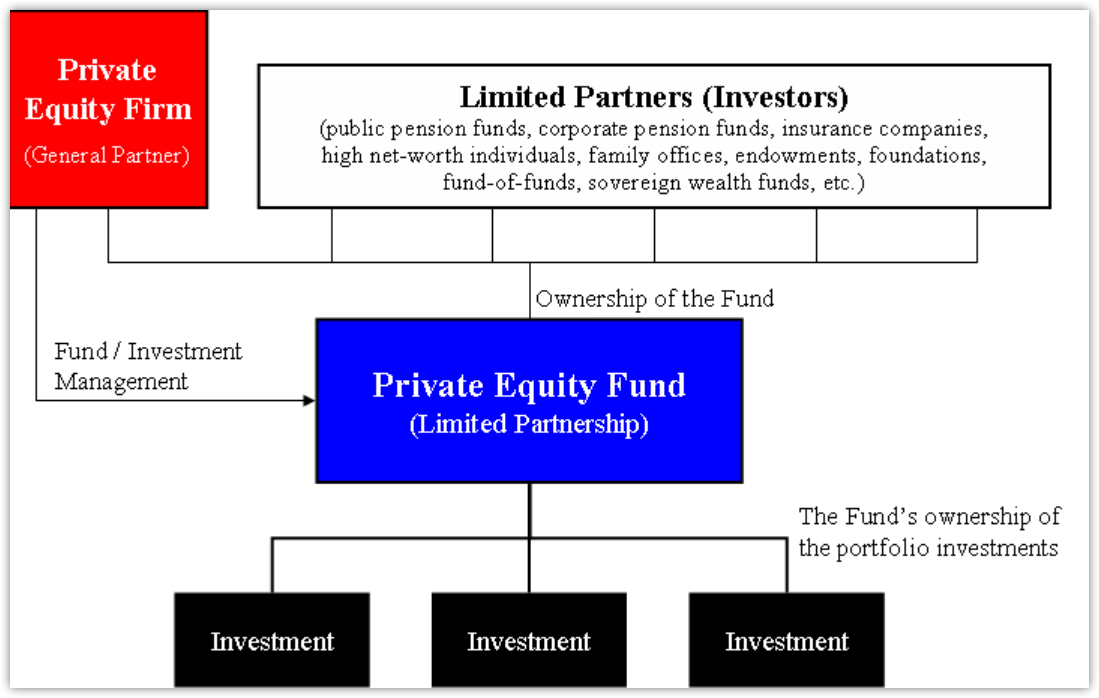

The structure of a private equity corp mostly remains the same across the board. To get a better visualization of this, see the below diagram.

Source: Wikipedia (diagram of how private equity is structured)

Types

With private equity, there are four main categories of investments: distressed funding, leverage buyouts, real estate private equity, funds of funds, and venture capital.

Each has its unique selling point, which can be utilized for investments.

- Distressed funding – When a company has filed for Chapter 11 bankruptcy, private equity funding is used to help the troubled company make necessary changes to generate profit.

- Leverage buyouts – Probably the most popular option that involves a combination of debt and equity to finance the transaction.

- Real estate private equity – This usually requires higher minimum capital and longer holding periods for investment compared to the other private equity options, but its assets related to real estate only.

- Funds of funds – Primarily focuses on investing in other funds, like hedge funds, helping them get entry to a deal that has a high minimum capital requirement.

- Venture capital – Focuses on small start-ups/businesses, helping them gain enough funds to start their journey.

These are the four main investments the private equity corps offers its lender and capitalist. Understanding this is important, as it’ll help you develop a better “sense” of what’s available to invest or obtain funding from private equity.

How to invest

As an investor wanting to get involved in private equity, there are several options: Funds of Funds, Exchange Traded Funds (ETF), and Special Purpose Acquisition Company (SPAC).

- Fund of Funds – Holds share in multiple private partnerships that invest in private equities with a high minimum capital threshold.

- Exchange Traded Funds (ETF) – Track an index of publicly traded companies currently investing in private equities, then buy shares over the stock exchange without any minimum requirements.

- Special Purpose Acquisition Company (SPAC) – Publicly traded shell companies that make private equity investments in private companies that are undervalued significantly.

Above are three simple methods to start investing in private equity today. And, considering it has a higher annual return rate than the S&P 500, it’s more than worth it.

Conclusion

As you can see, understanding private equity corp is highly important for both businesses and investors. By understanding this, you can make better decisions involving the investment type, enhancing the possibilities of success. So, now you know this, approach with care and enjoy the benefits of private equity.