There is no one-size-fits-all solution built for hedge funds because not every fund is built the same. Funds with $500 million or more assets under management have very different requirements than smaller funds. Likewise, onshore funds have different reporting requirements from offshore funds and funds that deal in more exotic investments may have more complex…

Why does your family office need General Ledger Software?

The Growth of family offices and their governance needs Growing global wealth has increased the need for better accounting systems and has resulted in a worldwide surge in the number of family offices. Bloomberg referred to family offices as “the vehicle of choice to protect and preserve assets for future generations.” Family offices cater to…

Crypto: The Future of ApeCoin DAO

The craze from the famous NFT Bored Ape Yacht Club is something worth talking about. As the crypto community has noticed over the past few weeks, a new ERC-20 utility token called ApeCoin has been released and saw amounts of controversial and impressive traffic. From launching 9 days ago at $1 and already seeing highs…

Options to Consider When Selecting a Software Package for your Private Equity Needs

Chances are that if you are in the market for a system to support your private equity needs, you are buying for the first time. Firms generally don’t change systems once they have one established due to concerns about disruption, familiarity and similar. With this being the case, it is important to do your due…

A Simple, but Complete Guide to Selecting an Accounting Solution for Fund Administration

Disruptive technology provides both opportunities and challenges. Opportunities to upend old, and perhaps tedious and cumbersome practices. Challenges in that if you don’t keep up, you get left behind. This carries over even into the field of accounting – especially software. Staying out in front of the pack requires a deeper look at the available…

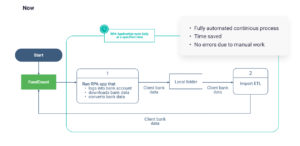

RPA, a Smart Robot that Saved One Family Office Time and Frustration

Managing multiple family offices involves juggling dozens of accounts and various asset classes. Our client, a Canadian-based Family Office and Investment Fund Managerial firm, had earlier adopted FundCount as their technological solution to help them manage, organize, analyze and report on these accounts. FundCount solved a ton of issues, yet there was still a problem…

Why Data is the Linchpin of Your Accounting System (and the Key to Smooth Implementation)

Ask any family office or asset management firm to cite the most challenging aspect of implementing a new accounting system and you’re likely to get the same answer: complexity around the data. But the issue of complexity is actually twofold. It refers to both the difficulty in gathering the data and integrating it into your…

Bringing Order to Chaos – The Benefits of a Unified Ecosystem

When the CFO of a mid-sized family office in North America began investigating new accounting software for the firm, he found that it was difficult to distinguish between offerings. Every vendor seemed to have a similar message. “We streamline your operations.” “We integrate portfolio and partnership accounting.” “Our reporting platform is easy to use.” It…

How to Avoid Costly Mistakes When Implementing a New Accounting System

How to Avoid Mistakes When Implementing a New Accounting System Choosing accounting and reporting software is a lot like having a house built. You may spend a lot of time vetting an architect and contractors, but that doesn’t mean you just sign off on their work and sit back and wait. In order to ensure…