One of the most extensive conversations recently with the current drop in the stock market is regarding big data and how managers in the financial industry are profiting from using big data systems. This has created a buzzword in many sectors, but aside from it having a lot of influence, there are a lot of…

Articles

Crypto: The Future of ApeCoin DAO

The craze from the famous NFT Bored Ape Yacht Club is something worth talking about. As the crypto community has noticed over the past few weeks, a new ERC-20 utility token called ApeCoin has been released and saw amounts of controversial and impressive traffic. From launching 9 days ago at $1 and already seeing highs…

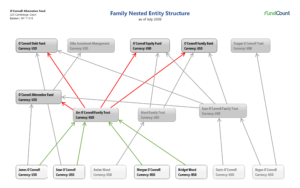

Accurate and Robust Portfolio Accounting – The FundCount Way

Ashley Whittaker, President, Global Sales at FundCount, talks to Tom Burroughes, Group Editor of Family Wealth Report about its successes. What sets you apart from your peers this year and why? FundCount continues to be a leading provider of wealth management solutions to family offices, which is a major sector for the company, representing one-third…

Why are Family Offices Still Searching for a “Single Source of Truth”?

Accounting and investment reporting are notorious pain points for family offices, but this needn’t be the case if technology is configured specifically for their needs. Ashley Whittaker, President, Global Sales at FundCount, explains why family offices really can achieve a single source of truth if their data and systems are organised in the correct way….

Bitcoin or Bust: Why Cryptocurrency is Here to Stay

Investing in Bitcoin, or any cryptocurrency, is not for the faint of heart. Originally launched in 2009, Bitcoin has climbed and crashed several times over the years. But none of this compares to the rollercoaster ride that started in 2017. It culminated recently with an incredible four-month rally that saw Bitcoin rise from a little…

Thinking of Asking Your Vendor for a Proof of Concept or Proof of Value? Think Again!

When it comes to purchasing software, it is no secret that companies like to ‘try before they buy.’ This holds true for companies of all sizes, whether a large fund administrator implementing a costly enterprise system or a more modest single family office looking for a simple portfolio accounting solution. As a result, the Proof…

The Secret Hong Kong and COVID-19 Share (and what it means for asset managers)

Hong Kong has offered a stable and welcoming environment to asset managers for more than 20 years, steadily building steam to emerge as a financial powerhouse behind New York and London. With its business-friendly tax structure and position as a gateway to China, one of the world’s largest markets, this semi-autonomous region is home to…

COVID 19 – The Ultimate Black Swan Event for Stress Testing Your Firm’s Operations

A black swan event in finance is characterized by its rarity, unpredictability, severe impact and the belief that maybe – just maybe – it was actually obvious and we should have seen it coming. This sounds quite a bit like COVID-19. Nassim Nicholas Taleb, a former Wall Street trader who popularized the phrase black swan…

5 Asset Management Trends to Watch in 2020

Interview with James Haluszczak, Managing Partner, SteelBridge Consulting James Haluszczak, industry veteran and founder of SteelBridge Consulting, and his firm are exclusively focused on serving as a strategic advisor to private equity and venture capital fund managers, investors, and administrators. FundCount asked James to share his perspective on the top 5 asset management trends that he…