Data is the lifeblood of every business, and the financial industry is no exception. From small investment firms to family offices, data empowers smarter choices and fuels growth. However, managing the ever-increasing volume and complexity of data can be a major challenge. This article explores how small businesses can leverage modern data management techniques to overcome these hurdles and unlock the true potential of their information.

Key Takeaway:

- Small businesses drown in data.

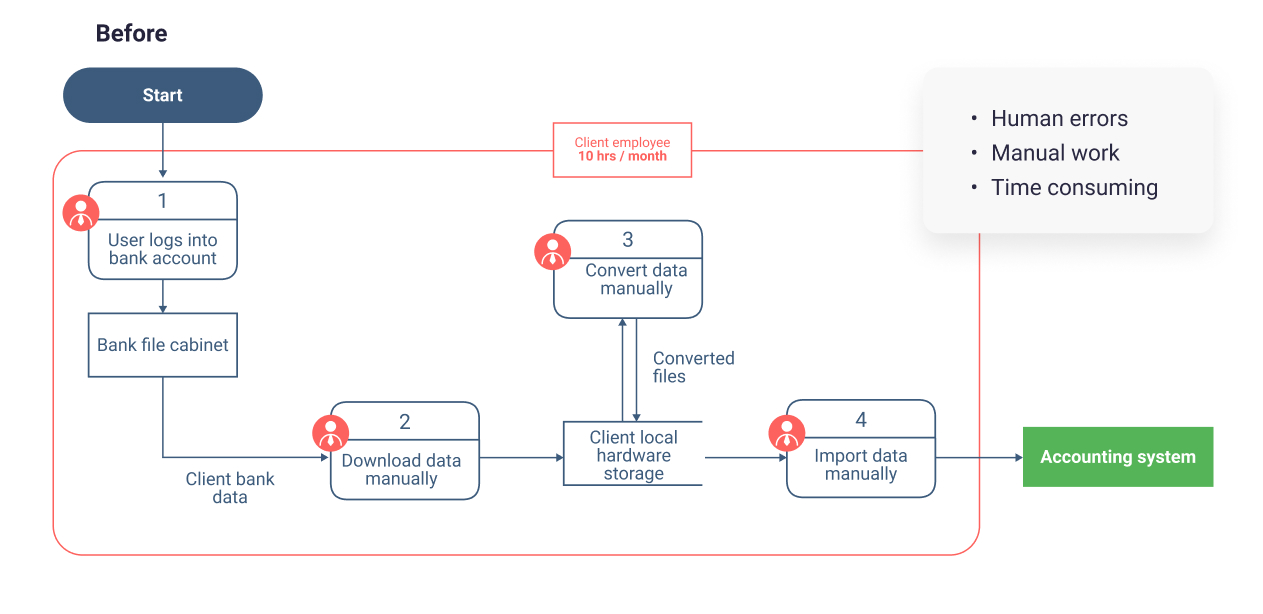

- Manual processes waste time & cause errors.

- Modern solutions automate & improve insights.

The Changing Landscape that Complicates Data Management in Small Businesses

The nature of work and the demands on our time continue to evolve in today’s fast-paced business environment. As we solve old problems, new challenges arise that require even more modern solutions. This is a situation that many small businesses find themselves in, grappling with issues that can hinder their growth and productivity.

Human error plagues many small businesses in the form of mis-entering passcodes. Being locked out of a bank account due to a simple user error is not a trivial matter to resolve. It typically involves a time-consuming process of contacting the bank, verifying identity, and convincing them that you are not a fraudster trying to gain illegal access to the account. Sometimes, this can result in being locked out of crucial accounts for days.

How do you explain to your customers that their service is delayed because you have been locked out of an account? It’s challenging to maintain a professional image when facing situations beyond your control.

Time Consuming Processes

It’s often found that in addition to the risk of errors, the process is also time-consuming. After logging into multiple accounts, users often have to navigate through complex paths to access data files for each account. These files then need to be manually downloaded, saved to a local storage folder, converted to a usable format, and then manually imported into the business system.

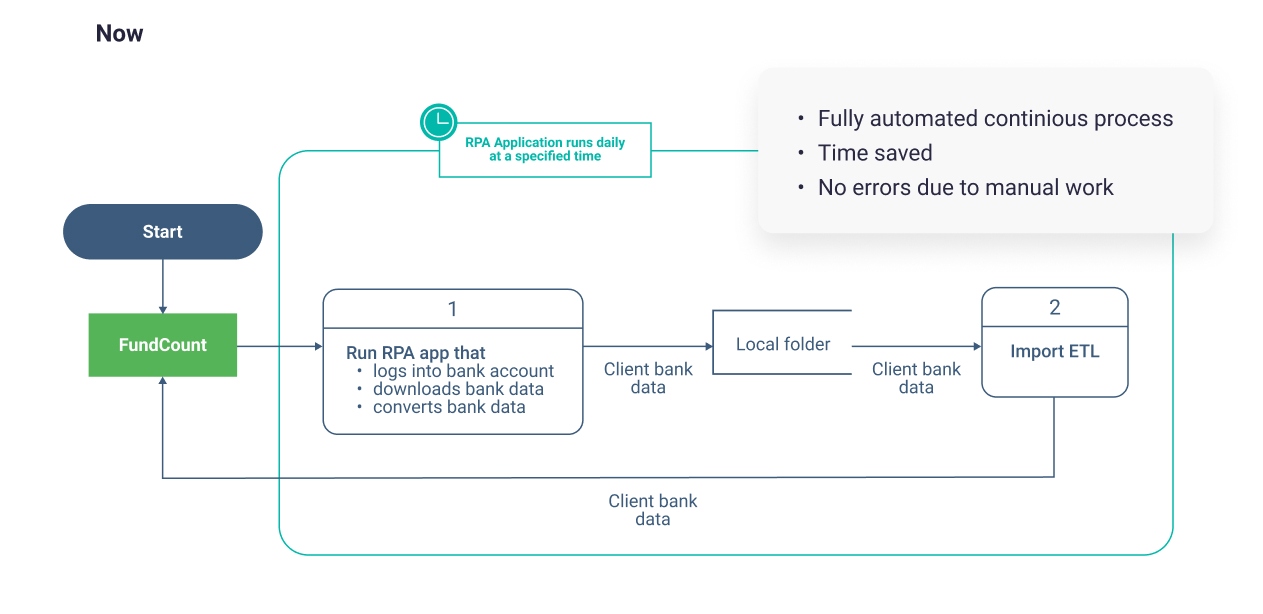

Robotic Process Automation (RPA) is one tool that can help small businesses modernize their data management procedures. RPA is a smart robot designed to save countless hours of repetitive tasks and contribute to overall employee satisfaction. RPA uses a combination of artificial intelligence (AI), machine learning, process analytics, and other technologies. The result is a hyper-automation remedy that fully automates data processing.

This tool can be implemented seamlessly so that the grueling task that led to the call for help simply disappears from the perspective of the business. In just a few short days, a small business could have a fully automated solution that would eliminate the time-consuming and error-prone process they regularly had to deal with.

Quantifiable Advantages

After implementing the RPA solution, businesses simply see the workload disappear. Data pulled from the banks automatically appears in the business system, to be automatically processed, analyzed, and fed into reports. The process now starts and ends with the business system. The business system, via its scheduled task manager, now runs an RPA app, which uses robots to log into each account, download and convert the data, save it to a special destination folder, and then upload it all into the system. The user now enjoys a hands-off, no-more-pain procedure.

This frees up 10 or more hours a month and removes a whole lot of tedious grunt work. To the satisfaction of the business, user errors disappear, and their customers no longer face delays. Moreover, their business system is now exponentially more efficient and effective.

Technology that leverages standardized protocols and APIs can automate data collection and aggregation

The Data Deluge: More Information, More Problems

Gone are the days when investment decisions relied solely on traditional sources like annual reports. Today’s data landscape is vast, encompassing financial and non-financial information from the internet, social media, and a multitude of other sources. This influx, driven by factors like the search for alpha and globalization, creates a “data deluge” that can quickly overwhelm small businesses.

From Garbage In to Gospel Out: Ensuring Data Quality

The old adage “garbage in, garbage out” rings true in the data age. The sheer volume of unstructured data makes maintaining quality a constant battle. Manual processes for data manipulation and integration not only increase errors but also hinder efficiency. Nearly two-thirds (61%) of SMEs, for example, said they do not run any data cleaning or update processes on the data they hold

Here’s where modern solutions come in. Technology that leverages standardized protocols and APIs can automate data collection and aggregation, eliminating human error and ensuring clean, reliable information.

Data Governance: Building Trust and Transparency

Data governance establishes policies and procedures to safeguard information accuracy, security, and accountability. This is especially crucial for building trust with investors and regulators.

One example is shadow accounting, where firms maintain a separate set of books to verify a third-party administrator’s records. This practice, once optional, is becoming increasingly common for firms of all sizes. Additionally, data lineage tools track information flow and identify potential inconsistencies, fostering transparency and mitigating risk.

Extracting Value: The Power of Business Intelligence

Data is valuable only if it can be transformed into actionable insights. Business intelligence (BI) tools empower firms to analyze vast amounts of data, uncovering trends and patterns that inform better decision-making.

Modern data management solutions can automate key tasks like calculating net asset value, managing cash flow, and compiling risk reports. User-friendly interfaces allow for easy data manipulation and report generation, ensuring stakeholders have the information they need, when they need it.

The Road to Modernization Starts Here

The good news? Modernizing data management doesn’t require a complete overhaul. Small businesses can take incremental steps, starting with the adoption of user-friendly technology solutions designed for their specific needs. By embracing these advancements, small firms can unlock the true power of their data and gain a competitive edge in today’s dynamic financial landscape.