When it’s time to build your own wealth team

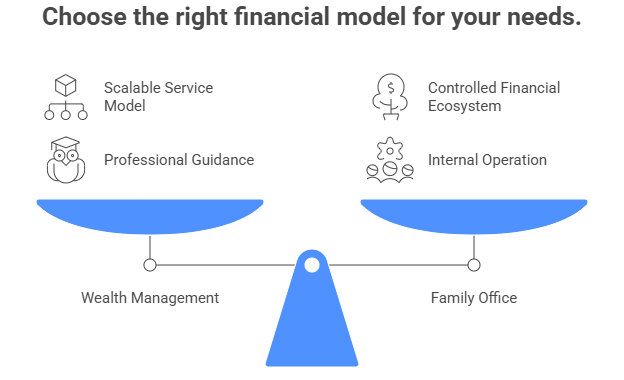

The family office vs wealth management question usually shows up long before anyone says those words out loud. Wealth management works because it is built to scale. You hire an advisor and a firm that already has investment process, planning expertise, and a service model that can handle most families well. For a long time, that is exactly what you want. You get professional guidance without having to build an internal operation.

A family office is a different idea. It is not just another advisor. It is a wealth operating model, meaning you build a team and a process that can handle your full financial ecosystem. That includes investments, but also entity level accounting, consolidated reporting across trusts and LLCs, bill pay and cash controls, advisor coordination, and governance. The goal is not to replace expertise. It is to bring the work into a structure you control.

The shift tends to happen when complexity rises. Alternatives and direct deals introduce reporting lag and document heavy workflows. Multiple entities and accounts make it hard to answer simple questions quickly. Multiple custodians and managers create multiple versions of the truth. At some point, the family starts to feel like it has a wealth manager, yet still cannot see the whole picture.

In the sections below, we will lay out a plain English comparison, a decision checklist, and realistic paths to move toward a family office model, including outsourced and multi family options that do not require hiring a large team on day one.

Quick definitions so we’re not talking past each other

These terms get used loosely, and that is where people end up debating the wrong thing. The simplest way to think about it is scope and structure, not status.

What wealth management typically includes

Wealth management is usually an advisor led relationship built around investment management and planning. That often includes portfolio construction, monitoring, and rebalancing, plus tax aware strategy, estate coordination, insurance review, and periodic reporting. Many firms also help coordinate with your CPA and attorney, but the core model is still advice and implementation delivered at scale.

What a family office includes

A family office includes the same investment and planning work, but adds an operating layer that handles the full financial ecosystem. That means accounting across entities, bill pay and cash controls, consolidated reporting that rolls up trusts and LLCs, vendor coordination, governance support, administration, and often multi generation education and continuity. It is designed to run the complexity instead of working around it.

A family office does not automatically require a huge staff. Many families start with a lean internal lead and outsource the rest. Wealth management is not automatically bad or conflicted. Plenty of advisors do excellent work. The difference is structure and scope, meaning whether you are buying an advice relationship or building an operating model you control.

Family office vs wealth management comparison table

Most families do not need a philosophy debate. They need a clear view of what each model actually covers, what it costs in effort, and what they gain in control. This table is meant to make the tradeoffs visible without overselling either side.

| Dimension | Wealth management | Family office |

|---|---|---|

| Who it’s for | Families who want to delegate investing and planning without building an internal operation | Families whose complexity and coordination needs justify an in-house operating model |

| Service model | Standardized tiers with defined services and meeting cadence | Bespoke structure built around the family’s entities, assets, and governance needs |

| Control | Advisor-led recommendations and implementation; transparency depends on reporting model | Family-led decision rights with higher transparency and tighter control over workflows |

| Coverage | Investments and planning with some coordination across professionals | Full financial ecosystem including investments, entities, accounting, reporting, controls, and coordination |

| Entity complexity handling | Often supported, but can become fragmented across accounts, entities, and advisors | Designed to manage multi-entity structures and ownership with repeatable processes |

| Reporting | Portfolio reporting, often by custodian or manager; consolidation may be partial | Consolidated reporting across entities and portfolios, with entity-level and family-level views |

| Cost structure | Typically AUM based fees, sometimes planning fees | Operating budget, retainer, or hybrid model depending on outsourced, MFO, or SFO approach |

| Privacy and vendor coordination | Advisor coordinates within their scope; vendor sprawl can remain | Central coordination of advisors, vendors, and sensitive workflows with stronger process ownership |

| Governance and next-gen education | Often available as an add-on or limited program | Built into the operating model for continuity, education, and multi-generation planning |

Where wealth management works great and why people stay

Wealth management shines when the financial life is relatively clean. If the balance sheet is straightforward, the number of entities is limited, and most assets are public markets with only light exposure to alternatives, the advisor model can be efficient and effective. You get access to investment expertise, planning, and a steady cadence of reviews without having to build a back office around the family.

It also works well when the family’s priority is simplicity. Many people do not want to manage a team, oversee processes, or own vendor coordination. They want a trusted relationship, clear recommendations, and someone else to handle the mechanics.

In that context, an internal operating layer can be unnecessary overhead. If portfolio reporting answers the questions you care about, entity administration is manageable, and coordination with your CPA and attorney is smooth, wealth management can be the right fit for a long time.

The outgrowing wealth management signals

Use this as a quick checklist. If you find yourself checking several boxes, it is usually a sign that complexity is starting to outrun the traditional wealth management model.

☐ Multiple entities, trusts, or LLCs and no unified picture

☐ Alternative investments create reporting lag and recurring surprises

☐ Multiple custodians or managers drive inconsistent reporting and definitions

☐ Cash movement and approvals feel risky, informal, or overly dependent on one person

☐ Family members want more transparency and clearer governance

☐ Tax and accounting are reactive rather than integrated with investment activity

☐ Vendor sprawl with no real coordinator across CPA, attorney, admin, bank, and property managers

Family office options you don’t have to jump straight to an SFO

A family office is not a single decision where you flip a switch and suddenly have a staffed operation. Most families take a staged approach, adding structure and control as complexity grows and as they learn what they actually need.

Outsourced family office

This is often the leanest step up. You keep your core advisor relationships, but outsource the operating layer to a specialist team that can coordinate reporting, entity administration, bill pay controls, and vendor management. It is a practical way to get family office level process without hiring an internal staff immediately.

Multi-family office

A multi-family office gives you a shared team, platform, and repeatable process, with deeper coordination than traditional wealth management. It can work well when you want more consolidated reporting, governance support, and operational coverage, but do not want to build a standalone office. The tradeoff is that customization is real, but not unlimited, because the model is still designed to serve multiple families.

Single-family office

A single-family office is the full build. You control the people, process, and technology, and you design the operating model around the family’s needs. The upside is maximum alignment and customization. The responsibility is that you own execution, meaning hiring, oversight, vendor management, and the internal controls that keep everything running smoothly.

Most families move through stages, starting with an outsourced model or an MFO, then building toward a more dedicated structure as the benefits become clear.

The real tradeoff control and customization vs overhead and execution

The decision is not really family office versus wealth management. It is whether the family wants to own the operating model. A family office can deliver more control and clearer reporting, but it also comes with real responsibilities that do not disappear just because the investments are doing well.

What you gain

You gain alignment and decision control, because the work is organized around the family rather than a standardized service tier. You also gain deeper reporting, especially across entities, alternatives, and cash, because someone is responsible for producing a unified view and defending it. Coordination improves because one team can connect the dots across the CPA, attorney, bank, administrators, and property level vendors. Over time, governance and continuity get easier, because roles, approvals, and documentation live inside a repeatable process instead of informal habits.

What you take on

You take on execution. Even in an outsourced family office model, someone still needs to own the relationship, oversee the process, and make decisions when tradeoffs appear. You also take on process maturity, because the office needs consistent workflows for cash movement, reporting, and access control. Vendor management becomes more central, and the technology stack matters more, because the system layer needs to support multi-entity reality and reliable reporting without depending on spreadsheets or heroics.

The operational backbone of a family office where tech matters

A family office sounds simple until you try to run it without a real system. The moment you have multiple entities, multiple accounts, alternatives, and multiple stakeholders who expect clean answers, the work becomes less about investing and more about producing a reliable picture of what is happening. Without an operating system, families end up with spreadsheet based consolidation, scattered documents, and reporting that cannot be defended when someone asks how a number was produced.

The backbone is the books and reporting layer. It is the part that makes entity level activity real, ties investment activity to accounting reality, and preserves an audit trail so decisions and changes are traceable. When that layer is weak, every month end becomes a scramble and the family office starts depending on a few individuals who know where everything is.

At a minimum, the operating system needs to consolidate entities and investment activity, track ownership and allocations, tie reporting to the books, and support repeatable month end and quarter end processes. Many family offices use a dedicated portfolio accounting and reporting platform, for example FundCount, to consolidate investment activity and multi-entity accounting in one place so reporting does not depend on spreadsheets or one person’s process.

If you’re building a family office, your books and reporting layer is the foundation.

A practical decision framework 10 questions

You do not need to decide family office versus wealth management in the abstract. The clearest answer usually comes from a few practical questions that force you to look at complexity, coordination, and how much control you actually want to own.

- How many entities and accounts do we have today?

- How many managers and custodians are involved?

- How much of the portfolio is in alternatives or direct deals?

- Do we have recurring reporting surprises or delays?

- Do we need consolidated entity-level financials, not just portfolio views?

- Do we need clearer governance or next gen education?

- Are we comfortable with an AUM fee model as complexity rises?

- Do we want product independence and more control over vendors?

- Who owns coordination today across the CPA, attorney, administrators, and banks?

- Are we willing to invest in operations, meaning people, process, and technology?

If you answered yes to several of these, consider starting with an outsourced family office or multi-family office model and building toward a single-family office as the benefits become clear.

90-day start the family office path plan

This is a practical way to move toward a family office model without trying to build everything at once. The goal is to create visibility and control quickly, then put the operating layer on a repeatable cadence.

Weeks 1 to 2 focus on inventory. List every entity, account, custodian, manager, and major advisor relationship, then capture what reporting you get today and what you wish you had. The output is a clear map of where the data lives, who touches it, and where the gaps and duplications are.

Weeks 3 to 6 are about defining the reporting pack and the rules that protect it. Decide what the family needs to see each month and quarter, what the source of truth is for each component, and who owns each workflow. This is also where basic controls belong, such as cash movement approvals, access rules, and a simple exception process for when numbers do not tie.

Weeks 7 to 12 are where you make it real by implementing consolidated reporting and an accounting workflow that can scale. That usually means reducing spreadsheet based consolidation and moving to a system layer that can handle multi-entity accounting, investment activity, and auditability in one place. Many teams use a portfolio accounting and reporting platform such as FundCount as that foundation so month end and quarter end processes are repeatable and less dependent on individual heroics.

FAQ

What’s the difference between a family office and a wealth manager?

A wealth manager is an advisor relationship focused on investments and planning delivered through a standardized service model. A family office is an operating model that adds an internal layer for entity administration, accounting, consolidated reporting, controls, and coordination across the family’s full financial ecosystem.

Do I need $100M to have a family office?

Not necessarily. It depends on complexity more than a single asset number, and many families start with an outsourced family office or a multi-family office before building anything fully in-house.

Is a multi-family office worth it?

It can be, especially when you want more consolidated reporting and operational coordination than wealth management provides, but you are not ready to build a standalone team. The tradeoff is less customization than a single-family office, since the model is shared.

Can I keep my wealth manager and still build a family office?

Yes. Many families keep investment relationships in place while they add a family office operating layer for reporting, accounting, governance, and coordination. In practice, the family office becomes the hub that organizes information and decision making across advisors.

What software does a family office need?

A family office needs a system that can handle multi-entity accounting and investment activity while producing consolidated, repeatable reporting with an audit trail and role-based controls. Many families use a dedicated portfolio accounting and reporting platform such as FundCount to connect entity level books and investment reporting so the numbers are consistent and defensible.